Main reference: Story in Nanfang Daily

WHILE IT'S clear that suitcases full of hot money are flowing into Hong Kong real estate, here’s why the property bubble won’t burst anytime soon.

We can see that the growing pressure on the Hong Kong dollar to appreciate thanks to the US dollar peg is doing little to push even higher turnover or share prices in the Special Administrative Region’s (SAR) bourse these days.

Most of the world’s major economies are relying on loose monetary policies to temporarily “print” their way out of current difficulties.

However, Hong Kong – city/state/SAR that it is – has steadfastly stuck to the greenback peg for nearly three decades, at a constant rate of around 7.8 to 1.

By choosing this route, Hong Kong has been unable to avoid major influxes and outflows of capital chasing real or perceived advantages in currency disparities among the major monies of the region and wider world.

But judging by both the decades-old currency peg and Hong Kong’s recent experience, it would be risky to bet against the SAR being once again able to handle the current surge of “hot money” flooding into, and oftentimes just as quickly -- out of – a range of assets including physical properties and their listed shares.

“From Hong Kong’s perspective, the best thing about the US dollar peg is that it helps stabilize the market during heady times and provides a semblance of confidence within investment circles.

“But the biggest drawback to the peg is its inherent inflexibility, which becomes an easy target for speculators,” said economist Shen Jianguang with Mizuho Securities.

Mr. Shen was not alone in his relatively upbeat take on the peg – at least in terms of its ability to provide a steady hand on the tiller when seas turned choppy.

Although the de facto linkage to the greenback meant that the local Hong Kong currency lacked wiggle room during crises, it does however provide the market with “guidance” as to the Hong Kong dollar’s “relative value.

”But we’ve recently seen the peg do okay amid a climate of hot money inflows and appreciation pressure on the Hong Kong dollar. The peg performs much better in this scenario versus the opposite – depreciation pressure and capital flight,” said Bank of East Asia economist Deng Shi-an.

Both believe that the current property “bubble” is unlikely to burst, thanks mainly to the stability that the peg offers as well as the newly-implemented 15% stamp duty on property purchases by non-locals (read: Mainlanders).

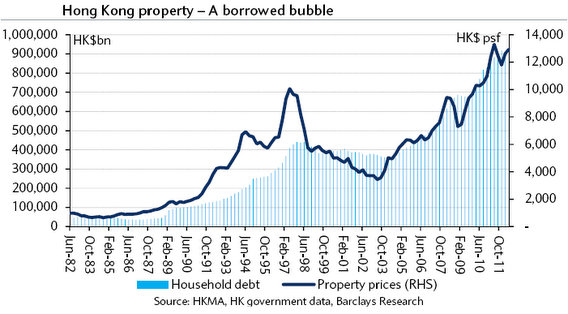

Barclays is less optimistic, saying that over the 27 months from March 2009 to June 2011, mortgage debt in Hong Kong expanded by 34%, while property prices rose 78% over the same period.

It added that for Hong Kong, the financial crisis and the lowering of US interest rates to zero, transmitted via the HK/US$ peg, provided a profitable opportunity to invest in an undersupplied, inflationary property market.

However, there is a need to let a bit of air out of the bubble, which the new disincentive on speculative property buying mainly by PRC investors will help to eventuate.

All things being equal, most market watchers agree that a “currency reform” initiative is needed, as the Hong Kong dollar cannot be forever wed to the fate of the greenback.

See also:

18 Months! That’s When China Shares Might Recover

China Pension Fund Chief: Market’s Hit Bottom

'CHINA'S LADY BUFFETT': Latest Dealings

CHINA’S LADY BUFFETT Struggling Like Rest Of Us