CHINA’S TOP monocrystalline solar wafer play Solargiga Energy (HK: 757) endured the lowest point in the solar sector’s recent history during the first half, but serious oversupply problems should be worked out by next year, said its CEO.

Management met with investors to announce first half results and spell out a brighter plan for the future.

“The first six months represented a historic low for the industry,” Solargiga CEO Hsu Youyuan told a roomful of investors in Hong Kong.

And although the solar sector is still relatively new compared to more established industries like autos and steel and not in possession of a decades-long history, it was still a very difficult half-year for all wafer and ingot makers, bar none.

Mr. Hsu was not only speaking on Solargiga’s behalf, but could have also been voicing the concerns of any number of listed solar power plays in China who have struggled to stay afloat in an extremely crowded marketplace buried under stockpiles of overcapacity and supply and falling average selling prices.

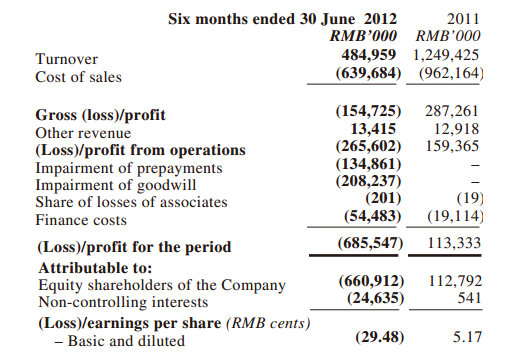

In the first six months, Solargiga’s revenue slipped 61.2% year-on-year to 485 million yuan due to what the company called a “slowdown of the global solar market.”

Selling prices of solar products have indeed dropped precipitously during the period which led to Solargiga’s lower turnover.

But the main culprit contributing to Solargiga swinging to a first half net loss of 660.9 million yuan versus a net profit of 112.8 million a year earlier was silicon price weakness.

“We recorded a loss because of the slowdown in the global solar market which led to the drop in selling prices and thus our lower turnover.

“Moreover, raw material prices (i.e. silicon) came down resulting in an inventory provision of 132.8 million yuan during the end of the first half,” said Solargiga Chairman Tan Wenhua.

The Chairman added that a goodwill impairment loss of 208.2 million yuan occurred due to the acquisition of solar business subsidiaries as well as a write-down on raw material pre-payments of 134.9 million.

With the provision, impairment and write-down costs, it quickly becomes apparent how Solargiga managed to swing to a net loss in the first half.

During the first half of the year, Solargiga maintained its production capacity of silicon ingots to “further exploit its technological advantages.”

Mr. Tan added that the company has reached a milestone in terms of product quality, earning it special privileges in its home market.

“Our products are the only monocrystalline silicon solar ingots in China which are exempt from quality surveillance inspections.”

A leading manufacturer of monocrystalline silicon solar ingots and wafers in China, Solargiga has also extended into the production and sale of photovoltaic cells and modules as well as the installation of photovoltaic systems.

Currently, its annual monocrystalline silicon solar ingot production capacity stands at approximately 1.2 GW, with annual monocrystalline silicon solar wafer production capacity of around 900 MW, and solar cells and modules at 300 MW and 150 MW, respectively.

Looking ahead, as CEO Hsu asserted, January-June was the worst the industry has ever seen, which suggests that things are bound to get better sooner rather than later.

“Although the solar industry faced a very difficult time in the first half, from a long-term outlook we believe the sector has good prospects.

The CEO added that industry shakeups are not all bad, as they let the marketplace separate the wheat from the chaff.

“Currently the market is facing a serious problem of oversupply and in the process of consolidation, the weaker companies are falling by the wayside which allows the stronger ones to improve, which helps the overall market condition in the long run,” he said.

For this reason, Mr. Hsu was sanguine on Solargiga’s prospects and the overall solar energy market going forward.

“We estimate that the extreme imbalance of supply and demand will be resolved by the end of 2013. The process of consolidation will promote the establishment of a long-term healthy developmental environment for the solar energy industry.”

He added that the sun only shone on the fittest of the solar firms in market downturns, and Solargiga was confident it would emerge stronger following market consolidation and remedied oversupply.

“The survivors of the consolidation will enjoy fruitful rewards in the future and we are adopting several measures to make sure we will emerge stronger.”

Mr. Hsu said some of these strategies include consolidating units and divisions of the Group as well as developing new client pools to “bring better rewards to our shareholders.”

“We will enhance R&D to boost quality and efficiency, and all capital expenditure will be suspended in order to reduce cash outflows. Furthermore, in the process of enhancing quality, we will seek to simultaneously reduce costs."

However, Mr. Hsu stressed that in the process of reducing costs, the target of quality enhancement has to be reached with no compromises on the latter.

The CEO added that Solargiga would increase the production ratio of “N-type” products and launch higher efficiency products aimed at reducing power generation costs per unit.

Solargiga operates its major production facilities -- producing solar ingots, wafers, cells and modules -- in the Northeastern Chinese city of Jinzhou in Liaoning Province.

The firm also operates a solar ingot production plant in Xining, Qinghai Province and operates polysilicon reclaiming and upgrading facilities in Shanghai and Jinzhou.

Solargiga said it aspires to be the world’s largest monocrystalline silicon solar ingot and wafer maker, capitalizing on its vertically-integrated business model to become a “one-stop solutions provider” for the solar power industry.

See also:

SOLARGIGA Sales Surge To 2.8 Bln Yuan But Prices Casting Shadow

ANWELL: Shining Solar Sales And EPC Prospects

SOLARGIGA: Targeting To Be One-Stop Solution Provider