Photo: CSS

Bocom: ‘Outperform’ on CONSUMER DISCRETIONARY

Bocom International said it is maintaining its “Outperform” recommendation on Hong Kong-listed consumer discretionary shares, meaning the research house expects the sector to grow by over 10% within the next 12 months.

The upbeat call on the industry comes even after a lackluster conclusion to the interim reporting season and despite saying that “no second half recovery is anticipated.”

“We remain cautious on the 2H12E sector growth outlook, as we see any sign of recovery is unlikely amid the sustained macro headwinds.

“Coupled with the destocking impact (not limited to sportswear), we believe China retail sector’s SSS (same store sales) and margins will remain under pressure in 2H12E,” Bocom said.

In light of this, the research house said it favors those stocks with “better defensiveness, particularly those backed by healthy brand recognition and strong asset backing, apart from the solid growth stories.”

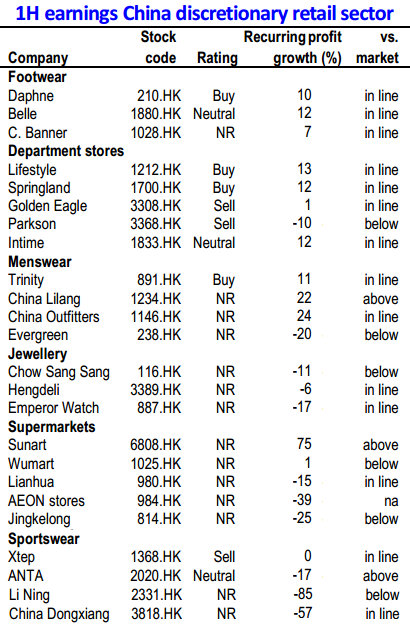

Its “Key Buys” are PRADA (HK: 1913), still its top pick in the sector, Sa Sa (HK: 178), Lifestyle (HK: 1212), Chow Tai Fook (HK: 1929), Trinity (HK: 891), Daphne (HK: 210) and Springland (HK: 1700).

Bocom maintains its “Sell” on Golden Eagle (HK: 3308) and Parkson (HK: 3368), and “Neutral” on Belle (HK: 1880), CRE (HK: 291), Intime (HK: 1833) and Anta (HK: 2020).

“The key factors to watch in the second half include SSS trends, retail discount pressure and new store expansion pace."

The interim results season for the China discretionary retail sector has ended, with average net profit growth of 14%, a noticeable deceleration from +30% in FY11.

“Imminent growth slowdown was evident across all segments, despite footwear (10% avg. growth) having fared slightly better than department stores (5% growth) and menswear (9% growth).

“The most common points of the retailers’ results were the slowed SSS growth and the margin declines, due to weakened consumer climate and the resultant increased promotional activities,” Bocom said.

It added that unlike the previous results, very few stocks had positive earnings surprises this time, except for China Lilang (HK: 1234) and Sunart (HK: 6808).

Footwear in general reported in-line earnings, while department stores and menswear were mixed, with Parkson and Evergreen (HK: 238) coming below while Lilang was above.

“We made no major ratings and earnings changes in our stock universe, except for Parkson downgraded to 'Sell' (from 'Neutral').”

Footwear

Average first half net profit growth was 10%, with Belle +12%, Daphne +10% and C. Banner (HK: 1028) +7%.

The key drivers were 5-17% SSS growth and 7-20% new stores growth, but partly offset by a decrease of operating margin by 0.7-4.4ppt to 13.8-27.1% due to higher sales markdowns and operating costs (particularly rental and wages).

“Daphne remains our preferred stock in the footwear universe due to its better longer-term growth story (FY13-14E EPS CAGR of 24% vs. 15% growth of Belle) on the scope of margin upside as the group’s operational revamp increasingly bears fruit (vs. Belle’s peaked margin trend).

"SSS growth, sales discounts and ASP trends are the sector’s key points to watch in 2H12E," Bocom said.

The note to investors is reiterating its “Buy” on Daphne and “Neutral” on Belle.

Department stores

Average first half net profit growth was 5%, with Lifestyle being the strongest (+13%) and PCD the weakest (-52%).

The key drivers were SSS growth (2%-12%) and new store growth (GFA up 3%-44%), partly offset by margin declines due to higher new store start-up losses, increased promotional activities and negative sales mixes.

“We reiterate “Sell” on Golden Eagle due to potential earnings downside and excessive valuation, and Parkson on its imminent deteriorating outlook. Lifestyle and Springland remain our preferred stocks in light of better growth resilience underpinned by strong asset backing.”

Sportswear

As expected, the segment saw little surprise, with earnings ranging from flat growth to 85% declines, as most stocks had been guiding down expectations before the results (with some having issued profit warnings).

“We believe this segment’s earnings downside risk remains high on mounting sales and margin pressure amid the industry’s sustained structural problems (destocking and over-expansion).”

See also:

XTEP: Overperforming In Overcrowded, Overstocked PRC Sportswear

TWO LEFT FEET: China Sneaker Play Li Ning Sees Dire Year

Houses Hike XTEP To ‘Outperform’, 'Buy'; GIORDANO Target 15% Upside

XTEP Orders Lead Sector