HILONG HOLDING Ltd (HK: 1623) is China’s top non-state-owned integrated oilfield equipment manufacturer and services provider, and is the world’s No.2 maker of drill pipes and OCTG coating materials.

Having a strategic supply contract with China’s biggest company – Sinopec – is a big help, a company official told investors.

“Last month, Hilong and Sinopec signed a strategic three-year supply cooperation agreement during which Hilong will supply drill pipe products to Sinopec Ltd (HK: 386; SHA: 600028) with both parties aiming to jointly develop overseas markets,” Hilong Executive Director Ms. Amy Zhang told investors at the Aries Consulting-sponsored “Braving the Waves: China Investment Strategies 2013” conference.

Speaking at the event in Shenzhen featuring China, Hong Kong and Singapore-listed firms, Ms. Zhang said the Chinese oil giant – the country’s biggest company – and the Hilong, the PRC’s top supplier of drill pipes and OCTG (oil country tubular goods), would work together on the localization of specialized drilling equipment, OCTG as well as boosting anti-corrosion and anti-abrasion technology in pipelines.

Having a strategic supply contract with Sinopec has helped put Hilong on the global oilfield products and services map, especially since Sinopec was the first Chinese firm to break into the highly prestigious Forbes Global Top Ten list not long ago.

Specializing in drill pipe and coating materials, Shanghai-based Hilong churns out drill pipe products and provides OCTG and line pipe coating services and oilfield services in overseas markets, while also developing and producing anti-abrasion/anti-friction materials.

The Hong Kong listco is not content to rest upon its laurels as China’s No.1 sector play, but is always on the lookout for growth opportunities worldwide.

“Since 2008, we have been expanding into oilfield services, beginning with exploratory drilling work.

“Hilong has set up six regional sales centers in and around China’s major oilfields as well as sales offices in six countries,” Ms. Zhang said.

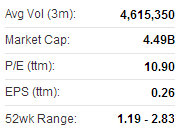

Hilong enjoyed much improved financial results in 2011 with net profit attributable to shareholders soaring by 69.1%.

First half 2012 performance also trended upwards despite global price volatility in the crude market.

January-June revenue rose 22.0% year-on-year to 930 million yuan, producing a 10.4% gross profit increase to 372 million, and a bottom line jump of 10.3% to 130 million.

“Hilong enjoys a well-balanced revenue contribution model from three major segments,” Ms. Zhang added.

Recent revenue for Hilong has been derived from drill pipes, line pipes and OCTG coatings/oilfield services, contributing 44%, 29% and 26% to the top line, respectively.

“Our improved recent performance was mainly due to strong sales growth in drill pipes business and oilfield services, as well as a general improvement from coating materials and services operations.”

In the drill pipe market, Hilong enjoys a 34% domestic market share and a 13% global take.

“Our chief competitor in the Chinese market is NOV Tuboscope while on the global stage, our chief rivals in this industry are NOV Tuboscope, Vallourec and Tenaris,” Ms. Zhang added.

In the oil country tubular goods (OCTG) market coatings and line pipe coatings, Hilong enjoys a commanding 72% market share in China and a 14% global share.

Hilong’s top rival in the Chinese coatings market is NOV Tuboscope, while the group’s chief competitors on the global stage are NOV Tuboscope and Schlumberger.

Not only is natural market demand for oilfield products and services around the world driving orders for Hilong, but strong support from Beijing is also proving a major uplift.

“The ‘Energy Development’ section of China’s 12th Five-year Plan states that the energy sector will place primary focus on areas in the energy sector, giving support for electricity, coal and petroleum/natural gas.

“State policy encourages private investment to enter into energy industries, lending strong support for privately-owned enterprises such as Hilong,” Ms. Zhang said.

She added that Hilong will also fully utilize its research & development abilities to further strengthen its competitiveness in high-end products so as to grasp additional market share overseas.

“Recently, Hilong established a new R&D center in Shanghai to boost our competitiveness. We believe overseas oilfield services businesses will also be the growth driver by which Hilong will expand aggressively.”

She added that being No.1 in China did not mean Hilong was not aggressively looking for opportunities abroad, with the ultimate goal of being No.1 globally always on everyone’s mind.

Hilong has rapidly expanded into the oilfield services business with a primary focus on drilling services – an undertaking offering increasingly substantial and reasonably stable revenue streams.

Currently, Hilong operates nine drill rigs in Ecuador, Kazakhstan, Nigeria and Colombia for key clients including PetroChina, Shell and other global powers.

By offering oilfield services, Hilong is keen on boosting its brand name and reputation as a top-notch supplier in new overseas markets.

See also:

Energy Spurt: NEW OCEAN Target Hiked, HILONG 'Outperform', PETROCHINA & SINOPEC Both ‘Buys’

Stepping On The Gas: NEW OCEAN ‘Buy’, CNOOC/KUNLUN Top Picks

SINOPEC, NEW OCEAN ENERGY: Heading In Opposite Directions