MAJOR WAFER PLAY Solargiga Energy (HK: 757) boosted its revenue nearly 50% last year to 2.8 billion yuan.

But the Chinese firm took a big hit when silicon prices tumbled late last year, executives told investors in Hong Kong.

Solargiga CFO Jason Chow said said that as the price of polysilicon – a major raw material in solar wafers and ingots – continued to decrease during the second half of 2011, Solargiga was required to make a one-off write down for the inventories of 161.7 million yuan.

Excluding the one-off write down for the inventories, Solargiga’s gross profit in 2011 would have been 415.5 million yuan instead of the reported amount of 253.8 million, which was down 38.6% year-on-year.

The write down last year helped contribute to a 74.6% year-on-year decline in the bottom line to 54.3 million yuan.

Given the net profit performance, Solargiga’s directors do not recommend payment of a final dividend for the period.

“Due to raw material price volatility, especially during the latter part of last year, we were forced to make adjustments including the inventory write down,” Mr. Chow said.

Photo: Andrew Vanburen

However, Solargiga was able to use the polysilicon price volatility to its advantage whenever possible with management saying that despite the continuous declines in inventory prices as well as costs for finished products, the company still successfully enhanced its production scale.

While saying that 2011 presented formidable challenges to all solar sector firms, with Solargiga being no exception, management was still very upbeat on future prospects given the reality of the shelf life of non-renewable sources of power like oil and gas as well as growing public and government support for a long term solution to energy issues.

“There is still plenty of upside growth potential,” said Mr. Chow.

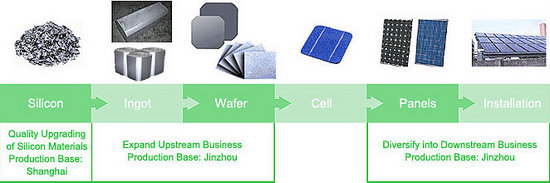

Solargiga said that it successfully built an effective and unique “inverted triangle” integrated supply chain last year.

“We gradually completed the transformation from a solar energy materials manufacturer to a one-stop service supplier of solar power projects. These individual projects include ingots, wafer cells and modules within the supply chain that can be sold externally.

“For all these, the sales performance last year was satisfactory,” said Hsu You Yuan, CEO of Solargiga.

He said that thanks to a strong track record of quality and efficiency, Solargiga is the only monocrystalline silicon solar ingot maker based in the PRC to have been granted exemptions from regular quality surveillance inspections.

Also, the company’s photovoltaic conversion efficiency for its monocrystalline silicon products exceeds the industry average.

“Looking forward, we are optimistic on the outlook of the solar energy industry after integration and we expect it will replace traditional fossil-based fuels in the future,” Mr. Hsu said.

He pointed to recent industry research the forecasts the Asia Pacific region will become the most important solar energy market in the world.

“Since the developed countries in Europe have been lowering government subsidies for their solar energy industries, it is believed the development focus of the future of the solar energy sector will gradually shift towards the Asia Pacific region.”

However, Solargiga was not willing to put too much emphasis on government-led initiatives and realized that at the end of the day, natural market demand would drive the industry.

“Focusing on market demand, Solargiga will continue to formulate our development core, adjust the pace of advancement as well as continue to enhance our production capacity, technological standards and operational efficiency,” Mr. Hsu added.

Indeed, a quick look at 2011 activity by the company displays as much.

Over the 12-month period, Solargiga aggressively expanded its solar ingot production capacity. As of the end of 2011, the group operated 493 monocrystalline ingot pullers and four multicrystalline casting furnaces.

The external shipment volume of self-manufactured and processed silicon solar ingots last year stood at 85.86 MW and 55.38 MW, up 11.5% and 113.5%, respectively, year-on-year.

Solargiga focuses on the production of monocrystalline solar ingots and wafers, but has begun to expand production to include photovoltaic cells and modules as well as full installation services for entire solar energy systems.

Its current annual monocrystalline silicon solar ingot capacity stands at 1.2 GW, while capacity for solar wafers is now at 900 MW and solar cells and modules have reached 300 MW and 150 MW, respectively.

Hong Kong-listed Solargiga has two main production bases: one in Liaoning Province which focuses on ingots, wafers, cells and modules, and another plant in Qinghai Province where it produces ingots.

It also operates polysilicon reclaiming and upgrading facilities in Shanghai and Liaoning.

CEO Mr. Hsu said the company was eager to shift focus to higher-margin products whenever feasible.

“We are aiming to selectively expand the production scale of downstream modules according to market conditions, gradually shifting to a strategic business model of ‘golden cup’ vertical integration from an ‘inverted pyramid’ model.

“We believe this will consolidate our current leading position in the market and further sharpen our corporate competitive edge in order to provide our shareholders with steadily growing performance.”

Solargiga Chairman Tan Wen Hua was also very sanguine on Solargiga’s prospects down the road – both due to the intrinsic merits of the Hong Kong-listed firm as well as assurances of continued government support.

“Renewable energy is a key component of the current 12th Five-year Plan, with solar power being one of the most promising sectors within this field,” Mr. Tan said.

He also added that Solargiga, having listed in Hong Kong in 2008 and selling TDRs in Taiwan since 2009, was a major established player in the solar power industry, and local firms wanting to challenge its supremacy would find the task very daunting.

“We are on the cusp of a major consolidation of the PRC solar sector. It is becoming very difficult for new competitors to enter this field as entry barriers are very prohibitive given the high technical barriers and economies of scale needed.”

And M&A-based growth was becoming a more common expansion strategy for Solargiga, especially after the firm acquired solar cell maker Sino Light Investment Ltd last year, which added 33.4% to Solargiga’s total solar cell external shipment volume post-acquisition.

Through the purchase of Sino Light, Solargiga management said it was now better able to connect the upstream and downstream businesses within the group to attain greater synergy.

And despite the write off last year due to declining prices for polysilicon inventories and end-products, he was upbeat on the future.

“Sector consolidation will bring more price support and we expect more stability for raw material and end-product sales going forward. Therefore, we expect our margins to improve under these expected conditions,” Mr. Tan added.

And the firm was not shy about aiming high regarding its ultimate goal.

“Solargiga aspires to be the world’s largest monocrystalline silicon solar ingot and wafer maker.”

See also:

ANWELL: Shining Solar Sales And EPC Prospects

SOLARGIGA: Targeting To Be One-Stop Solution Provider