Cinda: Initiates coverage of PAX GLOBAL with ‘Buy’

Cinda International said it is initiating coverage on PAX Global (HK: 327) – China’s No. 1 player in EFT-POS (electronic funds transfer point of sale) terminal solutions business – with a “Buy” recommendation and a target price of 2.30 hkd, based on 12.2x FY12E P/E or 20% discount to peers.

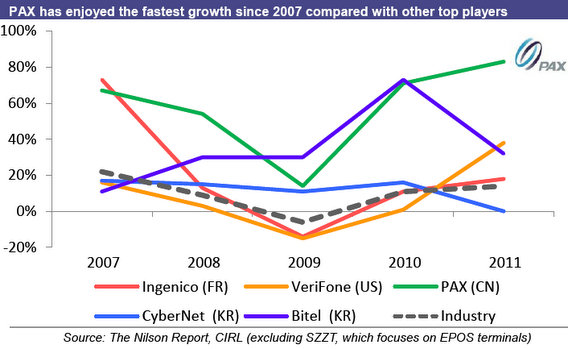

“PAX Global is an undervalued leader in e-payment, and ranks third globally. Over the past few years, the company has enjoyed the fastest shipment growth amongst the top players,” Cinda said.

The research note added that potential losses from fraud in the market could be so significant that customers must ensure the terminals they use are up to the highest security standards.

“Therefore, behind the company growth is strong customer confidence, supported by PAX’s advancing leading position, qualification and established track record.”

Secular growth due to low penetration and EMV upgrade

In 2011, global payment card terminal shipments increased 14.4%, with 33.2% growth in emerging markets.

There is still huge room for growth in emerging markets given the low penetration rate (emerging markets: <5 units/1,000 people, versus developed markets: 10-35 units).

“Growth will also be rekindled in developed markets with EMV (Europay, MasterCard and Visa) upgrades which offer higher security as a means to combat credit card fraud.

“We believe PAX can benefit from these opportunities as well as expand their overseas' market share,” Cinda said.

Industry consolidation favorable for overseas market share gain

In recent years, global top players have been pursuing growth through aggressive M&As.

As industry consolidation leads to fewer choices and lower bargaining power for customers, the customers will be more open to deal with other qualified providers.

“We believe PAX, the third largest global player just after Ingenico and VeriFone, can benefit and gain further overseas market share.

“With fast growing overseas sales, of which GPM is above the company average, the blended GPM will be pulled up.”

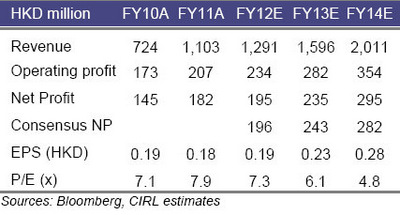

The company is currently trading at 7.3x FY12E P/E (2.4x FY12E ex-cash P/E, with 973.2 mln hkd cash in 1H12), which is 51.8% lower than the average 15.2x of its peers (Verifone, Ingenico and Xinguodu).

“We believe the valuation discount will be narrowed given its growth in global market share,” Cinda added.

Founded in 2000, PAX is the No. 1 and No. 3 EFT-POS terminal solution provider in China and the world, respectively. It is strong in the Asia Pacific and Mideast/Africa. Its major customers are acquiring banks and merchant service providers such as CCB (HK: 939), BOC (HK: 3988), ABC (HK: 1288) and UMS.

See also:

QUIET SUCCESS: Hong Kong Hits 14-Month High

CHANGING FACES: Five Sectors Turning Bullish

China Shares No Compass For Economy

Roadshow Reveals Growing Interest In China Shares

Goldman Sachs: BYD Kept at ‘Sell’

Goldman Sachs said it is maintaining its “Sell” recommendation on BYD Co (HK: 1211) due to slower sales of autos and solar products.

BYD reported third quarter revenue of 10.5 billion yuan and net profit of five million yuan, down 11%/94% y-o-y, respectively.

“The net profit miss is likely a combination of: 1) lower than expected revenue on low car sales; in particular, SUV model S6 volume fell 3% yoy (-9% qoq) despite 29% SUV total market yoy growth in 3Q12 in China,” Goldman Sachs said.

In addition, sales volumes of older models such as F0, F6 and G6 were also below expectations; 2) continued losses in the solar panel division due to weak demand and trade sanctions on some overseas markets; and 3) weak gross margin (after depreciation and amortization) at 10.6% vs. 3Q2011’s 14.1% and GHe FY12 13.0% on price erosion and lower revenues and economies of scale.

“In light of below-expectation auto and solar business sales and higher COGS, we cut our 12E/13E/14E EPS -75%/-18%/-9% to Rmb0.04/0.39/0.62. Consequently, we cut our 12M SOTP based target price to 10.92 hkd from 11.64, which implies 30.4% downside from the Oct. 29 close.

“Risks include higher auto sales volume/price, especially from S6, G6 and new F3 models; recovery of handset and solar business.”

See also:

BYD Auto Founder To Get Golden Parachute?

BYD AUTO: Buffett's Bumpy Bargain

TOP 10 HK Dividend Yields Sport Seven Lenders

BAD APPLES: Hong Kong’s Listing Laggards