Bocom: Hong Kong retail sales below estimate

Bocom Research said Hong Kong’s recent retail sales growth was below market estimates.

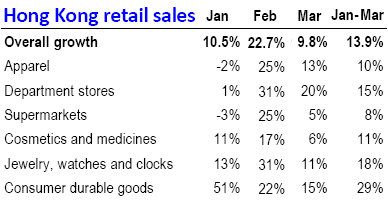

Hong Kong retail sales growth (in value) eased to 9.8% y-o-y in March (vs. +15.8% in Jan-Feb), and was well below the consensus estimate of 14.7%.

Source: Bocom ResearchFor Jan-March 2013, the average retail sales growth was 13.9%.

Source: Bocom ResearchFor Jan-March 2013, the average retail sales growth was 13.9%.

“Apart from the macro headwind, we believe the lower-than-expected growth of Chinese tourist arrivals in March (+14% vs. +23% in Jan-Feb) was the key attributing factor.

“Looking into 2Q13E, the sustained cautious consumer climate in both Hong Kong and China will cap the pace of rebound of Hong Kong retail sales growth, in our view,” Bocom said.

The research house added that the reappearance of Avian Flu in China is also dragging down expectations for some industries in Hong Kong, especially those catering to the waves of Mainland Chinese shoppers.

“Furthermore, we believe the bird flu since April in China is likely to post short-term pressure on Chinese tourist arrival growth.”

Bocom has maintained its “Market Perform” rating on Hong Kong’s consumer sector, and reiterates its “Buy” on retailer Sa Sa (HK: 178) and “Neutral” on Lifestyle (HK: 1212).

The key consumer segments that showed a slowdown in Hong Kong in March were consumer durable goods (+15% vs. +37% in Jan-Feb), jewelry & watches (+11% vs. +21% in Jan & Feb) and cosmetics (+6% vs. +14% in Jan-Feb).

Segments that showed improvement were department stores (+20%, vs. +14% in Jan-Feb) and apparel (+ 13%, vs. +9% in Jan-Feb).

Face Time: Magic has top market share in China for beauty masks. Photo: MagicBocom: MAGIC kept ‘Buy’

Face Time: Magic has top market share in China for beauty masks. Photo: MagicBocom: MAGIC kept ‘Buy’

Bocom Research said it is maintaining its “Buy” recommendation on beauty mask product leader Magic Holdings (HK: 1633).

“Magic’s share price has outperformed Hang Seng Index by 22% over the past month. In our opinion, investors’ genuine interest in Magic can be explained by its re-rating potential building on the company’s on-track performance and acquisition story,” Bocom said.

The research house recently toured hypermarkets and Watsons stores (two channels generating 73% of Magic’s sales) in Shanghai to explore the competition in China’s beauty mask sector.

Spring has put a spring in the step of Magic's shares.

Spring has put a spring in the step of Magic's shares.

Source: Yahoo Finance

Several positive signs

Bocom’s POS walkthroughs revealed several positive trends for Magic.

(1) Magic’s MG-branded beauty masks continued to dominate the best and the largest shelf space in the stores with apparent optimization in product display;

Magic recently 4.35 hkd(2) Magic continued to present the widest array of mask offerings. Its four new MG basic series have been fully shelved to allure more consumers;

Magic recently 4.35 hkd(2) Magic continued to present the widest array of mask offerings. Its four new MG basic series have been fully shelved to allure more consumers;

(3) Price promotion was limited in hypermarkets where it faced less direct competition;

(4) Magic’s RMB10 masks (70%+ of total sales) had the latest production dates (Jan-Feb 2013), vs Oct 2012-Feb 2013 of other major brands like My Beauty Diary (#3 market share), P&G’s Olay (#4) and Garnier under L’Oreal.

“This should all help quell the concern about Magic’s moderating revenue growth amid competition.

“We continue to be fond of Magic’s unique and enhanced market leadership coupled with its profile of being an ideal acquisition target.”

Bocom has raised Magic’s target price to 4.50 hkd 4.00 which is pegged at the same target P/E of 15x (recent share price 4.35).