IN AN article on 30 June 2013, we presented a selection of our articles on 8 stocks that looked promising to readers who posted in our forum.

IN AN article on 30 June 2013, we presented a selection of our articles on 8 stocks that looked promising to readers who posted in our forum. In addition, these past articles have garnered a high volume of hits. We also took into account analysts' recommendations on these stocks.

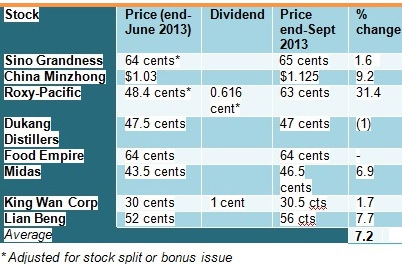

As at end-yesterday, three months on, their stock prices have done OK (see table). The average price gain was 7.2%, far superior to the 0.55% rise in the benchmark Straits Times Index. (Both figures were looking even better until news broke about the insane possibility of a partial shutdown of the US government.)

Thus, the performance was 6.65 percentage points better! In 1Q and 2Q, the readers' selection gained 25.7% and 16.8%, outpacing the 4.4% rise and 4.8% fall of the Straits Times Index.

It's probably got a lot to do with luck too.

Again, considering reader popularity and stock fundamentals, analysts' recommendations, and not forgetting a bit of 'tikam tikam', we re-looked things and present here another selection of stocks (4 new, 4 old) and the articles we have done recently about them.

What are your views? Please post them below.

(Prices are as at end of 3Q2013).

Sino Grandness is spinning off its beverages division for an IPO in Hong Kong next year. The parent company will retain its new domestic bottled fruits business and its established OEM canned vegetables business. Photo: Company1. Sino Grandness (65 cents)

Sino Grandness is spinning off its beverages division for an IPO in Hong Kong next year. The parent company will retain its new domestic bottled fruits business and its established OEM canned vegetables business. Photo: Company1. Sino Grandness (65 cents)Telecon with SINO GRANDNESS; Better 2H for UNI-ASIA

NextInsight forum postings

2. XMH Holdings (41 cents)

XMH: Unaffected by soft coal prices and rupiah slide

XMH acquires Mech-Power Generator for $17.4 m in earnings-accretive deal

3. King Wan Corp (29.5 cents)

@ KING WAN's AGM: Greater clarity on IPO of KTIS and special dividend

OSK-DMG'S selection of small cap jewels for 2013

4. Dukang Distillers (47 cents)

Dukang gets Fidelity as shareholder

DUKANG: FY2013 net profit up 78.7% at Rmb 389.7 million

5. Superbowl (56 cents)

NextInsight forum postings

SUMER: "My latest take on my 10 property stocks"

6. Midas (46.5 cents)

Kevin Scully: "MIDAS Still one of my top picks for 2013"

DBS Vickers: "Small mid-caps can continue to outperform"

7. HanKore (7.3 cents)

HANKORE, YANGZIJIANG singled out in respective industries

HANKORE: Entering high growth phase for BOT projects

8. Geo Energy Resources (37 cents)

- strong balance sheet (net cash)

- growing operating cash flow

- strong investing records

- potential high yield play

- astute management team

Next catalyst is the listing of KTIS in Thailand Stock Exchange, which may realise significantly gains for company and its shareholders.

1. recurring income

2.growth potential

3.good business

4 already restructured

5.New fund from financial expert