Translated by Andrew Vanburen from a Chinese-language piece in China Securities Journal

MARKETS DON'T always act rationally.

Anyone putting their money into China's listed property developers is all to aware of this.

An odd phenomenon is taking place in China’s stock market.

After it was learned that China’s third quarter GDP growth of 7.4% hit a nearly four-year low and over 30% of housing markets in the country fell, the market did a strange thing.

It shot up on Thursday with property shares leading the charge.

The reason?

Less fear of government controls in a softer market.

Following the ostensibly bad news on the macro front with slower-than-expected GDP expansion, it became clear that listed property developers in Shanghai and Shenzhen were expected to be some of the most obvious “beneficiaries” of the weaker economy.

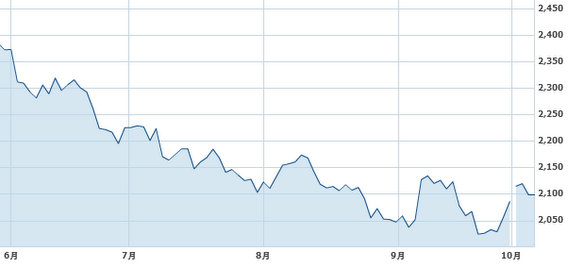

For much of 2012, the real estate industry in China has shown erratic growth in both property prices and prices for the sector’s listed enterprises.

And throughout the year, Beijing has used carrots and sticks to keep rampant speculation in the sector at bay.

Now, with the overall economy growing at a more sluggish pace, it will be much harder for developers to command sky-high prices for their residential units, and commercial property plays will have more trouble asking for premium rentals from shopping mall and office tenants.

Therefore, it is only logical that the country’s economic and market regulators will be more likely to turn a blind eye to property speculators and ease off the macro-economic measures targeting over-fast growth in the sector.

And the discounted prices for property shares of late thanks to said cooling measures were simply too tempting a prospect for bargain hunters to ignore ecently.

Furthermore, given the poor performance of property shares of late, the uptrend for their share prices is likely to continue for some time in an extended game of catch up.

Indeed, not only is China’s highly-watched GDP growth rate showing a slowing trend, but housing prices are also showing similar characteristics.

According to the most recent industry figures, home prices in 30% of Mainland China’s 70 largest urban areas declined in the month of September, with a 0.4% decline month-on-month seen for all cities surveyed.

This may not seem like a precipitous decline, but residential property prices in China over the past few years have often expanded faster than the overall rate of inflation, especially in some of the fast-growth regions like the tropical island province of Hainan.

On a year-on-year basis, the findings were even more noteworthy, with 55 of the 70 urban areas surveyed showing lower housing prices.

The question for property investors going forward will be: How long will housing shares rise amid a slowing economy?

See also:

China Shares No Compass For Economy

Roadshow Reveals Growing Interest In China Shares

BEHIND THE SCENES: Top China Funds Faceoff In Beijing

REACHING CONSENSUS? 8 Takes On China Shares