Dukang's FY2013 bottom line was up 79% at Rmb 389.7 million. It wants to increase capacity by about 40% by the next financial year. Company photo

Dukang's FY2013 bottom line was up 79% at Rmb 389.7 million. It wants to increase capacity by about 40% by the next financial year. Company photo

THE FY2013 profit attributable to shareholders of Dukang Distillers has surged 78.7% year-on-year to Rmb 389.7 million, but at a recent telecon, the management cautioned fund managers about the industry's slow down.

Revenue was Rmb 2.4 billion, up 31.7%, thanks to the following reasons:

> Sales volume of Luoyang Dukang rose 124.7% yoy to 33,910 tons for FY2013

> In April, the Dukang brand of was endorsed as one of the baijiu appointed for use in banquets or as gifts for foreign dignitaries to China.

> A successful brand building and penetration into the high-end baijiu market.

> Average selling price for Luoyang Dukang improved 9.0% yoy to Rmb 55.7 per kilogram.

> Consumers switched to the Dukang brand after the government imposed spending curbs at civil service events on high-end baijiu such as competing brands Maotai and Wuliangye.

For more information, refer to its FY2013 results media release here.

Zhou Tao (above) was appointed executive chairman after former chairman and major shareholder Gao Feng stepped down in March 2013.

Zhou Tao (above) was appointed executive chairman after former chairman and major shareholder Gao Feng stepped down in March 2013.

Company photo

Executive chairman Zhou Tao and financial controller Raymond Ho provided fund managers with a corporate update in a telecon held in the afternoon after the company posted its FY2013 results on 28 August. Below is a summary of questions raised by fund managers at the telecon and the replies provided by the management.

Sales growth

Q: What is Dukang's market share in Henan?

The baijiu market in Henan was Rmb 48 billion in 2012. Baijiu sales under our Dukang brand was Rmb 1.9 billion in FY2013, about 4% of this.

Q: What is the sales contribution ratio from Henan and outside Henan from the Dukang brand?

70% of our Dukang brand sales came from Henan. 30% came from outside Henan. In the past, we believed that there will be greater growth outside Henan. After the government clamp-down on entertainment expenditure by civil servants, sales of luxury baijiu such as Maotai and Wuliangye have dropped significantly, especially in Henan. The demand has shifted to Dukang as it is a more affordable alternative.

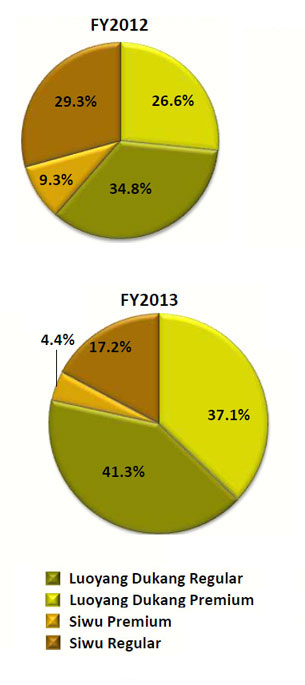

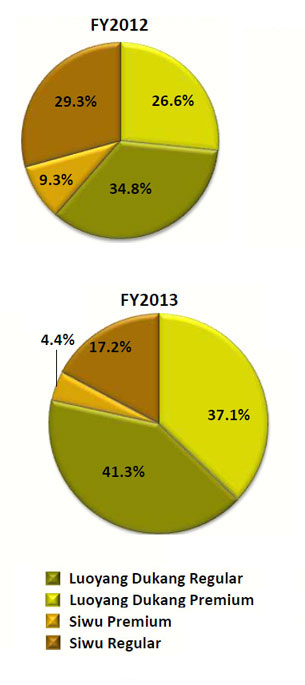

Q: Why did Siwu sales fall?

Sales at Zhoukou city dropped after Siwu's relocation to Luoyang city. After the relocation, there was an integration between Siwu and Dukang distributors and they chose to focus on the Dukang brand.

Q: How have sales changed in the past two months?

We are expecting greater challenges in the baijiu market. Firstly, average selling prices of baijiu in the market are sliding. Secondly, we are seeing first-tier brands like Maotai and Wuliangye rolling out products with relatively lower prices that compete in our key market segment. We are expecting lower sales growth in the current financial year as a result.

Sales contribution of the Dukang brand has been gaining ground over the Siwu brand.

Q: Please provide an update on your marketing efforts outside China.

Following our cultural world tour launch in Singapore, the response from distributors has been encouraging and we believe Dukang baijiu will be available for retail sales in Singapore by October. We are currently following up with distributors and beverage companies in South Korea. We are also talking to distributors from Thailand.

Q: Given the size of your distribution, why did distributors in China outside Henan increase by only 4?

In the past 2 years, we have had a spurt of growth in distributors as we began to sell outside Henan. When we exceeded 80 distributors last year, the key regions in China were covered. In FY2013, we dropped some distributors who did not perform and added other new distributors. This streamlining of distributors improves our sales.

Q: What are your plans for capital expansion in the year ahead?

We want to add 700 new fermentation pools by end 2013. These 700 pools will provide capacity for another 3,000 tons of grain alcohol over and above our existing capacity of 7,610 tons a year. By the end of FY2014, our capacity will increase to more than 10,000 tons a year.

Margins

Q: Do you need to lower your selling prices to compete?

We do not intend to lower our selling prices. Vicious price war erodes the industry's margin and is destructive in the long term. We intend to intensify efforts on our mid range products, Jiuzu Dukang - Zone 6 Cellar and Zone 9 Cellar. We will also roll out more affordable products to compete with the new products from the competition.

Q: Will your gross margins be affected by the business climate?

The industry gross margins will be affected. We expect to maintain Dukang's sales volume growth. We expect sales volume to increase, but margins may be affected as consumers switch to more affordable products.

Q: You have previously mentioned an advertising expense ratio target of 12%. However, it was only 10% last year. Will it increase in the year ahead?

Our advertising expenditure in FY2013 was in line with budget. The A&P expense ratio was lower because of higher than expected revenue. However, given the difficult business climate in the year ahead, we expect A&P expense ratio to rise year-on-year.

Cash management

Q: How is Dukang different from S-chips targeted by short-sellers like Glaucus and Muddy Waters? China Minzhong was alleged to have fabricated sales to its two top customers.

We do not have excessive accounts receivables that is typical of revenue booked for payment that cannot be collected. Our accounts receivables turnover ratio was only 5 in FY2013 because we sell on cash-on-order terms, which is even better than cash-on-delivery. We have many customers and our top 3 customers contribute only 6% to our total sales. Investors are welcome to visit our production facilities.

Dukang's stock price took a hit this week, falling more than 10% to 40 cents after a short seller alleged that another S-chip had fabricated its sales figures. The stock rebounded to 42 cents after it posted stellar results on 28 Aug. Bloomberg data

Dukang's stock price took a hit this week, falling more than 10% to 40 cents after a short seller alleged that another S-chip had fabricated its sales figures. The stock rebounded to 42 cents after it posted stellar results on 28 Aug. Bloomberg data

Q: Why did you take up a bank loan of Rmb 84 million during FY2013 when you have such a large cash reserve (Rmb 757.6 million as at 30 June)?

We need to maintain good relations with banks because we anticipate needing to take up substantive loans for our future expansion.

Q: Where is your cash deposited? Why is interest income so low?

Our cash is currently held in bank current accounts because we have high liquidity needs. We may consider placing a portion in fixed deposits.

Q: How do you intend to manage your cash? Do you intend to have a share buyback to support Dukang's share price?

We do not intend to invest in high-yield financial products. We need a relatively large amount of working capital because of our advertising and promotion expenses. We also need cash reserves to continue expanding capacity during the impending slow down in the baijiu industry. Earnings growth will boost our share price much more than any share buyback program.

Q: What is your potential for dividend payment, given the size of your new cash?

There was a recent change in shareholding structure because of the disposal by our former chairman, Gao Feng. We can only hold a board meeting to decide dividend policy after the shareholding restructure transactions are completed.

Q: How does the new shareholding structure affect the company's strategy?

Synear CEO Wang Peng is very experienced in fast moving consumer goods sales. Kaifeng Tian Feng Mills was a former supplier of grains used in our alcohol production. The two new shareholders have great faith in the industry prospects. They do not intend to change any of the existing management executives. They also do not intend to change our strategic direction.

Recent story: DUKANG DISTILLERS: Ex-Chairman Sells Out For S$166 Million

Dukang's FY2013 bottom line was up 79% at Rmb 389.7 million. It wants to increase capacity by about 40% by the next financial year. Company photo

Dukang's FY2013 bottom line was up 79% at Rmb 389.7 million. It wants to increase capacity by about 40% by the next financial year. Company photo Zhou Tao (above) was appointed executive chairman after former chairman and major shareholder Gao Feng stepped down in March 2013.

Zhou Tao (above) was appointed executive chairman after former chairman and major shareholder Gao Feng stepped down in March 2013.

Dukang's stock price took a hit this week, falling more than 10% to 40 cents after a short seller alleged that another S-chip had fabricated its sales figures. The stock rebounded to 42 cents after it posted stellar results on 28 Aug. Bloomberg data

Dukang's stock price took a hit this week, falling more than 10% to 40 cents after a short seller alleged that another S-chip had fabricated its sales figures. The stock rebounded to 42 cents after it posted stellar results on 28 Aug. Bloomberg data NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

This site always call stock that got people got stuck. I remember sapphire, qingmei and some other s-chip.