Photo: Benny Yu, Aries Consulting

E FUND MANAGEMENT (HK) Co Ltd is one of just four renminbi Qualified Foreign Institutional Investor (RQFII) firms winning approval to launch an exchange-traded fund (ETF).

The ETF specialist – analogous to Singapore’s highly successful iShares MSCI Singapore Index Fund – became the first such listco in Hong Kong to track the A-share index this year with its IPO in late August.

Its listing of the E Fund CSI 100 A-Share Index ETF (HK: 83100) in Hong Kong this summer marked a watershed moment for the securities industry, and also registered a vote of confidence in Mainland China’s capital markets, which have struggled of late.

E Fund Management (HK) thinks this is the perfect time to launch, a top executive said.

"Many of our investors consider now very ripe for the taking as the A-share market is flirting with four-year lows. Current levels are seen by a good number as a good jumping-in point," said Managing Director Nathan Lin of E Fund Management (HK) Co Ltd.

Launched earlier this year, the RQFII program lets foreign investors raise offshore Chinese yuan to buy shares listed in Shanghai and Shenzhen – the venues of the PRC’s two stock exchanges.

The difference between RQFII and the decade-old QFII campaign is that funds in the former scheme are denominated in the Chinese yuan currency as opposed to greenbacks.

Chinese market regulators originally assigned a quota of 20 billion yuan to the RQFII scheme, a sum initially earmarked for fixed income funds.

However, given the campaign’s healthy reception and genuine market demand, the quota has since grown to 50 billion yuan, with the extra amounts targeting ETFs under the RQFII program.

This is extremely good news for E Fund Management.

"We are excited to see the successful listing of the E Fund CSI 100 A-Share ETF on the Main Board in Hong Kong.

“As the first RQFII ETF of E Fund, E Fund CSI 100 represents a significant milestone for our commitment to developing RQFII-related products as our core strategic business in Hong Kong," Mr. Lin said.

E Fund Management Co – the parent of E Fund Management (HK) Co Ltd – is based in the southern Chinese city of Guangzhou, a short commute from Hong Kong by ferry or high-speed rail.

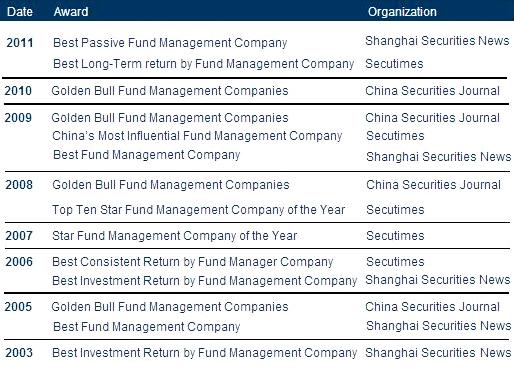

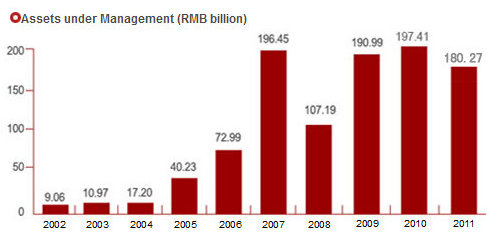

The group has grown to become the second largest mutual fund manager in Mainland China and the top index fund and ETF manager in the country.

As of September 30 of this year, the firm had AUM of around 200 billion yuan.

Photo: Benny Yu, Aries Consulting.

It has won full licenses for the management of mutual funds, separate accounts, National Council for Social Security Fund mandates, enterprise annuities, QDII and RQFII.

When asked how E Fund intends to develop its RQFII products in Hong Kong, Mr. Lin said the market potential was enormous.

“RQFII marks a milestone in our business development. E Fund Hong Kong was one of the first batch of China-based asset managers to set up offices in Hong Kong.

“We are the second largest mutual fund company and biggest index manager in China. As a wholly-owned subsidiary and the only offshore office of E Fund Management, E Fund Hong Kong is strategically positioned to leverage on the investment platform of the E Fund Group and provide investment management services to global investors seeking exposure to China’s capital market.”

He said that RQFII was put in place in December of last year by the Chinese government as a mechanism to allow offshore investors with RMB deposits to invest in China’s capital markets.

“In the wake of China speeding up its capital market opening and boasting the renminbi as a major settlement currency, RQFII is definitely an area of substantial potential growth in the coming years.

“So far we have launched two RQFII funds, one fixed income fund and the CSI100 A share ETF. We have more RQFII products in our pipeline that span across the risk spectrum, from low cost, high liquidity cash management strategy to various ETFs tracking different A share indices,” Mr. Lin added.

E Fund saw many distinct differences between itself and other ETF funds that gave it significant competitive advantages, with a major selling point being that E Fund’s CSI100 A share ETF is a physically backed ETF.

“Compared to existing A-share ETFs in the market, which are mostly synthetic, physical ETFs have two major advantages,” Mr. Lin said.

“First, physical ETFs are a lot cheaper. For example, the total expense ratio of our CSI 100 ETF is 99 basis points, versus 139 basis points of management fee and around 300 basis points of total costs for one of the biggest synthetic A share ETF in Hong Kong.

“Second, because physical ETFs do not use P-notes or swaps, there are no collateral related counterparty risks typical of synthetic ETFs.”

Photo: Chow Sang Sang Jewelry

He added that compared to other RQFII ETFs, the CSI 100 ETF appeals to investors because the cost is low and the experience of E Fund in managing ETFs helps ensure smooth operations.

“For cross border ETFs such as the CSI 100 ETF, the operational challenges are big for managers and not every manager is equally well prepared.

“E Fund is one of the two managers with mandates to manage cross border ETFs in two ways, both outgoing from and incoming to China. Investors need to study the operational readiness and reliability of the manager before they make a decision on which one to invest in,” Mr. Lin said.

NextInsight asked Mr. Lin to compare E Fund’s products to the iShares MSCI Singapore Index Fund (EWS), which is heavily weighted to large/giant cap firms which comprise over 90% of the fund’s assets.

“From the perspective of ETF management and operations, I believe the CSI 100 A share Index is an ideal index to go with.

“It tracks the largest 100 companies listed on the Shanghai and Shenzhen stock exchanges in terms of market cap and liquidity, and therefore is a core blue chip index that offers exposure to the Chinese economy.

“Compared to some offshore large cap A-share indices, the CSI 100 Index is more diversified across various sectors and offers greater exposure to some of the fastest growth sectors, such as the consumer, healthcare and certain specialized industrial sectors that are less represented by offshore indices.”

Investors in Singapore and regional markets might not have to wait too long to be able to learn more about E Fund and its products firsthand.

“We are interested in the Southeast Asian markets, particularly Singapore.

China has been strengthening its economic ties with ASEAN counties in the past years and bilateral trades have surged. As the Chinese economy keeps growing and contributes more and more to the regional and global economy, it increasingly makes sense for investors in the Southeast Asia to invest in China’s capital markets,” Mr. Lin said.

He added that from the perspective of market timing, he believes it is the right time for investors to jump in.

“The A-share market looks very cheap now, and the CSI 100 A share Index trades at around 10 times PE.

“Given the sheer size of the Chinese economy and its growth potential, I believe the decision of investing in China is not one about “to be, or not to be,” but rather one about how and when.

“RQFII ETFs present a rare opportunity to share the economic growth of China. The worst of times could actually turn out to be the best of times, if investors take a contrarian and long-term view,” Mr. Lin said.

About E Fund CSI 100 A-Share Index ETF

CSI 100, known as the "Core A-Share," is made up of the 100 largest A-Share issuers in terms of market capitalization listed on the Shanghai and Shenzhen stock exchanges. With an investment strategy of full replication, E Fund CSI 100 aims to closely correspond to the performance of the CSI 100 Index after fees and costs.

In addition, with the support of physical ETF, E Fund CSI 100 A-Share ETF is not exposed to counterparty risks of derivatives, resulting in a more competitive total expense ratio. Also, it has less of an impact on exchange rate fluctuations in investment returns, and will therefore be safer and more cost-efficient for investors when they track the performance of A-Shares. As at August 2012, the CSI 100 Index has outperformed the FTSE China A50 Index over the past five years.

See also:

Not All Hong Kong Shares Stuck In Neutral

CANCELLING OUT: Why Hong Kong Shares Stuck In Neutral

BUYER’S MARKET? 12 Consumer Plays Eyeing HK IPOs

SPILLED MILK: China Mengniu In Yet Another Outrageous Scandal