Photo: Andrew Vanburen

NEWOCEAN ENERGY HLDGS (HK: 342), South China’s leading distributor of liquefied petroleum gas (LPG), saw sales of the key oil product fuel furious bottom line growth last year, surging over 124% to 306 million hkd.

Management of HK-listed NewOcean Energy took a group of investors on a whirlwind, day-long tour of its storage and distribution facilities across South China as part of a site visit organized by Aries Consulting.

We gathered early Friday morning at the Hong Kong-Macau Ferry Terminal operated by regional transportation heavyweight Chu Kong Shipping, with the ferry strategically located in the shadows of the tallest buildings along Hong Kong Island’s famed waterfront.

From there we were whisked an hour south by high-speed ferry across the South China Sea to the city of Zhuhai, just north of the gambling Mecca of Macau, along the coast of Guangdong Province.

Upon arrival at Zhuhai Port, we were then shuttled overland an hour’s drive to the firm’s NewOcean Sea Terminal

An hour’s walk around the firm's sprawling storage facilities, including a loading dock that stretched far out into the South China Sea to accommodate large tankers in the deeper waters, left the group eager to pose questions to management over, naturally, a lunch featuring locally netted clams and crab.

And for such a fast-growing, diverse sector, NewOcean realized it was sometimes better to work with partners.

Last month, it announced plans for a new business alliance with the Guangdong branch of China Petroleum and Chemical Corporation (Sinopec Guangdong) in the fields of LPG, liquefied natural gas (LNG) and refined petroleum products.

Raymond Chiu, NewOcean's Executive Director, explained to the entourage how the Hong Kong-listed and Hong Kong-based firm was able to enjoy such stable, and often, robust growth over the past few years.

“We have achieved a healthy balance between sales of LPG to major petrochemical firms, terms of which offer good credit and large-volume orders, but relatively lower margins.

“On the other hand, we also have significant sales to industrial end-users who provide us with higher margins,” Mr. Chiu said.

Besides individual canister-based sales of LPG destined for kitchens and patios across the region to provide gas for cooking and hot showers, NewOcean Energy Holdings was also very upbeat on the transportation-fuel side of the business.

There was a huge market in both Guangdong Province with its 100 million-plus residents, as well as affluent and adjacent Hong Kong for LPG stations to fuel up properly fitted taxis and buses.

And as Guangdong was one of the country's most populous and prosperous provinces, responsible for a full quarter of the country's exports, there was little chance of a slowdown in demand for the coveted oil product anytime soon.

However, NewOcean Energy – while appreciative of government promotion of LPG as a “green energy” alternative – believed that overreliance on policy was a poor long-term growth strategy, and believed in being more proactive.

“Concessions are provided by governments. But actual market share is given by the customers themselves.

"Therefore, we believe we must earn market share the old-fashioned way,” Mr. Chiu added.

It is this attitude that surely contributed to the firm’s robust bottom-line growth last year backed by a nearly 20% year-on-year revenue increase to over 10 billion hkd.

To this end, a key component of NewOcean’s success to date has been a relentless effort to reduce the middleman and own all assets, top to bottom, within their logistics chain.

“We are not traders. We are suppliers. Therefore, our goal is to minimize logistics costs and maximizing our profits by working to gain ownership over all our trucks, storage facilities, bottling plants and roadside LPG filling stations,” he said.

While conceding that this meant heavy capital expenditure at the outset, once the returns on investment began rolling in, profitability would quickly expand and the entry barriers to potential competitors hoping to get into the game would soon become prohibitive.

“Entry barriers are high in this business because we have established a top-to-bottom distribution network. Also, the level of refining and the grade of LPG demanded by different customers is very technically advanced, and only a few firms are positioned to meet the myriad requirements.

“Hong Kong taxis in particular have very exacting specifications for LPG standards, so our being granted one of 12 licenses to supply products there is a definite coup for our firm. In addition, selling prices for LPG in Hong Kong are around three times those in Mainland China,” Mr. Chiu said.

After visiting two sprawling LPG filling stations along a busy thoroughfare in the bustling provincial capital of Guangzhou, it became clear just how much potential this segment of the business held for NewOcean.

Photo: Aries Consulting

The two LPG stations had both taxis and buses alike waiting patiently in long lines for their turn at the pumps, with NewOcean Energy’s distinctive blue/green logo prominently displayed above the facilities for all to see.

“We believe that fewer is better, meaning we can save on costs by providing a few LPG filling stations, but equip each with a maximum number of filling nozzles,” the Managing Director said.

However, management was fully aware of the ongoing slowdown in China's economy and that is why it was emphasizing cost-saving measures, including pushing for self-owned facilities and land, now more than ever.

NewOcean was also not resting on its regional laurels, despite enjoying a 60% share for the auto-gas market in Guangzhou, as the firm also supplies LPG to other nearby markets.

“We also have major export clients in Vietnam and the Philippines,” Mr. Chiu added.

And as a “Green Energy” resource, LPG is far less polluting that traditional petrol, and helps alleviate often notorious air pollution readings in crowded Hong Kong and heavily industrialized neighboring Guangdong Province, thus providing even more sales incentives for NewOcean’s chief product – LPG – which now has risen to account for 90% of revenue, with electronics a distant second place.

After seeing the firm’s storage facilities in the coastal city of Zhuhai in the morning, its LPG roadside filling stations in provincial capital Guangzhou in the afternoon followed by a visit to its bottling plant outside Shenzhen later that day, it became clearly evident that NewOcean Energy Holdings was committed to staking a strong presence up and down the entire LPG distribution chain.

Speaking about the Hong Kong-listed firm’s stellar 2011 results, Chairman Shum Siu Hung said its after-tax profit of over 300 million hkd was a “remarkable achievement” given the economic uncertainty in the EU and US.

“We continued our business expansion with the LPG segment successfully maintaining an annual growth of around 20% to reach nearly 1.5 million tons of sales for the year, setting a new milestone for the group,” he said.

For the remainder of this year, NewOcean has the following plans in place: To cater to the long term need for self-owned property as the business and administration centre in China, during the year the Group acquired a plot of approximately 15,000 square metres located in Xingzhou District, Zhuhai.

With the completion of the second stage of Lianxin acquisition at the beginning of 2012, the Group is now engaged directly in the auto gas refueling business. Immediately after completion of the acquisition, the Group has put forth a series of development plans related to autogas refueling and is confident that autogas refueling will become a new driving force to enhance the Group's earning capability.

With respect to the plan to sell bottled LPG in Hong Kong, the license of "Registered Gas Supply Company" has been awarded by the Hong Kong Government in September 2011. The Building Department is processing our application for approval of the construction plans of the transit warehouse that will be built in Tuen Mun. By then, the sales of bottled LPG in Hong Kong under the NewOcean brand will commence.

Proximity of the Zhuhai Hengqin Bottling Plant to the Macau/Zhuhai border has given a predominant niche to the Group which has been promoting cross border bottle refilling services to the Macau distributors. Through the adoption of this service model, transportation distance will be shortened, logistic efficiency enhanced and transportation cost reduced. Rapid growth of this business in 2012 is expected. In respect of the oil products project, construction of all storage tanks has been completed by the end of 2011.

The pipeline system and auxiliary facilities are being installed with all works scheduled to be completed in the third quarter of 2012. In operating the oil products business, a strategy similar to that of LPG will be adopted, emphasis will be put on high storage turnover and low inventory; an integrated supply chain and extensive distribution networks will also be built at the same time targeting continual market share expansion.

NewOcean Energy is the largest LPG operator in South China, wholly owning and operating a Class 1 LPG sea terminal in Zhuhai, China for VLGCs (Very Large Gas Carriers) through which it conducts its international importing and re-exporting businesses. Wholesale and retailing of LPG is conducted in China by the Company through a network of 16 bottling plants in 11 cities and is joined by a further network of 17 autogas refueling stations in and around Guangzhou. The retailing network has been expanded to cover Macau and, very soon, Hong Kong. The energy business portfolio of the Company has been extended to refined petroleum products in May 2012 with the commencement of operations of a fuel oil and light diesel fuel supply station in Hong Kong.

See also:

RED FLAGS: Over 100 HK Listcos Warn Of Poor Results

EXPERT OPINION: Bulk Of PRC Brokerages Bullish On 2H

Five China Sectors About To Get Hot

BUCKING TREND: China Shares Ready For Rebound?

I've been trying to email you, but the hotmail address as per this site results in a permanent failure. Could you pls. advice on how to reach you?

Thanks

Sincerely,

Andrew

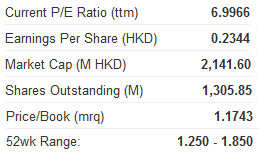

PE would be cheap for this type of energy company with ready assets.

The results are pretty satisfactory. The top line growth and operating profit are to my expectations. Only concern is the exchange loss and the one-time gain in derivative instrument.

Overall good results.

Congratulations to the management

This sounds like an interesting stock idea. At the present 7x PE, I believe it is a safe investment.

I have bought 1.5 million shares over the past few days. Will put it in my radar screen and observe.

When is the interim results date?

NewOcean will be providing details on contributions from its Lianxin acquisition in its upcoming interim earnings report. So far, it has said the following on the acquisition and revenue contribution: Under the Framework Agreement signed on 21 Oct 2010, the Company agreed to acquire Lianxin Energy Dvpt Ltd, a business in China which owns and operates a network of 17 autogas refueling stations in Guangzhou by acquiring 5% of its share capital, provision of a 580 mln yuan loan to the vendor for the financial restructuring of Lianxin and the exercise of an option to acquire the remaining 95% share capital. All the matters involved in the acquisition of 5% of the registered capital of Lianxin and the provision of a 580 mln yuan loan to the vendor for the financial restructuring of Lianxin were completed by the end of December 2010. Since the Group only held a 5% stake in Lianxin for the period from 1 Jan 2011 to 31 Dec 2011, the financial results of Lianxin were not consolidated into the financial statements of the Group during 2011. However, cash interest income amounting to approximately 120 mln hkd related to the loan granted by the Group under the Framework Agreement has been duly received and booked under the heading "interest income from Entrusted Loan." The income contributed significantly to the profit growth of the Group in 2011. Acquisition of the remaining 95% stake in Lianxin was completed in January 2012.

Can I know what is the contribution of the Lianxin acqusition to the Group earnings in 2012?