Essence: NEW OCEAN ENERGY initiated ‘Buy’

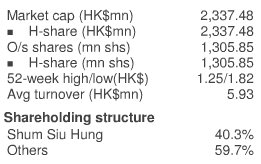

Essence International Securities said it is beginning coverage of LPG powerhouse NewOcean Energy Holdings Ltd (HK: 342) with a “Buy” recommendation and a six-month target price of 2.29 hkd.

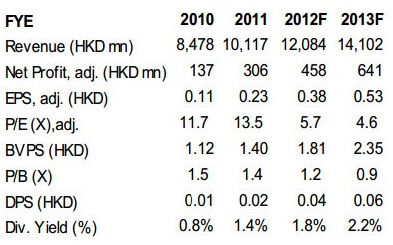

“The company is currently trading at the 2012/2013 P/E of 4.9/7x, respectively. We anticipate upside potential for the company’s share price with improving gross margins and cashflow due to increasing share of the downstream business,” Essence said.

The research house added that it expects the valuation to improve and the P/E to approach the peer average of 17x due to investor recognition of its downstream business and progress made in the refined oil product business, better market sentiment and strong liquidity.

NewOcean Energy is a leading liquefied petroleum gas (LPG) operator in South China, with a market share of 23.9% in Guangdong Province.

The company plans to 1) develop downstream business, including autogas refueling and sale of bottled LPG in Hong Kong and Macau;

2) develop refined oil business; and

3) cooperate with Sinopec Guangzhou to develop the retail business and potential growth on natural gas.

“We expect the company’s revenue and net profit to post a CAGR of 22.3% and 29.5% during 2011-2014, respectively,” Essence said.

Leading fully-integrated gas operator in South China

NewOcean controls nearly a quarter of South China's LPG market. Photo: Andrew Vanburen

NewOcean controls nearly a quarter of South China's LPG market. Photo: Andrew Vanburen

NewOcean Energy operates terminals, storage tanks, transport fleets, 16 bottling plants, 220 retail outlets and 17 autogas refueling stations.

Its business covers Hong Kong, Macau, the Philippines and Vietnam.

The firm is developing both upstream gas supply and retail business aggressively.

The CAGR of revenue and net profit reached 33.5% and 51.5%, respectively, between 2006-2011, due to the cost reduction of intermediate procedures and economies of scale effect.

Oil refining business to boost gross margin

The company recently completed the acquisition of Lianxin Energy, the largest autogas operator in Guangzhou, with a market share of 60% in the city.

“This business is expected to have gross margin over 13% (the GM of LPG business was 6.1% in 2011). The company plans to develop its oil refining business, and a 70,000 tonne oil production terminal will be completed at the end of 2012,” Essence said.

NewOcean Energy announced a strategic cooperation with Guangdong Sinopec and will extend its LPG distribution business to Guangdong Sinopec’s 1,700 retail outlets.

The company began providing marine bunkering services in Hong Kong from May 2012, and Essence believes its GM will increase to 7.2% compared to 4.2% in 2011.

Expect net profit of CAGR 29.5% in 2011-2014

“With the cooperation of Lianxin Energy and new business in Hong Kong, we expect the company’s net profit to post a CAGR of 48.9% in 2011-14, while the LPG sales volume will post a CAGR of 12.9% during 2011-14 and reach 2.09 million tonnes.

“We forecast the company’s revenue to post a CAGR of 22.3% during the period and reach 18.5 billion hkd in 2014,” Essence said.

It added that it expects the LPG, electronic products and oil products business to account for 86.8%/9.6%/2.6% of the company’s revenue in 2012.

Essence estimates NewOcean’s gross margin will increase to 7.9% in 2014, compared to 4.2% in 2011, and 2012/13/14 net profit is seen increasing by 42.8%/32%/15.3% year-on-year to 437 mln/577 mln/665 mln hkd, respectively.

See also:

SINOPEC, NEW OCEAN ENERGY: Heading In Opposite Directions

NEW OCEAN ENERGY: H1 Profit Soars 39% On Strong China Sales

LPG Fuelling Furious Growth For NEW OCEAN ENERGY

HSBC: CNOOC, KUNLUN Top LNG Picks

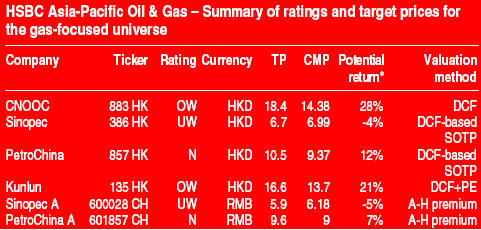

HSBC said its top picks in Asia’s liquefied natural gas (LNG) market are CNOOC Ltd (HK: 883) and Kunlun Energy Ltd (HK: 135).

“Asia’s natural gas industry is a volume growth story. In our view, CNOOC, Kunlun Energy and Petronet LNG have the best positioned exposure to unregulated natural gas volume growth in our Asia-Pacific oil and gas universe,” HSBC said.

Asian domestic gas production is forecast to grow modestly outside of China and Australia.

Shale gas is 5+ years distant and not a near-term answer.

Factors driving prices higher include poor pipeline connectivity between Europe and Asia, constraints in US gas exports, and high capex of marginal Australian LNG.

“Winners include businesses able to sell at market prices and distributors able to pass down import prices. Our preferred picks are companies with leverage to freely priced gas volumes and/or low cost contracted supplies,” HSBC said.

It added that it avoids those exposed to price regulation.

“Price deregulation creates option value for producers and pipeline operators, but deregulation has been slow to come.”

CNOOC

Mid-term production growth target of 6-10% per annum holds the key to growth story.

“Smooth execution of the potential Nexen acquisition will bring value-accretive barrels. We believe the market has discounted too much of the negativities of a dividend cut announced during 1H12 interim results,” HSBC said.

It is reiterate its “Overweight” call on CNOOC with a target price of 18.4 hkd.

“The fundamental argument for a higher share price remains valid.”

Kunlun

HSBC said it addressed key concerns to its upgrade call including weak gas demand, slow LNG vehicles adoption, among others.

“Kunlun is more resilient amid the near-term slowdown of China’s gas demand growth. Near-term growth is driven by pipeline transmission that has no commodity price exposure, and longer term Kunlun will be a leader in LNG vehicle market taking price risk and reward.”

HSBC is reiterating its “Overweight” recommendation on Kunlun Energy with a target price of 16.6 hkd.

See also:

RH PETROGAS: Big Moves And News To Come

9 things to know about RH PETROGAS, the largest exploration & production company on SGX