Fujian Zhenyun Plastics factory and HQ in Fuzhou, the capital of Fujian province. Photo: Internet

Fujian Zhenyun Plastics factory and HQ in Fuzhou, the capital of Fujian province. Photo: InternetPrice Target: S$0.77/share (Upside >300%)

(All calculations are denominated in SGD, based on 1 SGD : 4.89 RMB)

Background

Flashback to 2007 scene of a booth in Raffles Place distributing IPO materials of Fujian Zhenyun. Photo: http://singapore-ipos.blogspot.sg/1. Fujian Zhenyun Plastics Industry (FJZY) is based in China, and manufactures plastic pipes for water distribution, communications, gas and electrical cables. Based on fundamentals, FJZY is an extremely undervalued stock.

Flashback to 2007 scene of a booth in Raffles Place distributing IPO materials of Fujian Zhenyun. Photo: http://singapore-ipos.blogspot.sg/1. Fujian Zhenyun Plastics Industry (FJZY) is based in China, and manufactures plastic pipes for water distribution, communications, gas and electrical cables. Based on fundamentals, FJZY is an extremely undervalued stock. According to its 2Q2013 report, FJZY had a net asset value of $1.19/share, with a strong net cash position of $0.60/share.

Furthermore, FJZY has been profitable since its IPO in 2007. Despite the recent decrease in profitability, earnings are still positive at $0.07/share as of 2012. Note: Calculations of net cash and earnings are prior to adjustment for non-controlling interest.

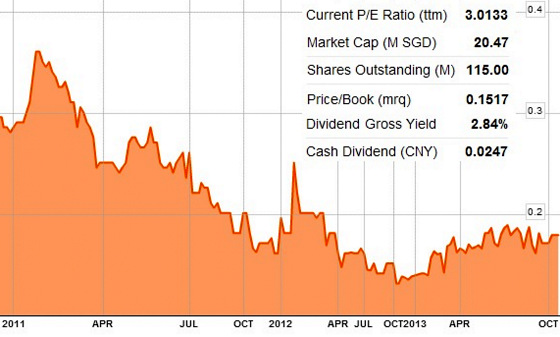

2. As of 1st October 2013, the stock price was trading at only $0.17/share. The huge price-value differential may be due to the following reasons, which can all be considered market inefficiencies:

Possible reasons for extreme undervaluation

3. The price of FJZY nosedived following the release of a disclaimer of opinion on the 2009 financial statements by KPMG, as it was unable to verify transactions and balances with certain customers and suppliers. In response, Deloitte & Touche were appointed as special auditors and they did not detect the presence of foul play, as follows:

“There are no other findings in their report in respect of the reliability or validity of documents relating to the Group’s transactions with certain trade debtors and sales, trade creditors and purchases, inventories, and cash and bank balances in relation thereto that were covered by Deloitte’s AUP.” – Deloitte

4. Yet, the assurance by Deloitte was fleeting as confidence in FJZY sank further after a series of high profile attacks by Muddy Waters LLC on fraudulent accounting practices by other S-chips. This may have cast a negative light on FJZY and turned away many potential investors.

5. Little attention has since been paid to this stock and there is not enough traction to pull the stock price from its doldrums. The board of directors, who owns over 70 out of the 115 million shares not listed in SGX, appears to be unconcerned about the share price. The directors do not have a plan to buy back the shares or sell their stakes.

Data and chart from Bloomberg

Data and chart from BloombergAssessment of Key Risks

6. While the validity of FJZY’s financial statements have been called into question, it is highly unlikely to manipulate its accounting figures due to the nature of assets held. Unlike the Chinese companies targeted by Muddy Waters LLC that revealed inflated earnings, revenues or plant assets, much of FJZY’s estimated value is in cash (and audited by Deloitte). Further, Mr. Lim Cheng Kee, an independent director, reassured shareholders in AGM 2012 that the cash is real. It is also reassuring to know that Mr. Lim purchased FJZY’s shares, although the amount is not a substantial one.

7. Over time, a stock price should converge towards its true value as sufficient investors begin to discover its true value. In the short term, a 3% dividend yield caps the downside risks while FJZY remains unloved.

7. Over time, a stock price should converge towards its true value as sufficient investors begin to discover its true value. In the short term, a 3% dividend yield caps the downside risks while FJZY remains unloved.Note: FJZY pays dividends annually. The yield is based on the stock price as of 1st Oct 2013. A short-term risk-averse environment is expected amidst the negative news surrounding Blumont, Asiasons and LionGold Corp. However, FJZY differs from these as it is fundamentally undervalued.

Valuation

8. The target share price is conservatively estimated based on the biggest assets of FJZY:

a) Net Cash ($0.60/share): The greatest asset of the company is its cash. Yet, with no announced plans, inflation will erode the value of the cash over time. In addition, Deloitte pointed out a number of areas where FJZY’s internal controls could be improved. Hence, a discount factor of 20% will be applied.

b) Trade receivables ($0.29/share): FJZY has extended generous credit terms to its customers, which saw its receivables balloon in recent years. It is plausible that not all receivables can be eventually collected. Hence, a discount factor of 30% will be applied.

c) PPE + Inventory ($0.37/share): The usual accounting valuation method of PPE is through the use of historical costs. Similarly, inventories are accounted at cost of goods in inventory. However, the true market value of this component is unclear. A conservative discount factor of 50% will be applied.

d) NCI ($0.10/share): Not all the assets declared in the FJZY group consolidated statements are owned by its shareholders. The amounts owned by the non-controlling interests should be subtracted.

9. The valuation does not factor FJZY’s earnings. This very conservative position is adopted to reduce the likelihood of overestimating the price target because there are also hidden costs to doing business in China. FJZY stated in its 2012 annual report that it took a loan in order to maintain ‘guanxi’, or relationship.

Additional upside for consideration

10. Cash-rich companies can take advantage of opportunities in a downturn. According to information shared by users on NextInsight, a resolution was passed in FJZY’s EGM on 10th May 2013 to “provide for the expansion of the company’s scope of business to include engaging in engineering works, design and installation of products. This change would enable the company to tender for a wider range of projects and improve its profitability.”

11. FJZY’s sales could grow. It has been sourcing for channels to distribute its products beyond China. The company is also active in outreach to customers. For example, it sources for customers through Facebook and has an up-to-date website (verify with date of photos).

12. FJZY is building up its reputation and credibility. According to information posted on SulekhaB2B, FJZY attained certifications in “AS/NZS 1206; ISO 14001:2004; ISO 9001:2000; OHSAS 18001:1999; and is in the process of obtaining certifications for ASTM standards.” In addition, FJZY is certified ‘AAA’ by中质信评估, a China Credit Quality Evaluation company.

Disclaimer for research report: The use of this research is at your own risk. You should not act on it without first independently verifying its contents. The author has holdings of the above stock, and therefore stands to realise gains in the event of a price increase. This report is solely for information only, and is not an offer to buy or sell any security.

Previous NextInsight stories:

Just my 2-cent worth.

Does management hold any of the listed Fujian Zhenyun shares?

Just want to see if they are motivated to declared dividends....