Translated by Andrew Vanburen from a Chinese-language piece in Shanghai Securities Journal

CHINA BEGAN grudgingly allowing gradual investment in its coveted A shares for qualified foreign institutional investors as part of its QFII scheme a full decade ago.

Now foreign investors appear to be moving in to mop up bargains in the struggling Chinese capital markets.

Back in 2002, under pressure from the international investing community to open up its capital markets, Beijing launched the QFII campaign which granted foreigners their first chance to buy into the country’s A shares listed in Shanghai and Shenzhen.

This was a much more tantalizing prospect than purchasing B shares --counters specifically designed to assuage foreigners yet historically offering very poor returns.

A decade ago, when the QFII scheme was first unveiled allowing licensed overseas investors the opportunity to buy and sell yuan-denominated A shares, just a few high-profile institutions were allowed in the door with an aggregate quota of just a few billion usd.

By April of last year, the program has rapidly expanded to include over 100 licensed QFII investors with an aggregate investment quota of over 20 billion usd.

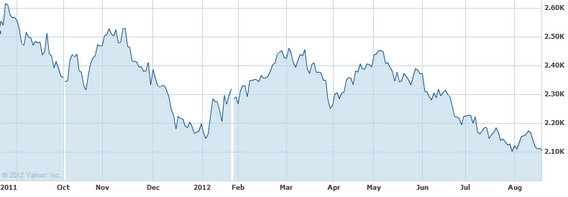

However, with China’s benchmark Shanghai Composite Index being the worst performing major stock tracker worldwide earlier this year, Beijing decided to open the floodgates to kickstart the domestic bourses.

In April of this year, the QFII total quota available to foreigners surged to 80 billion usd, a move which firmly put the Shanghai and Shenzhen A-share markets on a footing to directly compete with Hong Kong for foreign funds.

UBS was the first to be approved for the decade-old QFII program, and was quickly followed by highly-recognizable names in global finance including Nomura, Morgan Stanley, Citigroup, Goldman Sachs, Deutsche, HSBC, etc.

The Government of Singapore Investment Corp Pte Ltd and Temasek Fullerton Alpha Investments Pte Ltd jumped onboard the QFII bandwagon in 2005.

Before China’s market regulator boosted the allowable QFII investment quota to rise from 20 billion usd to 80 billion this April, the scheme only accounted for a miniscule 0.8% of total A-share market capitalization investment.

But with the bear market dragging on in the PRC for most of this year – the Year of the Dragon – it looks like QFII investors are beginning to make their presence known in a much broader way thanks to the bargain basement prices available amid the market downturn.

Fortunately for Beijing, the growing “foreign invasion” also means that not everyone is downbeat on China’s economic prospects going forward.

BoA-Merrill Lynch said in its global economic outlook this month that overseas fund managers now have reached a near two-year high in terms of their confidence in the health of the Chinese economy.

Although it may not seem like much to write home about, some 14% of polled overseas fund managers believe that the PRC economy will see a strong recovery over the next 12 months – a percentage not seen since November of 2010.

The same poll found that only 16% of fund managers believed China was still destined for a “hard landing,” which in local terms is defined by GDP growth of less than 7%.

To back up their sentiments, it appears that existing QFII investors are putting their money where their mouths are and taking a serious look at newly-affordable A shares.

Since the beginning of the year, QFIIs have been approved for an additional 6.9 billion usd in share investments.

This eight-month total surpasses any 12-month figure seen since the birth of the QFII program a decade ago.

For QFII investors, the biggest draw is the bargain prices in the local bourse.

Helping matters is the fact that current P/E ratios for Shanghai Composite constituent stocks are 54% below 10-year averages, which makes local counters even more irresistible to QFII bargain hunters.

Kim Jun Sung, chief of Samsung AMC, said: “The Chinese stock market is clearly full of investment value. However, its full potential is still stymied by a less-than-rosy economic outlook.”

Samsung AMC didn’t let the murky economic forecast in the PRC stop it from boosting its QFII application by another 150 million usd in the heart of the global downturn two years ago.

Mr. Kim said he is “very bullish” on the mid- to long-term outlook for Chinese A shares, but added that another stimulus from Beijing would go a long way towards boosting confidence among foreigners in the PRC’s capital markets.

See also:

POWER STRUGGLE: Who Wins PRC Electronics Price War?

Rocky Going For Hong Kong’s Cornerstone Investors

BUCK STOPS HERE: 15% Of China H1 IPOs Denied

HEAT STROKE: China’s Erratic Summer IPOs