Lizhong Wheel is set to ride the recovery on PRC automobile sales growth. Company graphic

Lizhong Wheel is set to ride the recovery on PRC automobile sales growth. Company graphic

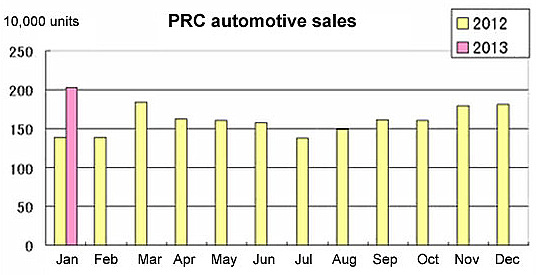

CHINA’S PASSENGER vehicle sales are recovering after a 2-year slowdown.

A total of 1,704,185 cars, sport utility vehicles, multi-purpose vehicles and minivans were delivered in January, up 45.4% over January last year and a 9.2% increase from December, according to the China Passenger Car Association.

'The quality of wheels made in China is increasing. We are able to capture the substitution market for made-in-Japan imports,' said executive chairman Zang Ligen. Photo by Sim Kih

'The quality of wheels made in China is increasing. We are able to capture the substitution market for made-in-Japan imports,' said executive chairman Zang Ligen. Photo by Sim Kih

This is good news for Lizhong Wheel, which derived 65% of its revenue from China in FY2012.

The company generated revenue of Rmb 2.4 billion in FY2012, up 23.7% year-on-year.

A second development that may benefit the aluminum wheel maker is the knock-on effect of the strained Sino-Japanese diplomatic relations on Chinese demand for Japanese cars.

The bilateral ties have been deteriorating due to tensions over sovereign rights to two islands in East China Sea after nearby waters were found likely to hold oil reserves.

Chinese consumer sentiment against Japan was so badly affected that car sales in China in February by Toyota and its China joint ventures were down 45.7% year-on-year to 36,300 units.

Expansion plans bearing fruit

“We now have the largest aluminum wheel production capacity in China,” said executive chairman, Mr Zang Ligen, during an exclusive interview with NextInsight recently.

”Because of our size, we are now more influential in the automotive wheel industry. More people have been approaching us for joint venture partnerships,” added Mr Zang.

Last September, Lizhong Wheel (through wholly-owned subsidiary Tianjin Lizhong) entered into a 68.8%-owned joint venture partnership with Korea HBE. South Korea possesses globally advanced molten metal forging equipment and technology, which are able to meet the technological development and demands of the heavy truck and high-grade passenger car wheels industry in China.

South Korea possesses globally advanced molten metal forging equipment and technology, which are able to meet the technological development and demands of the heavy truck and high-grade passenger car wheels industry in China.

The cooperation with Korea HBE improves the Group’s mould and machinery manufacturing development as well as its research and implementation of molten metal forging technology.

With the joint venture, Lizhong is foraying into the production of wheels for large trucks (22-inch diameter or bigger).

Only 3 or 4 factories in China can manufacture such truck wheels, and the foray represents a technology breakthrough for Lizhong as truck wheels need to be more robust than passenger vehicles.

”The new technology reduces 30% of production process modules. This translates into lower production cost, higher productivity and better margins,” said Mr Zang.

In phase one of the joint venture, Lizhong intends to build production capacity for 60,000 truck wheels a month.

”Our capital expenditure will be high in the year ahead,” he added.

Financing of its capacity expansion has eaten into its net profit, though.

FY2012 profit attributable to shareholders was Rmb 46.3 million, down 3.7% year-on-year. It had taken up more bank loans during the year and interest expense had risen 40.3% to Rmb 37.6 million in FY2012. Data from China Association of Automobile Manufacturers.

Data from China Association of Automobile Manufacturers.

Related stories:

Snapping Up S-CHIPS At, Or Near, Their 52-Week Lows

LIZHONG WHEEL: 9M10 Revenues Surge 77% To Reach Rmb 1.1 Billion