Image: CRE

Bocom: CHINA RESOURCES Kept ‘Neutral’

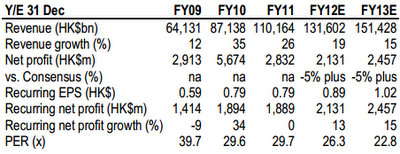

Food and beverage behemoth China Resources Enterprise (HK: 291) had its “Neutral” recommendation reiterated by Bocom International with a target price of 26.0 hkd, representing a 10% upside.

“We hosted a post 1Q results investor luncheon with CRE on June 8. Key areas that investors were interested in included 2Q-to-date performance and the group’s earnings and margin outlook, particularly the 2 major businesses - retail and beer,” Bocom said.

The brokerage said CRE executives reiterated their “cautious tone” about the FY12E earnings outlook amid the lingering cost pressure and the sustaining low visibility.

“In our view, the common trend across all its four businesses in FY12E is margin squeeze albeit sustaining top-line expansion supported by the group’s market-share focused strategy.

“Despite the near-term overhang, we believe the current valuation after the recent share price correction should cushion the downside.”

Bocom added that with CRE’s market leadership in the beer arm and the margin leverage potential of its other businesses -- particularly retail – it believes the Hong Kong-listed enterprise will see faster earnings recovery momentum in the next market up-cycle.

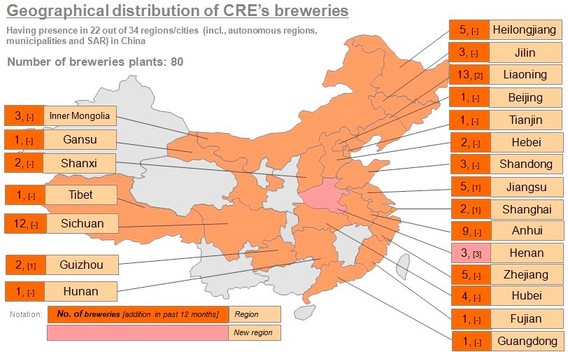

Beer

Volume growth has been picking up since April, supported by the warmer-than-expected weather.

In April, volume achieved double-digit growth (vs. 4% in 1Q) and continued to outpace the industry’s growth (high single-digit) while ASP growth stood at a mid-high single digit (vs. 9% in 1Q).

“While a single month result provides limited implications to the full year trend, we believe our FY12E revenue growth of 13% (on 8% volume and 5% ASP growth) is conservative enough to be attainable,” Bocom said.

Retail

Same store sales (SSS) growth has been trending down since 1Q and YTD SSS growth was about 5%, implying 2Q to-date SSS growth at 3.6%, nearly half of 6.4% of 1Q.

“Apart from the lower CPI, we believe consumption trade-down impact and rising market competition have been behind this trend," Bocom said.

In the first quarter, China new store losses widened to HK$100m (vs. HK$200m in FY11); and HK net loss rose to HK$50m (vs. HK$100m in FY11).

The brokerage added that with the CPI downtrend (Bocom’s 2012 house forecast is 3% vs. 5.4% in 2011) and higher new store losses amid the group’s continuing nationwide expansion and diversified sales channel strategy (ie, comprising hypermarkets, superstores and convenience stores), it believes CRE’s retail margins will remain under pressure in the coming few quarters.

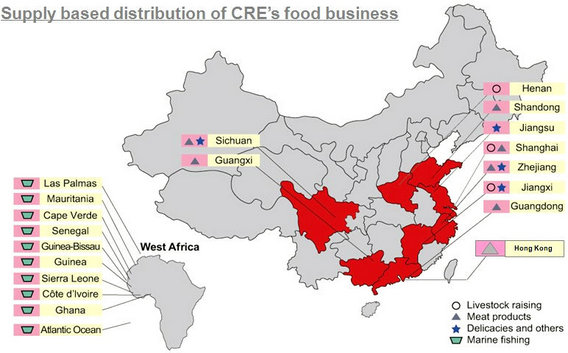

Food

According to management, the sluggish 1Q operating climate continues to carry into 2Q.

“The unfavorable input cost landscape and the difficulty in passing on the cost rises due to the lack of critical mass of its China market have remained the key overhangs.

“That said, with an easier comparison and easing hog price trends, we expect the earnings pressure should lessen in the coming quarters,” Bocom said.

Beverages

The sustaining input cost pressure and the integration cost due to the Kirin JV inclusion (since last August) will continue to affect margins and earnings of the beverage arm this year, Bocom said.

“That being said, as the food business contribution to the group remains relatively small (6.6% of our FY12E net profit), we are less concerned about its impact.”

See also:

DRINKING PROBLEM: Master Kong Broadsided By Beverage Battle

Juice Wars: PRESIDENT Squeezing HUIYUAN'S Hold Over China

DUKANG: 2Q2012 Net Profit Up A Whopping 55% At Rmb 94.4m

FOOD FOR THOUGHT: WANT WANT, TINGYI Noodle Blue-Chip Bound

Bocom: PRADA Reiterated ‘Buy’

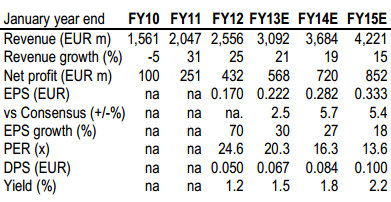

Bocom International said it is reiterating its “Buy” call on Italian luxury brand Prada (HK: 1913), while trimming its target price to 56.5 hkd from 62.8 previously, which now represents a still robust 25% upside.

“Prada reported 111% net profit growth in 1Q13 (Feb-Apr 12), largely in line with our expectation (21% of our full year forecast), fueled by strong top-line (+48% on +19% SSS) and improved operating margin (+6.7ppt to 24%) on scale improvement and positive operating leverage,” Bocom said.

The brokerage added that despite the continent’s financial woes, Europe was the leading growth market (SSS +31% boosted by rising tourist flow and spending), followed by Greater China (SSS +24%).

“The group’s SSS growth momentum has sustained well into 2Q, helping to alleviate the slowdown concern notwithstanding the admittedly easing SSS growth trend.

“Given this, coupled with the scope for network expansion underpinned by the potential of underpenetrated markets and its operating margin strength, we believe our 31% FY13E net profit growth is attainable, with surprise on the upside underpinned by the currently favourable weak euro environment.”

Higher-margin leather goods continued to be the group’s leading growth driver, with 1Q revenue +58% vs. +36% of footwear and +30% of ready-to-wear (accounting for 62% of the group’s revenue vs. footwear’s 20% and ready-to-wear’s 17%).

“All in all, with continuing effective product and channel mix, we believe our current EBIT margin forecast of +1.6ppt/1.4ppt to 26.2%/27.6% is attainable.”

See also:

PRADA Initiated ‘Buy’

BAGGING ASIA: COACH HK Listing Eyes China Luxury Market

CHOW SANG SANG Sales Surge; Move Over, India?

CHOW SANG SANG Kept At ‘Buy’