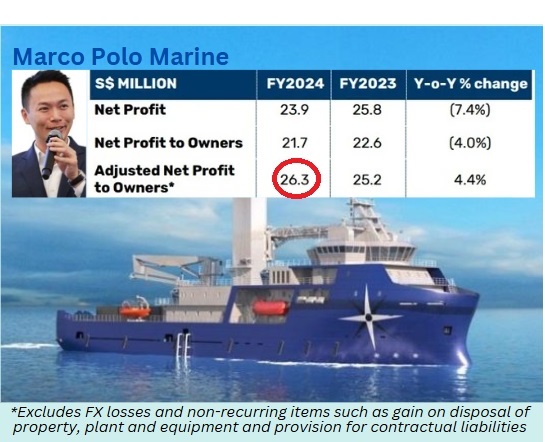

So Marco Polo Marine has just wrapped up its FY2024 (ended Sept) results, and the 2H headline numbers looked rough (net profit fell 41.5% y-o-y). But 2H operating results were obscured by one-offs and by issues that may not recur, such as forex loss and labour shortages. Excluding those, the decline was 11.2% (see company Powerpoint deck). For full year, this is how its adjusted net profit looks like:  Inset: CEO Sean Lee Inset: CEO Sean LeeThe forex loss arising from a weaker USD was US$5.5 million. Most of that was unrealized, meaning it’s more of a paper thing. With the U.S. dollar getting stronger against SGD, some of that could even flip into gains in FY2025. There were operational issues that beset the company: • Labor ShortageSome skilled workers headed to higher-paying opportunities in countries like South Korea and Saudi Arabia.The company had to source and retrain new workers. Thus the completion of its maiden Commissioning Service Operation Vessel (CSOV)has been delayed by about four months, and Marco Polo has made a SGD1.8 m one-off provision for liquidated damages to its charter client. • Dockyard for CSOV BuildThe CSOV (that’s a specialised offshore wind farm vessel) construction tying up one of their dockyards meant less capacity for ship repairs (a quick revenue spinner). Photo: Marco PoloBeing a Marco Polo-owned asset, the CSOV construction work does not generate revenue on the P&L sheet, and instead incurs expenses that bite the bottomline. Photo: Marco PoloBeing a Marco Polo-owned asset, the CSOV construction work does not generate revenue on the P&L sheet, and instead incurs expenses that bite the bottomline. The CSOV, however, will start earning big bucks when deployed in 1H2025 to offshore wind farm projects off Taiwan. It's US$50K a day, according to Maybank Kim Eng (see below) .... assuming the vessel gets off to a smooth start without hiccups. Looking ahead, things are shaping up nicely for FY2025. Marco Polo’s got exciting stuff lined up:

Read Maybank KE's latest take on Marco Polo below .... |

Excerpts from Maybank KE report

Analyst: Jarick Seet

Marco Polo Marine (MPM SP) -- Exciting times ahead

| Maintain BUY with SGD0.08 TP |

| FY24 core profit of SGD26.3m is in line with our forecast. Going forward, we reckon that exciting times are just starting for MPM.

Its CSOV is 91% completed and will likely start operating by March 25. |

||||

All engines starting to fire for FY25E

The CSOV delay led to fewer 3rd-party repair works in 3QFY24, which also caused a shortage of staff to work on 3rd-party repairs.

These issues have been resolved and utilisation of its repair capacity has risen from 50% to about 75%.

We also expect more volume driven by expansion of its 4th dry dock, which could see revenue rise 25% (with revenue recognition from Apr-25 onwards).

The CTVs that it acquired are operational and will also help to boost profitability with rates expected at around USD8,000/day.

We expect MPM to add another 1-2 CTVs by end-2025, increasing its CTV fleet to 4-5 vessels.

The CSOV is close to completion and should sail to Taiwan by end-Jan 2025.

Issues may arise in the first 6-8 months which could bring down its initial utilisation rate but it should be smooth sailing by FY26E.

All in all, we understand that the utilisation for the first 2 years will be close to 95% with rates averaging around USD50,000/day. This should make a significant contribution to its profitability.

|

Full report here