Macquarie Equities Research sets $4.60 target for Super Group

Analysts: Sam Chan & Conrad Werner

We initiate coverage on Super Group with an Outperform and a target price of S$4.60/sh based on a DCF approach, implying a total expected return of 22%.

David Teo, chairman of Super Group.

David Teo, chairman of Super Group. NextInsight file photoOur positive view is supported by rising wages in ASEAN fuelling instant coffee consumption growth in Super’s key markets and rising demand for premium, functional instant coffee.

It pays at least 50% of its profits as dividends. An unlevered balance sheet also offers scope for special dividends.

However, we think valuations are undemanding. Super’s PEG ratio of 1x (2012 as base year) is at a 30% discount to average ASEAN consumer staples and its closest comp, Mayora Indah (MYOR IJ, Rp27,150, NR).

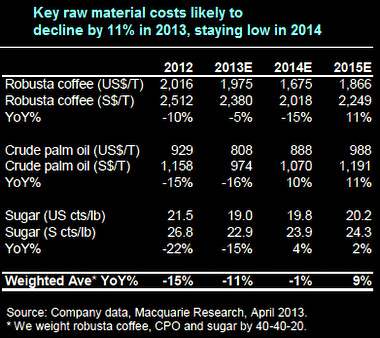

Catalyst: Tailwind from lower raw material prices. Super’s key raw materials costs declined 15% during 2H12.

Catalyst: Tailwind from lower raw material prices. Super’s key raw materials costs declined 15% during 2H12.Furthermore, our commodities team has a bearish outlook on these costs over the next two years on the back of a supply glut.

We estimate Super’s raw material costs to decline by 11% in 2013 and to stay low in 2014, leading to GPM expansion of c.4ppt. Given that the impact of raw material costs is felt 3-6months later, we expect to see margin expansion starting in 1H2013.

Related stories:

FOOD EMPIRE: US$21 m net profit in FY12, upstream projects taking shape

FOOD EMPIRE & GUOCOLEISURE: What analysts now say

Maybank KE says sell SMRT as it ended the year with a whimper SMRT stock price is akin to a train going downhill.Ø The previously unimaginable has happened. SMRT is expecting its first ever quarterly loss in its history for 4QFY3/13. This loss guidance validates our sustained SELL call, and we are reiterating it with a reduced, street-low target price of SGD1.19.

SMRT stock price is akin to a train going downhill.Ø The previously unimaginable has happened. SMRT is expecting its first ever quarterly loss in its history for 4QFY3/13. This loss guidance validates our sustained SELL call, and we are reiterating it with a reduced, street-low target price of SGD1.19.

Ø SMRT has been a dividend darling in the past, with stable and growing earnings providing shareholders with a steady stream of dividends to look forward to.

However those days of stability and certainty look to be coming to an end, as our final dividend forecast for FY3/13 is correspondingly cut by 30% to SG 3.5 cts /share.

Ø In light of such firm guidance on the challenges ahead for land transport operators like SMRT, we are slashing our earnings forecasts by 25% for FY3/13 and ~10% for FY3/14-15. Our target price is reduced to SGD1.19, as we maintain our valuation peg to 15x FY3/14 PER, a full

standard deviation below mean.

SELL SMRT.