Main reference: Story in Express Times

THERE'S SOME NOT so cheery news for anyone in a hurry to jump back into Chinese A-shares.

A sustained recovery may be as long as a year-and-a-half away.

Here’s why things look so dour.

Market observer Ge Yining is a familiar presence in financial journals.

So when he goes to his crystal ball, people tend to gather round.

“The root of the current bear market slump is a dearth of fund activity and their inability to spike things up. Therefore, I don’t expect any major long-term upturn for another 18 months or so,” Ge said.

That's hardly good bedside manner to comfort an ailing market!

He said he came to the 1.5 year figure because since the PRC IPO market was reopened with a vengeance in 2009, there has been a sharp uptick in newly listed firms’ expenditures including listing expenses themselves, refinancing, stamp duties, commissions, fund management fees and a host of other costs.

This has all resulted in total listing costs and brokerage fees over the period hitting an astounding 3.5 trillion yuan.

Ge said that nearly all of this money ends up in the hands of brokerages – a sector that has significantly outperformed the benchmark index these past three years.

The flow of IPO funds from private investors and shareholders to listed brokerages has stymied the potential returns to stakeholders, Ge said, not only throttling ROIs over the period, but also discouraging newcomers to the market – both in terms of investors and firms looking to go public.

These brokerage fees have grown precipitously these past few years and are severely hampering the ability of funds to boost market turnover and seek out gems hidden in the high grass.

Hence, Ge feels it will take the above-mentioned 18 months or so for a more equitable balance to be struck between brokerages and the funds they serve on how to better share the wealth for the good of the A-share markets.

Zhou Junsheng, another oft-cited market analyst by a wide range of financial media, has been frustrated that there is no fresh blood coming into the market to choose from via IPOs.

That’s thanks to a temporary halt in new listings meant to unclog capital and spur higher daily trading volume and share price movement.

But he also bemoans the fact that the lack of IPOs is not producing any discernible improvement with the existing A-share listed enterprises selling shares in Shanghai and Shenzhen.

“When the market began falling earlier this year, there were few calls for a halt to IPOs. Now that the benchmark index continues to lose ground, the halt calls have been heeded but there’s little improvement.

“We investors are not fools and know that pulling a few levers and moving the furniture around a bit is not going to change the fact that the market is fundamentally flawed and in need of a major boost – from somewhere,” he said.

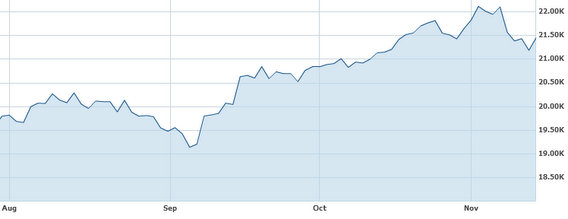

The Shanghai Composite Index has continued to cool off over the past month.

It is currently down some 20% from year-earlier levels and there is no indication that’s in a hurry to regain that lost ground anytime soon.

Those with a dog in the current fight will recall how the bourse watchdog has been urging “market calming measures” for the past month.

Meanwhile, each week a newcomer seemed to launch an IPO which on the surface doesn’t amount to much volume wise.

It seems like companies looking to go public are all too willing to hold off on their IPO plans, and have essentially gone into hiding until the sun comes out again.

And who can blame them?

There’s been only one recent IPO that didn’t get taken to the cleaners.

On November 2, automotive steering column products play Zhejiang Shibao (SZA: 002703) dual listed in Shenzhen to supplement its Hong Kong shares (HK: 1057).

The firm’s newly-listed A-shares debuted at 15.62 yuan, soaring over 505% from their offer price of 2.58, making it the biggest opening day for a PRC-listed firm in a decade.

Shibao’s shares surged over six times on their debut, but the meteoric rise was more due to fluke than fundamentals.

The historic opening day performance of the auto parts maker -- whose clients include the likes of Chery Auto and a Volkswagen JV – was mainly fueled by speculators attracted to the downsized share offering which Shibao was pressured into agreeing to by the market regulator.

For years, H-shares listed in Hong Kong were typically much cheaper than their co-listed cousins on the Mainland.

The China Securities Regulatory Commission (CSRC) has been working to reduce the price gap and give A-shares the appearance of being more market-determined.

Therefore, the interference of the bourse watchdog, while meant to make A-shares more market-driven, is by definition in and of itself contrary to the normal workings of the marketplace.

Therefore, perhaps it is a good idea that IPOs are currently being put on the back burner, at least for now.

If nothing else, it keeps investors from getting burnt.

See also:

China Pension Fund Chief: Market’s Hit Bottom

'CHINA'S LADY BUFFETT': Latest Dealings

CHINA’S LADY BUFFETT Struggling Like Rest Of Us

POOF! 1.7 Trillion Yuan Gone From China Mkt Since May