Kevin Scully, executive chairman, NRA Capital.

Kevin Scully, executive chairman, NRA Capital.

NextInsight file photoMIDAS HOLDINGS reported a good set of Q2-2013 results with revenue higher by 29% and net profit higher by 779.3%.

Key highlights of the results are as follows:

a) revenue rose 29.2% to RMB284mn

b) pretax profit was 133% higher at RMB19.5mn

c) net profit rose 779.3% to RMB13.9mn

d) H1-2013 revenue was up 8% to RMB486.4mn

e) H1-2013 net profit was lower by 50.8% to RMB8.29mn

f) H1-2013 EPS was RMB fen 0.82 down 40.6%

g) H1-2013 NAV was RMB2.42 Yuan or about S$0.506

h) Gross debt was RMB1.66bn while net debt was RMB1.24bn

i) Gross and net gearing ratios were 56.3% and 42.0% respectively

j) Company has declared an interim dividend of S cents 0.25

Midas’ forward looking statement was optimistic

The PRC Government’s pledge to speed up railway investments and China Railway Corporation’s (“CRC”) plan to raise annual investments in fixed assets to RMB660 billion in 20131 are expected to benefit industry players.

In view of the above, the Group remains moderately optimistic on the outlook ofChina’s railway industry over the mid to long-term. At the export front, the Group continues to make good progress in its strategy to grow its businesses, securing additional projects for the Russian and Singapore markets in early 2013. Moving forward, the Group will continue to actively identify and harness opportunities in other product segments as well as in export markets.

“We are optimistic that continued business opportunities in both China and regional markets will continue to benefit market players. In addition, our leading position as an established supplier noted for delivering quality products and services will continue to position Midas well to harness these growth opportunities,” Mr Chew concluded.

Important point to note – CFO of Midas Tan Kai Teck resigns

CFO departures are always cause for concern and we should be aware of them. The official response is that the CFO after 11 years with the company is leaving to pursue personal interest.

Commentary

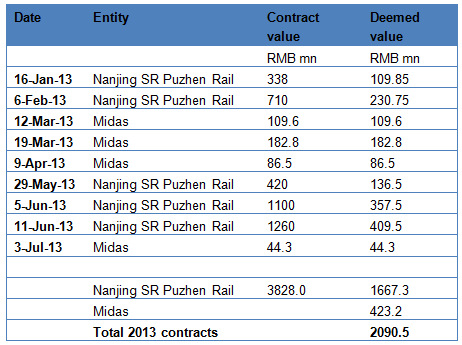

I still like Midas the macro picture in terms of what China wants to do remain positive and Midas should start to benefit from the contracts it has secured in 2013 (see table below) which totalled RMB2.1bn (using deemed interest only). These contracts which normally last about two years should start to flow through in the second half of 2013 and into 2014. Midas itself now has more than RMB700mn in contracts while its associate has more than RMB10bn in contracts.

Still one of my top picks for 2013.

This article was recently published on www.nracapital.com, and is republished with permission

let's wait for it to hit below 40 cents before looking at it.

Tell you buy, you buy ? Before you know it, they sell first, then tell you.

Anyway so many companies can give better decent profit and dividends. Midas is an underperformer.