Photo: Company

Translated by Andrew Vanburen from a Chinese-language piece in Sinafinance

SO FAR, an alarming number of Hong Kong-listed firms, over 100 to be more precise, have issued interim profit warnings.

As the half-year mark passes us by and the summer heat sears into its late season sizzle, all Hong Kong-listed firms are furiously preparing to issue their interim results, which along with their annual reports announcements are mandatory for all public enterprises in the Special Administrative Region.

The Hong Kong Stock Exchange, the world’s sixth largest bourse and No.3 in Asia behind Tokyo and Shanghai, is currently home to some 1,500 listed enterprises.

So when the number of its listcos issuing profit warnings quickly creeps toward nearly 10% of the total, it is no wonder that warnings bells are chiming and market analysts are riveted to the news and potential implications.

On Wednesday, eight more firms added their names to these ranks, with all of them warning of “steep declines” in profitability for the January-June period, with some of these even saying they could very well finish in the red.

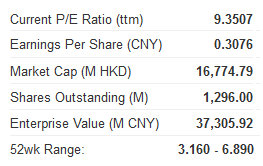

They include well-known large caps like China Shipping Development (HK: 1138), Sinotruk (Hong Kong) Ltd (HK: 3808) and steelmaker China Oriental Group (HK: 581).

Nearly all of the firms warning investors of sub-par first half results cite the economic slowdown in Mainland China as the primary reason for their weaker-than-expected top and bottom lines, with nearly all sectors of the economy impacted by the slump.

Given the rather anemic investment climate prevailing across the land these days, a larger-than-usual 150 or so firms have so far issued recent earnings guidance updates in order to give their investors advance notice -- a "heads up" of sorts -- of performance in such a market climate, with two-thirds of these announcements taking the form of interim profit warnings.

Among the crop of firms warning of weak first halves yesterday, it was state owned enterprise China Shipping Development which gave analysts and investors alike the biggest shock.

The 17 billion hkd Shanghai-based firm, along with major commercial vehicle maker Sinotruk, both cited shrinking demand for their weaker first half profits.

China Shipping Development pointed to rising bunker costs as well, along with both weakness at home and lackluster demand from overseas which affected shipping traffic over the period.

Meanwhile, China Oriental and fellow metal play -- nickel refiner Xinjiang Xinxin Mining (HK: 3833) both reported that first half bottom line performance was hit by rising costs coupled with weaker selling prices.

Market watchers were particularly taken aback by the wide range of enterprises involved in the current wave of profit warnings, which suggests that not just one or two sectors is impacted by specific government policies such as property has occasionally been in the past.

Instead, weakness seems to be more endemic this time around, and across the board.

See also:

EXPERT OPINION: Bulk Of PRC Brokerages Bullish On 2H

Five China Sectors About To Get Hot

BUCKING TREND: China Shares Ready For Rebound?

TOUGH TALK: Dissecting China Market Fall, Fate