Translated by Andrew Vanburen from a Chinese-language piece in Shanghai Securities Journal

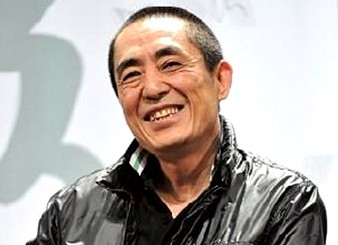

THE MAN BEHIND the extravagant Opening Ceremony for the Beijing Summer Games four years ago -- Zhang Yimou -- is easily China’s most recognizable director.

And now it seems he is about to call for more "action" in the world of finance after it was revealed that he had co-established a major new "art" heavy fund.

Analysts say he is unable to resist the cornucopia of low P/E stocks in the market.

But is he planning to swap his director’s chair for a boardroom chair?

First of all, it should be mentioned that stars and stocks don’t always mix well.

A recent NextInsight piece revealed how basketball icon Yao Ming lost 45 million yuan after deciding to accept his spokesperson’s salary in shares from rapidly falling tech firm UniStrong.

The former Houston Rocket’s center didn't exactly enjoy out of this world results with the satellite designer.

And Yang Zi, accomplished screen and TV actor, lost around 200 million yuan due to the bearish Chinese stock market and sluggish economy.

So Zhang -- the 60-year old former romantic partner of actress Gong Li -- is hoping to break the mould of failed celebrity investors and strike it rich with a new two billion yuan fund: The Zhang Yimou Cultural Assets (ZYMCA) Fund.

Other partners in the fund are birds of a feather, it can be said.

They include Beijing Galloping Horse Film & TV Production, an art house putting out award winning domestic films since 1998.

But one of the more intriguing partners in the new fund is property developer Dalian Wanda Group.

Wanda operates in five major industries: commercial properties, luxury hotels, tourism investment, department store chains and “the cultural industry.”

It is no doubt this fifth undertaking of Wanda that caught Director Zhang’s attention.

Certainly helping matters is the fact that unit Wanda Cinema Line – Asia’s largest cinema operator -- acquired US-based cinema operator AMC Theatres in May for some 2.6 billion usd.

This marked the biggest ever overseas purchase by a Chinese private firm.

Director Zhang is no doubt pleased to bring Wanda onboard with its newfound exposure to overseas cinema operations (and the potential launchpad this provides for Chinese films) as well as Wanda’s deep pockets.

Northeast China-based Wanda has assets of 250 billion yuan and an annual income of 140 billion yuan, and currently operates 55 Wanda Plazas, 34 five-star hotels, 814 cinema screens, 46 department stores and 51 karaoke outlets across the country.

Another key partner in the innovative new fund is Kunhong Media – a media production play.

And just like film critics, analysts can’t seem to agree on this latest “production” by Director Zhang.

Many say the upside will surely be an artful combining of Zhang’s directorial experience and his connections in the movie industry alongside Wanda’s deep pockets and experience on the cinema operations side.

These analysts say that the brains (Zhang) and brawn (Wanda) behind the new fund can truly make waves in the entertainment sector, if it invests wisely.

But detractors to the whole idea say that Zhang’s business dealings in the past – while extensive enough – were limited to drumming up support for some of his past films, and that investing in third parties is a whole different kettle of fish.

Therefore, they say they – like many Chinese – will not only be anxiously awaiting Director Zhang’s next blockbuster film, but also keeping a lookout for his first blockbuster deal on the investment front.

See also:

CHINA'S SILVER SCREENS: 'Precious Metal' For GOLDEN HARVEST

HK Flicks, Footwear & Financiers: Latest Happenings...

GOLDEN HARVEST: Singapore Top Cinema Play's Profit Up 37% On PRC Story

GOLDEN HARVEST Eyes PRC Big Screens