Excerpts from analysts' reports

UOB Kay Hian highlights United Envirotech's fast-growing profit from China's water industry

Analyst: Loke Chunying

Valuation

Valuation

Identified by the UN as one of the 13 countries with extreme water shortages, China has been stepping up its efforts in the waste water treatment industry with a pledged investment of Rmb3.4t (S$680b) according to its 12th Five-Year Plan. Average waste water treatment tariffs in China have also risen from Rmb0.3/tonne in 2001 to Rmb0.8/tonne in 2010, driving the market size of China waste water treatment industry from US$3.3b in 2007 to US$6.1b in 2010.

Dr Lin Yucheng, CEO of United Envirotech. NextInsight file photoGiven the favourable operating dynamics, net profit for Utd has grown at an impressive 5-year CAGR of 29.3% from FY08 to FY13.

Dr Lin Yucheng, CEO of United Envirotech. NextInsight file photoGiven the favourable operating dynamics, net profit for Utd has grown at an impressive 5-year CAGR of 29.3% from FY08 to FY13.

UOB Kay Hian highlights United Envirotech's fast-growing profit from China's water industry

Analyst: Loke Chunying

Valuation

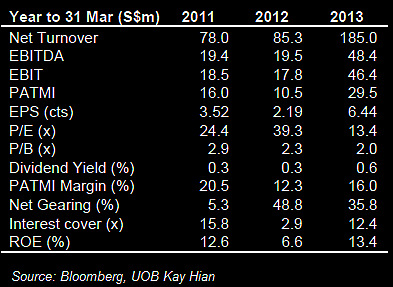

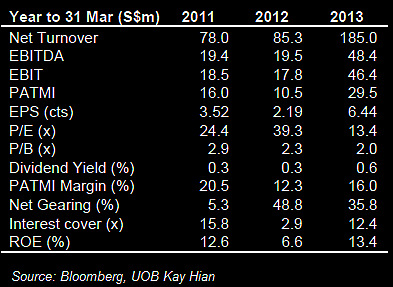

Valuation United Envirotech Ltd (Utd) is trading at 13.4 FY13 PE and 2.0x P/B. This compares to its 3 year historical PE range of 8.1- 17.3x.

Investment Highlights

Favorable operating dynamics. During the past three financial years,Utd has derived more than 80% of its revenue from China. Identified by the UN as one of the 13 countries with extreme water shortages, China has been stepping up its efforts in the waste water treatment industry with a pledged investment of Rmb3.4t (S$680b) according to its 12th Five-Year Plan. Average waste water treatment tariffs in China have also risen from Rmb0.3/tonne in 2001 to Rmb0.8/tonne in 2010, driving the market size of China waste water treatment industry from US$3.3b in 2007 to US$6.1b in 2010.

Dr Lin Yucheng, CEO of United Envirotech. NextInsight file photoGiven the favourable operating dynamics, net profit for Utd has grown at an impressive 5-year CAGR of 29.3% from FY08 to FY13.

Dr Lin Yucheng, CEO of United Envirotech. NextInsight file photoGiven the favourable operating dynamics, net profit for Utd has grown at an impressive 5-year CAGR of 29.3% from FY08 to FY13. Recurring earnings to grow. As revenue from engineering tends to be lumpy, Utd has been seeking to increase its recurring income through investments in water plants. In FY13, Utd processed 0.512m3/day (78.9% of its phase 1 design capacity) and generated an operating profit of S$17.4m (S$0.04/share) from the segment. With processing capacity projected to increase by more than 80% in FY14, Utd’s recurring income is expected to continue growing.

New strategic shareholder. Kohlberg Kravis Roberts & Co. L.P. (KKR), a major private equity firm with more than US$66b in assets under management, has subscribed to new shares in Utd at S$0.50/share.

In addition to its earlier US$113.8m investment in Utd’s convertible bonds, KKR will become Utd’s largest shareholder (45.2% interest) when the bonds are fully converted at S$0.45/share. Note that KKR is an active player in the leveraged-buyout industry, orchestrating some of the industry’s largest buyout transactions to date.

In addition to its earlier US$113.8m investment in Utd’s convertible bonds, KKR will become Utd’s largest shareholder (45.2% interest) when the bonds are fully converted at S$0.45/share. Note that KKR is an active player in the leveraged-buyout industry, orchestrating some of the industry’s largest buyout transactions to date.

Could drive new growth. We believe Utd’s profitability and business expansion could be accelerated with KKR’s strong financial backing and extensive network in China. Given KKR’s background in leverage buyouts, we do not dismiss the possibility of a privatisation further down the road.

Recent story: Buy calls on HI-P INTERNATIONAL and UTD ENVIROTECH

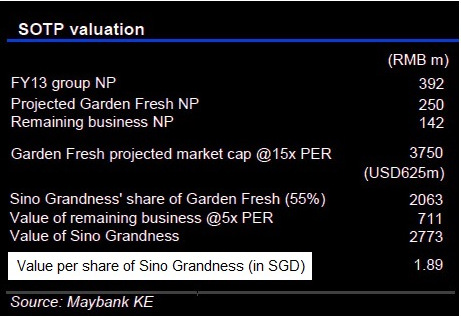

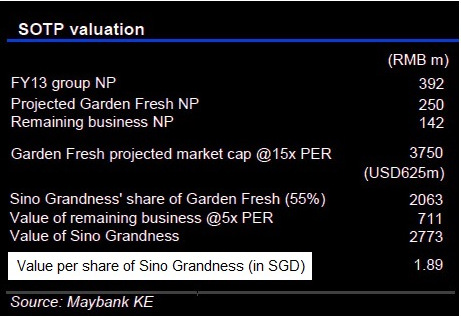

Now the big uncertainty is removed and the remaining steps are more under company’s control. We are more confident about a successful Garden Fresh IPO than before, thus we change our valuation methodology to SOTP. Our target price is raised to SGD1.89 accordingly. Maintain BUY.

Recent story: Buy calls on HI-P INTERNATIONAL and UTD ENVIROTECH

Maybank Kim Eng raises Sino Grandness target price to $1.89

Analyst: Wei Bin

Sino Grandness announced yesterday that it has obtained a no-objection letter from SGX for the proposed Garden Fresh spinoff. It is an important milestone that we have been waiting for. The approval from SGX is earlier than we expected.

Analyst: Wei Bin

Sino Grandness announced yesterday that it has obtained a no-objection letter from SGX for the proposed Garden Fresh spinoff. It is an important milestone that we have been waiting for. The approval from SGX is earlier than we expected.

Now the big uncertainty is removed and the remaining steps are more under company’s control. We are more confident about a successful Garden Fresh IPO than before, thus we change our valuation methodology to SOTP. Our target price is raised to SGD1.89 accordingly. Maintain BUY.

Garden Fresh IPO likely to launch in the next twelve months. Earlier-than-expected approval from SGX will give Sino Grandness more time to work on the remaining IPO preparation.

The next step is to appoint an investment bank. If everything goes smoothly, we expect the Garden Fresh IPO to finish in the next 12 months, which is about three months earlier than the first deadline for the convertible bonds (Oct 2014).

Recent story: SINO GRANDNESS: Way paved for HK listing, but will there be a special dividend?

The next step is to appoint an investment bank. If everything goes smoothly, we expect the Garden Fresh IPO to finish in the next 12 months, which is about three months earlier than the first deadline for the convertible bonds (Oct 2014).

Recent story: SINO GRANDNESS: Way paved for HK listing, but will there be a special dividend?