Excerpts from analysts' reports

OSK-DMG sets $1.05 target for Riverstone Holdings

Analyst: Edison Chen

A hidden gem, Riverstone is a nitrile glove maker set to be the next big thing. This river stone is ready to be polished into a true jewel as:

i) booming demand and expanding capacity make for exciting growth,

ii) a wide investment moat protecting its niche, and

iii) solid financials and management.

We initiate coverage with a BUY and SGD1.05 TP, based on a 16.3x industry average blended forward FY13/14 P/E.

OSK-DMG sets $1.05 target for Riverstone Holdings

Analyst: Edison Chen

A hidden gem, Riverstone is a nitrile glove maker set to be the next big thing. This river stone is ready to be polished into a true jewel as:

i) booming demand and expanding capacity make for exciting growth,

ii) a wide investment moat protecting its niche, and

iii) solid financials and management.

We initiate coverage with a BUY and SGD1.05 TP, based on a 16.3x industry average blended forward FY13/14 P/E.

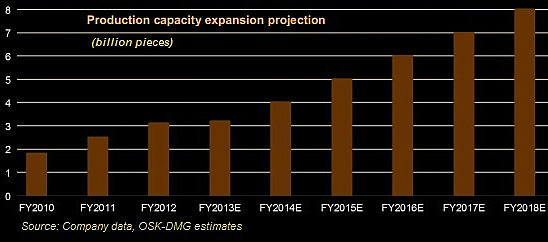

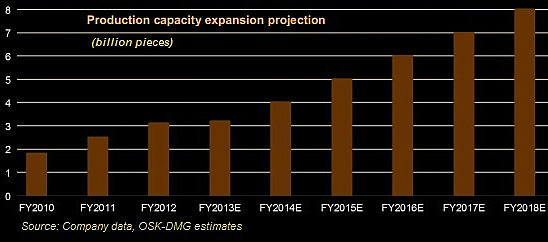

Booming demand, growing capacity make for exciting growth story. We believe that Riverstone’s on-going expansion will catapult the company into the big league.

Wong Teek Son, chairman and co-founder of Riverstone.

Wong Teek Son, chairman and co-founder of Riverstone. File photo: NRA CapitalDemand for its cleanroom products looks extremely robust, with the existing demand for premium nitrile gloves set to remain stable and its new product cracking open new markets.

On the healthcare side, Riverstone’s European customers are increasingly asking the company to boost capacity to help them diversify their supplier base, which may potentially triple orders.

If the company achieves its plan of expanding to an annual production capacity of 8.0bn pieces in FY19, we expect its earnings to grow at a CAGR of 22.4% starting from FY13, up more than 4.1x to MYR163.4m by then.

A wide moat protects its niche. Riverstone’s: i) high brand equity, ii) dominant market share in the high-end nitrile cleanroom glove industry, iii) status as the sole supplier to hard disk drive (HDD) giants, and iv) years of R&D and business experience have led to a wide investment moat protecting the company’s business.

Low valuation undeserved. Riverstone is trading at a 12.4x forward P/E, the cheapest vis-a-vis the 16.3x industry average, and 2.2x forward P/BV vs the industry’s 3.3x average. It also provides the highest yield.

We believe that the company’s listing in Singapore rather than Malaysia – where glove stocks are better understood – is one reason why investors have missed its sparkle.

Risks. These include: i) possible pricing pressure arising from expansion in healthcare glove capacity, ii) raw material price fluctuations, and iii) exposure to forex volatility.

Recent stories:

@ NRA seminar: Kevin Scully, Raffles Medical, Riverstone, JEP

RIVERSTONE: Ramping up production capacity massively in Taiping

Voyage Research says Ley Choon Group has positive growth prospects

Analyst: Yew Meng Hau

We initiate coverage on Ley Choon with an Increase Exposure rating based on an intrinsic value of S$0.280.

We initiate coverage on Ley Choon with an Increase Exposure rating based on an intrinsic value of S$0.280. We like Ley Choon due to:

(1) strong order book of S$237m that will deliver accretive earnings up to FY15,

(2) ability to secure more public infrastructure projects with the completion of its second asphalt premix plant, and

(3) establishing a presence in Shandong with a construction waste recycling plant to tap on the increase in development activities.

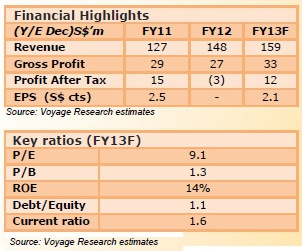

Ley Choon became a listed entity via a reverse takeover of Ultro Technologies in July 2012. Chart: FT.comBased on the company’s existing projects, we estimate FY13 revenue of S$158.7m and net profit after tax of S$12.2m.

Ley Choon became a listed entity via a reverse takeover of Ultro Technologies in July 2012. Chart: FT.comBased on the company’s existing projects, we estimate FY13 revenue of S$158.7m and net profit after tax of S$12.2m.Hiap Hoe Ltd took up a 14.9% stake in Ley Choon Group in July 2013 via a placement of new shares at 16.42 cents. Ley Choon provides pipes and cables laying, sewer rehabilitation, and road construction and maintenance. The company is a main contractor for PUB and is a major player for public infrastructure projects. Ley Choon has expanded overseas to Brunei by taking on public infrastructure projects and to China by providing construction materials waste recycling.