With the oil & gas sector doing well, we met with Dr Tony Tan, the CEO of mainboard-listed RH Petrogas, to get a low-down on the company.

From being loss-making as an electronics company, and from just one oil & gas asset in 2009, RH Petrogas has quickly turned in a profit and expanded its new oil & gas business.

Formerly known as Tri-M Technologies, RH Petrogas says it has a lot of potential growth, going by the amount of oil it is set to pump out over the years. Some investors say the business is not exactly the easiest to understand by investors outside of the oil industry. Well, read our primer then:

> 1. Listing: RH Petrogas is the largest listed pure-play exploration & production (E&P) company on SGX by market capitalisation of S$196 million based on a recent stock price of 43 cents.

Its oil & gas business only started in 2009 after an asset was injected into the company. Three more oil & gas assets were subsequently acquired while its core electronics business was divested.

RH Petrogas' executive chairman and controlling shareholder is Tan Sri Datuk Sir Tiong Hiew King, whose net worth was estimated at US$1.2 billion in 2010, placing him as the 10th richest Malaysian on the Forbes list for 2010.

The Tiong family owns 69.17% of RH Petrogas.

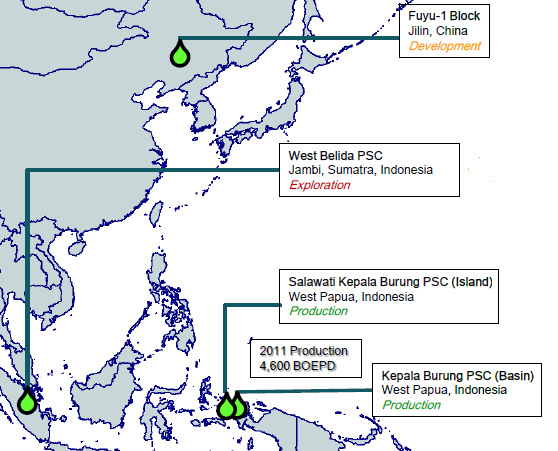

> 2. Business: Its portfolio of assets comprise four main sites in the Asia-Pacific area (see map above):

Two sites in West Papua, Indonesia which are mature and in production.

One site in Jambi, Sumatra, Indonesia, which is under exploration.

One site in Jilin, China, which is under development jointly with China National Petroleum Corporation.

The site will start production after a final Chinese government approval is obtained probably in the 4th quarter of this year.

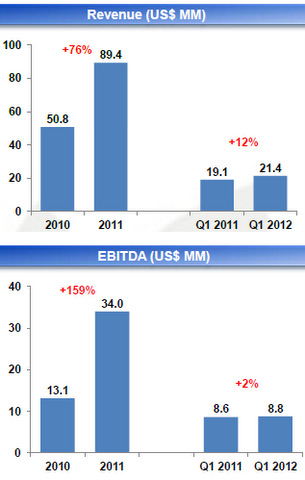

> 3. Financials: RH Petrogas has achieved growth in revenue and earnings before income tax and depreciation (see tables at right).

In addition, it reported net profit of US$1.274 million in 1Q2012 and US$2.93 million for the full FY2011.

> 4. Capex: To fund the drilling of development and exploration wells, the net capex this year is estimated at US$29 million, similar to last year's.

However, management expects the capex in the next few years years to rise significantly as it steps up its exploration and production activities -- but this will be supported by substantial cashflow from production.

> 5. Risks: Oil exploration can incur huge risks -- but RH Petrogas is focused on onshore ventures where the risks are low to medium, instead of deep water drilling.

For example, it targets onshore sites surrounded by established oil-producing sites. It focuses on the Asia-Pacific region where its management and technical teams have vast experience and knowledge of the oil producing areas.

Talking about risks, here is another one to bear in mind: RH Petrogas' earnings would be directly impacted by a fall in the price of oil.

> 6. Debt repayment: Its current net gearing of 104% arose largely from the acquisition of the two production sites in West Papua.

The net debt amounted to US$113.3 million as at 31 March 2012, of which US$61.5 million are shareholder loans from the Tiong family.

Subject to shareholder approval next month (Aug), the debt will be converted into equity through the issue of new shares to the Tiong family whose stake will rise to 77%, and the company's net gearing falls to 31%.

> 7. Expanding the portfolio: Subject to shareholder approval on Aug 7, RH Petrogas will place out new shares (at a minimum of S$0.36 per share) with free warrants. This is mainly for acquisition of more oil & gas assets.

RH Petrogas aims to raise up to S$94 million initially with up to a further S$38 million assuming full exercise of warrants (at 43 cents a warrant) within a year.

Details can be found in the company's announcement on the SGX website.

Following the placement and warrant conversion, the company will be in net cash and and the free float of the shares increases significantly while the Tiong family's stake will fall -- but not below 51%.

"Once the debt conversion and share placement exercises are completed, we will be able to further develop our existing oil and gas projects with the additional capital and will be in a stronger financial position

to consider some of the opportunities that we are evaluating in an endeavour to grow our asset portfolio,” said Dr Tony Tan.

> 8. Experienced Management Team: Dr Tony Tan is Group CEO and Executive Director, and has over 35 years of international petroleum exploration & production, merger & acquisition experience, especially in Asia-Pacific.

He joined the company in June 2010 from his CEO post at Orchard Energy, then a subsidiary of Temasek Holdings.

Other veterans include Francis Chang, VP for Exploration and Production (34 years experience) and Samuel Cheong,VP, Commercial (18 years with SPC).

> 9. Valuation: In a Feb 2012 report, using the discounted cash flow method, RHB had a fair value of S$0.65 for the stock.

"We believe RHP’s share price is largely impacted by the stock’s illiquidity. However, we are positive on the long-term demand for energy. We thus maintain our Outperform call on the stock," according to the analyst.

In 2011, Kim Eng Research and BNP Paribas pegged the target price at $1.80 and $1.20, respectively.

Another way to value it was suggested by Dr Tan:

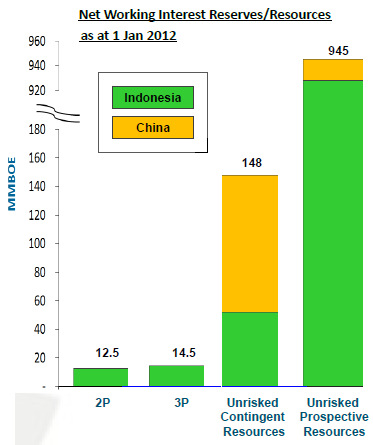

Taking 613 million issued shares (post-conversion of debt to equity for the Tiong family) and 148 million barrels of oil (unrisked contingent resources, see chart on the top right), the value of 1 share is equal to 0.24 of a barrel of oil.

Taking a barrel to be worth US$100, one RH Petrogas share is worth US$24.

From here, you can discount it by, say, 50% for the cost of production, and another 50% for risks (even though RH Petrogas emphasises low-to-medium risk ventures) and a further 50% for 'other factors'.

Result: US$3 (S$3.75). This is significantly higher than the stock's trading price of around S$0.43.

Previous story: RH PETROGAS' chairman is 10th richest man in Malaysia, and a successful serial entrepreneur