Excerpts from analysts' reports

OSK-DMG expects Nam Cheong to announce orders to close off FY13

Analysts: Lee Yue Jer & Jason Saw

OSK-DMG says Nam Cheong’s stock combines a high 24% growth with an undemanding 6.7x FY14F P/E, 6.8x EV/EBITDA, 0.12x net gearing and expected increases in dividend to yield of 3.0-4.2% over FY13-15F. File photo: CompanyWe anticipate Nam Cheong Limited (NCL) announcing a series of orders to close off FY13.

OSK-DMG says Nam Cheong’s stock combines a high 24% growth with an undemanding 6.7x FY14F P/E, 6.8x EV/EBITDA, 0.12x net gearing and expected increases in dividend to yield of 3.0-4.2% over FY13-15F. File photo: CompanyWe anticipate Nam Cheong Limited (NCL) announcing a series of orders to close off FY13.

We also take this opportunity to roll our valuation over to 10x FY14F P/E for a SGD0.45 TP (from SGD0.41).

It remains a Top Pick in the oil & gas (O&G) sector with its strong 24% earnings growth and undemanding 6.7x FY14F P/E, supported by an expected dividend increase to yield 3.0-4.2% over FY13-15F.

OSK-DMG expects Nam Cheong to announce orders to close off FY13

Analysts: Lee Yue Jer & Jason Saw

OSK-DMG says Nam Cheong’s stock combines a high 24% growth with an undemanding 6.7x FY14F P/E, 6.8x EV/EBITDA, 0.12x net gearing and expected increases in dividend to yield of 3.0-4.2% over FY13-15F. File photo: CompanyWe anticipate Nam Cheong Limited (NCL) announcing a series of orders to close off FY13.

OSK-DMG says Nam Cheong’s stock combines a high 24% growth with an undemanding 6.7x FY14F P/E, 6.8x EV/EBITDA, 0.12x net gearing and expected increases in dividend to yield of 3.0-4.2% over FY13-15F. File photo: CompanyWe anticipate Nam Cheong Limited (NCL) announcing a series of orders to close off FY13. We also take this opportunity to roll our valuation over to 10x FY14F P/E for a SGD0.45 TP (from SGD0.41).

It remains a Top Pick in the oil & gas (O&G) sector with its strong 24% earnings growth and undemanding 6.7x FY14F P/E, supported by an expected dividend increase to yield 3.0-4.2% over FY13-15F.

Entering 2014 in a position of strength. NCL’s orderbook is at a record MYR1.7bn (1 Jan 2013: MYR1.3bn).

It delivered its strongest ever quarterly earnings (MYR58.7m) in 3Q13 and its strong orderbook offers a high level of baseline activity that secures future quarters’ profitability.

Meanwhile, the large rig orderbook and the tightening global offshore support vessel (OSV) supply present positive industry dynamics that presage a healthy tailwind for NCL, which is now the largest shallow water OSV builder in the world (>12% market share).

(Subsequent to the publication of the analyst's report yesterday morning, Nam Cheong did announce the sale of 4 vessels for US$66 million.)

Recent story: NAM CHEONG: Likely beneficiary of Malaysia’s oil and gas capex plans

It delivered its strongest ever quarterly earnings (MYR58.7m) in 3Q13 and its strong orderbook offers a high level of baseline activity that secures future quarters’ profitability.

Meanwhile, the large rig orderbook and the tightening global offshore support vessel (OSV) supply present positive industry dynamics that presage a healthy tailwind for NCL, which is now the largest shallow water OSV builder in the world (>12% market share).

(Subsequent to the publication of the analyst's report yesterday morning, Nam Cheong did announce the sale of 4 vessels for US$66 million.)

Recent story: NAM CHEONG: Likely beneficiary of Malaysia’s oil and gas capex plans

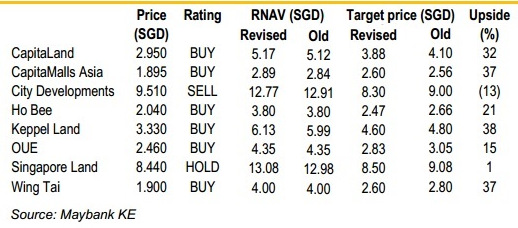

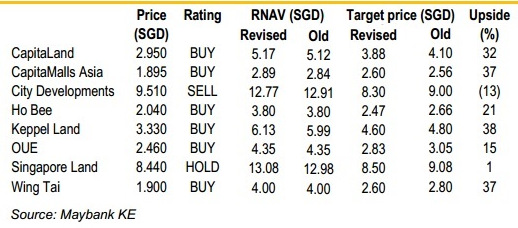

Maybank Kim Eng cuts target prices for all property stocks under its coverage

Analyst: Wilson Liew

We downgrade the Singapore property sector from Overweight to Neutral as we believe the prospect of QE tapering in 2014 will be a drag on Singapore developers’ share prices.

Physical prices look set to correct and we expect continued share price weakness unless the government removes some of the cooling measures.

Inexpensive stock valuations notwithstanding, we will adopt a Neutral view on the sector for 2014.

Related story: OSK-DMG: "Singapore Market Will Roar In 2014!"

Analyst: Wilson Liew

We downgrade the Singapore property sector from Overweight to Neutral as we believe the prospect of QE tapering in 2014 will be a drag on Singapore developers’ share prices.

Physical prices look set to correct and we expect continued share price weakness unless the government removes some of the cooling measures.

Inexpensive stock valuations notwithstanding, we will adopt a Neutral view on the sector for 2014.

We cut our TPs for all the stocks that we cover in this universe, based on slightly steeper discounts to RNAV (lowered by 5ppts).

This is to factor in the uncertainties associated with QE tapering.

The exception is CapitaMalls Asia, which remains our top pick as it benefits from new malls opening in Singapore and China.

Maintain BUY on CapitaLand and Keppel Land as well, given their diversified business models, reduced exposure in the Singapore residential sector and strong execution in China.

This is to factor in the uncertainties associated with QE tapering.

The exception is CapitaMalls Asia, which remains our top pick as it benefits from new malls opening in Singapore and China.

Maintain BUY on CapitaLand and Keppel Land as well, given their diversified business models, reduced exposure in the Singapore residential sector and strong execution in China.

Related story: OSK-DMG: "Singapore Market Will Roar In 2014!"