Main reference: Story in China Securities Journal

THERE ARE A few telltale signs that a sustained upswing in A shares is about to unfold.

The gradually improving liquidity in the market on a day in and day out level and the stable monetary and exchange rate policies from Beijing are among the most promising signs that things are looking up these days.

Here’s how things stand recently.

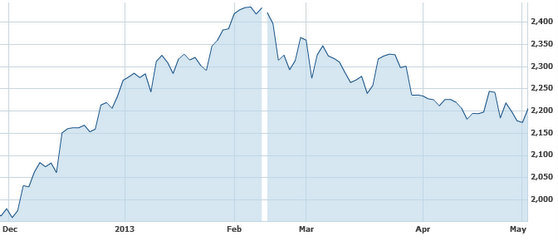

China's governement is supportive of a more consolidated, viable domestic solar sector. Photos: SolargigaThe benchmark Shanghai Composite Index, the go-to tracker for A- and B-shares listed in Shanghai and Shenzhen – recently managed to surpass the key 2,200 level, but only after struggling mightily to regain traction after prices began a sustained slump after the nine-day Lunar New Year market break.

China's governement is supportive of a more consolidated, viable domestic solar sector. Photos: SolargigaThe benchmark Shanghai Composite Index, the go-to tracker for A- and B-shares listed in Shanghai and Shenzhen – recently managed to surpass the key 2,200 level, but only after struggling mightily to regain traction after prices began a sustained slump after the nine-day Lunar New Year market break.

The Index is down nearly 7% from year-earlier levels, but notably higher than the low set in December of last year of 1,949.

There are lessons to be learned from The Middle Kingdom’s recent history.

Over the past decade, China has relied heavily on cut-rate labor costs to become the factory of the world, helping spur on continuous GDP growth backed heavily by exports and capital investment inflows.

All of this led to China leapfrogging from No.10 to No.2 on the global GDP size pecking order in 10 short years.

It also allowed the world’s most populous country to now claim the title as the biggest single holder of foreign exchange reserves – by a long shot.

But with the global financial turmoil of 2008, Beijing’s monetary policy has come under three-pronged pressure: maintaining the exchange rate at competitive levels to sustain exporting advantages; keeping the country competitive on a return-on-investment basis with regards to FDI; and helping manage risks from “hot money” inflows and outflows amid a volatile global financial landscape.

Beijing’s answer has consistently been to maintain a “stable” monetary policy and exchange rate regime.

This has been a chief contributor to China continuing to remain both an attractive place to invest as well as helping many of the country’s exporters weather the global economic downturn better than could be expected within such a sluggish external demand environment.

This has all helped cash-rich industries like property development, private equity funds and wealth management operators keep their collective heads above water among the ongoing turbulence.

China shares have been struggling to stay above the 2,200 level. Source: Yahoo Finance

China shares have been struggling to stay above the 2,200 level. Source: Yahoo Finance

And now with the ongoing refrain from Beijing that the long-ignored Chinese consumer is now the prime target for growth, there is every indication that the months-long slump in PRC-listed shares may finally become a thing of the near past.

Furthermore, the strong support for key industries from the new national government – especially new technologies, environmental themes, hybrid automakers, pharmaceuticals and solar power plays in particular -- suggests that some sectors will be bullriding before others.

With a general tamping down of anxieties on the global economic front and inflation figures well within control in China, investors in A-shares might want to consider fishing their rose-colored glasses out of their closets and looking for underappreciated plays in Shanghai and Shenzhen before they no longer become so underappreciated.

Although not exactly trumpeted as a sector in need of support from Beijing, China’s all-important property sector also continues to surprise on the upside.

And the rising wages and ongoing urbanization in the PRC can only make things better overall.

See also:

70% Of Investors Bullish On China