Photo: Company

Translated by Andrew Vanburen from Chinese-language piece in Sinafinance

WHEN THE GOING gets tough, the tough get going.

Only in the case of investors weathering the ongoing Hong Kong market downturn, I would advise shareholders not to go too far.

The best strategy at this point is to buy defensive stocks and hold positions so as to best endure the ongoing market volatility.

And despite the big gains last Friday for the benchmark Hang Seng Index, and the fact that China is currently leading the medal tally at last count in the London Games, there’s little else to cheer about in terms of prospects elsewhere for either the PRC or SAR.

The Big Picture

European Union Central Bank President Mario Draghi recently held a guardedly upbeat outlook on the euro currency as well as prospects for better growth in the world’s largest economy – the US.

With this turn for the better on the optimism front, albeit guarded, markets in Hong Kong headed higher for most of the trading day on Friday, tracking Thursday’s sharp gains in New York and Europe.

This of course has alot to do with the EU being the biggest trading partner of China.

The final tally for the Hang Seng on Friday was impressive, and a sight for sore eyes for investors.

The benchmark Index jumped 2.02% on the day, finishing at 19,275 points, with daily turnover staying virtually even day-on-day at just under 44 billion hkd.

Property stocks, which in principle have little correlation with the goings-on overseas in major markets like the US and Europe, nevertheless took the upturn as a rallying cry, adding 2.11% on the day.

Meanwhile, industrials – much more likely to benefit from a resurgence in demand from abroad – did even better, rising 2.16% on Friday, while financial plays were up 2.02%.

Lenders were spurred on by a move from Bank of China to standardize capital loans to six year terms, and information technology and telecom stocks surged after Beijing restated its goal of establishing “Broadband China,” a catchphrase for boosting speed, connectivity and user rates in the PRC -- the country with the most online users already.

However, not all the news from China’s capital city was good news for listed firms in Hong Kong.

A new pledge from Beijing to institute another round of price controls for pharmaceuticals – a highly sensitive component of the CPI basket – put pressure on the dozens of listed drugmakers in China.

Perhaps you are noticing a pattern here.

Most of the market levity (or angst) witnessed last week in Hong Kong’s stock market was the direct result of statements or policy from the highest levels of government and finance in the US, the European Union and/or Beijing.

Therefore, the mini upturn is far more attributable to policy rather than market reality.

Until there is a concrete improvement in economic activity and employment prospects in major markets, then a lot of the spurts of confidence going forward will be similarly overly dependent on words rather than deeds.

Primarily for these reasons, investors in Hong Kong would do well to stay defensive, as well as focus on cyclical plays that are less likely to be dragged down by any new bouts of volatility.

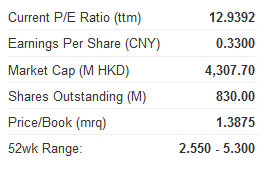

With this in mind, CPMC Holdings Ltd (HK: 906), a major manufacturer of food packaging products, looks like a safe, defensive bet for now.

Anchored by its relationship to flagship parent giant COFCO, CPMC is China’s No.1 metal packaging manufacturer for the colossal food and beverage sector.

While rather captive to aluminum and steel prices, CPMC is nevertheless attractive for its achieved economies of scale as well as its virtual immunity from broader economic downturns or volatility.

As a packager for a long list of staples, CPMC is worth looking at for its steady revenues and defensive nature.

See also:

HK-Listed Electronics, Insurers, Property Developers, And Shippers: The Latest...

HK RETAIL RUNDOWN: Summer Of Shivers

HK Market: CONSUMER, INSURANCE

Top 1H HONG KONG GAINERS: Property King Of The Hill