Photo: Andrew Vanburen

StanChart: BAOFENG ‘Confident’ amid OEM Shift

Standard Chartered said it recently visited Baofeng Modern’s (HK: 1121) management in the eastern Chinese province of Fujian and came to several conclusions about the casual footwear play.

Baofeng, China’s largest branded specialty retailer of slippers/sandals, is also the largest in exports, with 51% of 2011 sales sold under its own brand, and the remainder on an OEM basis.

“Baofeng Modern is the only company listed in Hong Kong with such a specialty focus. The company has a strategy of moving away from OEM towards retail.

“Many manufacturers in the light industrials space have attempted this shift. Management remains optimistic about its growth prospects,” StanChart said.

The company’s own-brands are Baofeng -- targeting the mid-priced mass market -- and Boree which aims for the higher-end market.

As at end 2011, it had 908 outlets, with products sold on a wholesale basis.

The company reported a 34% rise in 2011 sales to 1.12 billion yuan and net profit increase of 41% to 161 million. Meanwhile, sales of branded products rose 77% for the Boree brand and 92% year-on-year to 167 million yuan for the Baofeng brand.

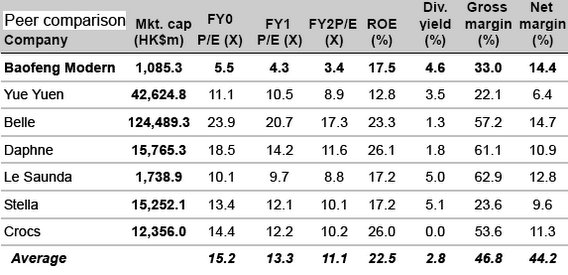

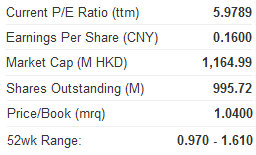

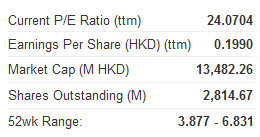

Baofeng Modern was listed in January 2011 at a price of HK$2.0 per share, and the shares have fallen by 33.5% since the IPO. The shares trade at 5.2x 2012E PER and 4.1x 2013E PER, with a yield of 7.4% and 10.2% for 2012E and 2013E, respectively.

The company was originally an OEM and launched its own brand, ―Boree -- in 2007.

From accounting for 5% of sales in 2007, own brand wholesale revenues have since expanded to 51% of overall sales in 2011.

“The company‘s Boree brand is primarily sold in specialty stores, concessions and department store counters, while its Baofeng brand is sold largely in supermarkets, wholesale outlets and other footwear stores,” StanChart said.

The research note added that the Hong Kong-listed firm plans to launch a range of new products through licensed brands in 2012.

It has a license to use the US National Basketball Association (NBA) logo, mascots and the logos of each NBA team on flip-flops, slippers and sandals.

“It also will make and sell Fashion TV (a television channel) branded flip-flops, slippers and sandals, which will come with a promotion campaign presenting the licensed products on the Fashion TV channel.”

StanChart added that Baofeng Modern also has rights to use the Spongebob Squarepants children‘s cartoon series trademarks and brands on its products.

“It also has a right to use Made with Swarovski Elements tags on products that use raw materials supplied by the Swarovski brand.

“It’s top five retail customers are Guess, Tommy Hilfiger, Disney, Etnies and Wal-Mart. These customers in aggregate contributed to around 26% of Baofeng‘s overall sales.”

See also:

BAOFENG Value ‘Shoe In’; Generous VST Payout; COMTEC Tenacious

BAOFENG ‘Buy’ On 2011; PRC CONSUMER Plays ‘Mixed Bag’

OSK Stays ‘Buy’ On BAOFENG; BOCI Cuts CHOW SANG SANG Target

MISS ASIA Contestants Lend ‘Hand’ To China’s Top Slipper Play

Bocom: LE SAUNDA Earnings ‘Lower than Expected’

Bocom International said that Chinese footwear play Le Saunda (HK: 738) announced year-to-February earnings that surprised on the downside.

“Le Saunda reported 2% FY12 recurring net profit growth, 7% lower than our expectation, mainly due to higher-than-expected OP margin pressure,” the research house said.

Bocom is maintaining its “Neutral” recommendation on the retailer and cutting its target price to 2.3 hkd from 2.8.

Second half earnings turned into a 13% decline from 35% growth in the first half, mainly due to the noticeable SSS (same store sales) growth slowdown since the 4Q and higher operating costs (particularly rental and staff), Bocom added.

“Inventory days rose to 210 in FY12 from 170 in FY11, affected by the unfavorable weather (late winter) and faster-than-expected sector growth slowdown.

“Looking forward, while we continue to view Le Saunda as a niche footwear player in light of its strong brand recognition in both China’s and HK’s markets, its near-term earnings outlook will continue to be depressed, due to the destocking pressure, potential higher sales markdown and sustained high operating cost environment amid rising macro headwind.”

Bocom is cutting its EPS forecasts on Le Saunda by 18%/15% in FY13/14E due to lower sales and margin assumptions.

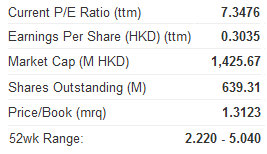

“That said, we believe its undemanding valuation (trading at 9.2x FY13E PE vs. 10.9x‐‐‐18.2x of footwear peers) and the ongoing hidden M&A premium (i.e., as being an ongoing takeover target, though we believe the likelihood in the near term is low) should cushion the share price downside.”

See also:

XTEP, INTIME, LE SAUNDA: What Analysts Now Say...

CHINA SPORTSWEAR Losing Footrace; PRADA Initiated ‘Buy’

MING FAI Gets ‘Buy’ On Retail; TIANYI ‘Positive’ On Strong Earnings

Photos: Sa Sa

Kingston: Hong Kong Remains ‘Key Market’ for SA SA

Kingston Securities said that beauty products retailer Sa Sa International (HK: 178) remains heavily exposed to Hong Kong despite an ongoing campaign to expand into the PRC.

“The Group has been actively working with a number of established beauty brands, however the lack of international high end brands in Sa Sa China has imposed constraints on prices and earnings growth.

“Hong Kong remained the key market,” the research house said.

Kingston’s buy-in price for Sa Sa is 4.1 hkd, the target price is 4.7 and the stop loss is 4.0.

Sa Sa’s China business recorded a loss of 19.75 mln hkd in the first half last year.

“As the number of stores increased in China, revenue also continued to rise. Meanwhile, the profitability was damaged due to the rising operating expenses led by the retail stores dispersion,” Kingston said.

Furthermore, transfer of experienced staff to support the more productive new stores and the challenge of providing inventory support for a fast growing portfolio of stores contributed to same store sales decreasing by 3%.

“A higher tax was imposed on imported cosmetics in China, coupled with the weak HKD/RMB exchange rate, which may cancel out the Group’s price advantage when compared with Sa Sa Hong Kong.

“The Group is keen to increase the sales proportion of the relatively-high GPM ‘Sa Sa’ products from 17% to 50%.”

See also:

MING FAI: Hotel & Airline Supplier Has Standout 1H, Yet Shares At 52-Wk Low

MING FAI: World’s Top Supplier To Hotels, Airlines Charging Ahead On Travel Boom

Bocom: SA SA Kept ‘Buy’

Bocom International said it is maintaining its “Buy” recommendation on beauty products retailer Sa Sa International (HK: 178).

“We recommend buying into this key defensive play ahead of its earnings release,” Bocom said.

“We believe Sa Sa’s growth will continue to outperform the other discretionary retail peers despite the admittedly easing SSS growth trend.

“Product resilience, dominant position in HK’s discount cosmetics market and continuing strong support from China tourists are Sa Sa’s key differentiating drivers from peers,” Bocom added.

Coupled with continuing positive margin outlook on better product mix and cost efficiency with rental continuing to be well under control within 11.5% of revenue, Bocom said it expects Sa Sa’s net profit growth outlook to “remain respectable” at 23%/19% in FY13E/14E.

“Together with encouraging China market development with narrowing loss and recovering SSS, we remain positive on Sa Sa’s growth story.”

Sa Sa will announce FY12 results in mid June.

“We expect 28% net profit growth. While we are 3% above consensus, we believe the company may surprise us on the upside due to the likely better-than-expected margin improvement.”

However, due to the lower peer valuation following the recent market correction, Bocom said it is paring its target price on Sa Sa to 5.38 hkd from 5.82, based on 18.7x FY13E PE (vs. 20.3x previously), continuing at a 25% premium to major peers in light of its growth resilience and enhanced sector leadership.

See also:

MING FAI Targets 2,000 PRC Cosmetics Stores This Year