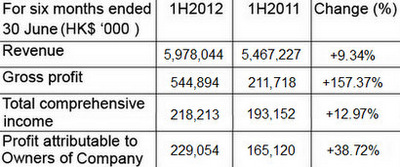

NEWOCEAN ENERGY Holdings Ltd (HK: 342), one of the fastest growing energy suppliers in prosperous South China, saw its first half net profit surge nearly 39% year-on-year to 229 million hkd thanks to strong sales of bottled LPG (liquefied petroleum gas) as well as its rapidly developing auto-gas refueling business.

Management says a key tieup with a major mainland energy giant is helping its cause.

Revenue in the January-June period jumped 9.34% to just under six billion hkd mainly due to strong and sustainable demand in Southern China for energy products.

“NewOcean has achieved remarkable growth in the first half buoyed by the smooth expansion into the end user market in Southern China,” said NewOcean Managing Director Lawrence Shum.

Mr. Shum added that demand was up for all of NewOcean’s goods and services, across the board.

“We are experiencing strong demand for LPG products from our industrial customers on the back of more long term supply contracts with the customers.

“Also, the collaboration with Sinopec Guangzhou is anticipated to provide us with more opportunities to expand our product range and increase our customer base.”

In the six-month period, gross profit soared 157.37% year-on-year to around 545 million hkd.

The gross profit margin rose to 9.11%, up from 3.87% a year earlier.

NewOcean's auto-gas refueling operations are expanding rapidly across South China.

NewOcean's auto-gas refueling operations are expanding rapidly across South China.Photo: Aries Consulting

This was largely due to a substantial sales increase to the end-user market inclusive of bottled LPG, as well as the fact that auto-gas refueling operations were added to the Group after the completion of the acquisition of Lianxin Energy Development Ltd in January 2012.

“The net profit growth pace of 1H2012 continued to be strong following the remarkable net profit growth of 124% in FYE2011,” Mr. Shum said.

The LPG segment saw sales volume increasing to 819,100 tonnes in 1H2012, an increase of 15.53% in comparison with 709,000 tonnes in 1H2011.

LPG turnover surged to approximately 5.543 billion hkd, a growth of 10.3% compared to approximately 5.024 billion in 1H2011.

“This improvement in sales was achieved despite the stagnant global economy. It well demonstrates the strong demand for LPG in the Southern China market and the immunity of the Southern China region from external changes,” Mr. Shum added.

Expanding its range of products, NewOcean has completed the construction of all oil storage tanks by 2011.

The pipeline system and auxiliary facilities are being installed with all the works scheduled to be completed by the fourth quarter this year.

“Leveraging on the experience of its LPG business, the Group will develop the oil products business segment rapidly with a target of achieving two million tonnes of annual sales in a couple of years’ time,” the company said.

NewOcean added it believes the “remarkable performance” of the Group in the first half provides a convincing signal that the Group is entering a “harvest cycle” after the implementation of the downstream expansion program laid down in 2009.

“The Group has strong confidence on the Southern China energy market and the demand for its energy products will continue to remain robust in the future.

“Barring unforeseen circumstances, the Group expects to achieve record revenue and profit for the financial year ended 31 December 2012.”

NewOcean Energy Holdings Ltd is the largest LPG operator in the South China region. The Company wholly owns and operates a Class 1 LPG sea terminal in Zhuhai, China for VLGCs (Very Large Gas Carriers) through which it conducts its international importing and re-exporting businesses and domestic wholesaling. The sales to end-users market in China is conducted in China by the Company through a network of 16 bottling plants in 11 cities and is joined by a further network of 17 autogas refueling stations in and around Guangzhou.

The retailing network has been expanded to cover Macau and, very soon, Hong Kong. The energy business portfolio of the Company has been extend to refined petroleum products in May 2012 with the commencement of operation of three bunker ships and light diesel fuel supply station in Yaumatei, Hong Kong.

See also:

LPG Fuelling Furious Growth For NEW OCEAN ENERGY

FOOD FOR THOUGHT: CHINA YURUN, UNI-PRESIDENT, HENGAN

Juice Wars: PRESIDENT Squeezing HUIYUAN'S Hold Over China

HK-LISTED CONSUMER PLAYS: Inflation Busters Vs Inflation Crashers