Excerpts from analysts' reports

Macquarie on upcoming "good results" to expect from its top picks

Analysts: Conrad Werner & Sam Chan

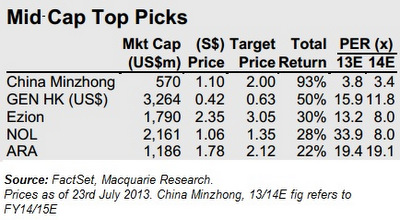

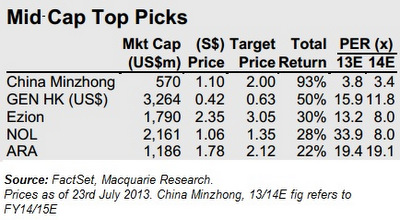

For the midcaps we are most excited by new Top Pick Ezion, which we think is set to report a record quarter, with more momentum behind it heading into 2H13.

For the midcaps we are most excited by new Top Pick Ezion, which we think is set to report a record quarter, with more momentum behind it heading into 2H13.

Genting HK has postponed the listing of Travellers, but a strong 1H13 (+58%) should reignite this compelling SOTP story.

Macquarie on upcoming "good results" to expect from its top picks

Analysts: Conrad Werner & Sam Chan

For the midcaps we are most excited by new Top Pick Ezion, which we think is set to report a record quarter, with more momentum behind it heading into 2H13.

For the midcaps we are most excited by new Top Pick Ezion, which we think is set to report a record quarter, with more momentum behind it heading into 2H13. Genting HK has postponed the listing of Travellers, but a strong 1H13 (+58%) should reignite this compelling SOTP story.

China Minzhong should see better gross margins, and is set to report a maiden dividend, we expect.

ARA is set for another strong showing (+39%) on the back of AUM growth.

NOL’s expected 117m loss sticks out, but our call is premised on being early ahead of a better 2014.

Recent story: 8 STOCKS That Inspire Investor Optimism For 3Q

DBS Vickers flags 'buying opportunty" after Goodpack's correction

Analyst: Ho Pei Hwa

David Lam, chairman of Goodpack. NextInsight file photoSwitching to fast gear. After a slow 2HFY13 (FYE Jun), Goodpack’s volume growth momentum is set to accelerate from 1QFY14 underpinned by additional demand of:

David Lam, chairman of Goodpack. NextInsight file photoSwitching to fast gear. After a slow 2HFY13 (FYE Jun), Goodpack’s volume growth momentum is set to accelerate from 1QFY14 underpinned by additional demand of:

1) 15k boxes /month from new synthetic rubber (SR) customer, Sibur in Russia; and

2) 8-9k boxes/month from newly commenced SR plants of Lanxess and Asahi in Singapore.

This lays the ground for 8-10% volume growth in FY14. In addition, Goodpack stands to benefit from the lower handling and logistic costs on its global tender exercise and leasing cost after the buyback of 300k leased boxes in FY13.

Price weakness is a buying opportunity. Goodpack’s share price has corrected by 21% from its YTD high of S$1.91 in early March against the backdrop of slow recovery in US/Europe and fear of slowdown in China’s economic activities, which would affect global rubber demand. The tide is changing for Goodpack in the light of improving rubber demand and as contributions from new SR contracts in Singapore and Russia kick in as well as the growing autopart segment. ARA is set for another strong showing (+39%) on the back of AUM growth.

NOL’s expected 117m loss sticks out, but our call is premised on being early ahead of a better 2014.

Recent story: 8 STOCKS That Inspire Investor Optimism For 3Q

DBS Vickers flags 'buying opportunty" after Goodpack's correction

Analyst: Ho Pei Hwa

David Lam, chairman of Goodpack. NextInsight file photoSwitching to fast gear. After a slow 2HFY13 (FYE Jun), Goodpack’s volume growth momentum is set to accelerate from 1QFY14 underpinned by additional demand of:

David Lam, chairman of Goodpack. NextInsight file photoSwitching to fast gear. After a slow 2HFY13 (FYE Jun), Goodpack’s volume growth momentum is set to accelerate from 1QFY14 underpinned by additional demand of: 1) 15k boxes /month from new synthetic rubber (SR) customer, Sibur in Russia; and

2) 8-9k boxes/month from newly commenced SR plants of Lanxess and Asahi in Singapore.

This lays the ground for 8-10% volume growth in FY14. In addition, Goodpack stands to benefit from the lower handling and logistic costs on its global tender exercise and leasing cost after the buyback of 300k leased boxes in FY13.

Given that fundamentals are intact, in our view, the overhang in the stock created by the selldown of a substantial shareholder should not be a cause for concern but is a window of opportunity for long term investors to accumulate Goodpack. Besides, Goodpack should not be affected by any potential rate hikes as c.90% of its debts are fixed rate.

Finalisation of autopart contract an imminent catalyst. Value is emerging for Goodpack, trading at 11.7x FY14PE and 1.8x P/BV, which are 1 S.D. below mean. Our DCF-based S$1.90 TP translates to 14.6x FY14F PE and 2.1x P/BV or 6-19% discount to historical mean. Goodpack also offers 3-4% dividend yields based on an informal 45% dividend payout ratio.

On the back of brighter prospects and 25% potential upside to our S$1.90 TP, we upgrade Goodpack to BUY. The finalisation of autopart contracts is an imminent catalyst.

Previous story: TECHCOMP's valuation is low, GOODPACK is a Xmas gift

One could indeed read it to mean that the 25K extra will be responsible for the 8-10% growth.

However, reading further into Pg 2 of the full report, one gets:

1. "These two plants will eventually take up c.100k of Goodpack’s IBCs (3.5% of existing fleet) when fully ramped up."

2. "Contracts with higher volumes are expected to come in from 1QFY14 with potential annual volume for 180k boxes."

Taken together, 100K + 180K = 280 K which is 10% of the IBC fleet of Goodpack. I think this is what the analyst was getting at.