MING FAI International Holdings Ltd (HK: 3828), the world’s top supplier of amenity products to hotels and airlines, saw its 2010 top line jump 34% to 1.1 bln hkd on an improving global economy and a new retail chain acquisition – 7 Magic.

Management told analysts and fund managers Thursday during Aries Consulting’s Company of the Month event that revenue contribution from the PRC is also on the verge of overtaking North America, and there is no looking back.

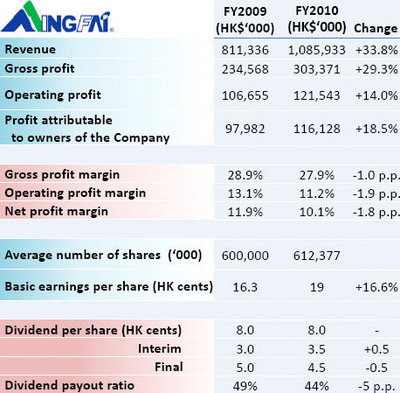

Net profit last year also rose a healthy 18.5% to 116 mln hkd.

“There was a significant rebound in tourism last year after the global economic turmoil of 2008 and 2009, which allowed us to acquire new clients as well as enjoy larger orders from existing hotel clients,” said Ming Fai CFO Henry Keung.

Ming Fai, which last year sourced 92.2% of its revenue from the hotel and airlines amenities and accessories business for products like shaving and sewing kits as well as hair car products, is heavily reliant on hotel occupancy rates and airline passenger load factors for its fortunes.

And last year did not disappoint.

Major five-star clients like Marriott, Shangri-La, Sheraton and Mandarin Oriental all had improved years, thus boosting orders for Ming Fai’s products.

And Ming Fai was not going to be caught off-guard when a breakthrough order came its way.

As of end-2010, Ming Fai had annual production capacity of 420 mln pieces for toiletries, 187 mln pieces for soaps, and 246 mln pieces for gift sets (toothbrush, vanity, comb, shower cap, etc), all of which are running at 80% capacity utilization.

“This will increase to between 85-90% next year,” Mr. Keung said.

As dependent as Ming Fai was on hotels and flights being “fully booked,” the Hong Kong-listed firm was also very reliant on its ability to control input costs, because raw materials currently account for a whopping 73.6% of total costs.

“Chemical-based materials are our biggest item, followed by paper and plastic. As you know, prices for these three commodities have been highly volatile that past couple of years, but we have taken measures to lock up long-term contracts and also have the ability to adjust the type of chemical inputs to meet our needs,” Mr. Keung added.

As for where Ming Fai made its money in the hotel and airlines sectors, it was increasingly becoming a Mainland China-dominated story.

In total, the company sourced 64.5% of its 2010 revenue from “overseas” and 35.5% from the PRC (including Hong Kong and Macau).

But looking behind the figures, the PRC market jumped to 35.5% revenue contribution from 31% in 2009, while the company’s top market – North America – fell to 35.7% in 2010 from 39% the previous year.

“We think the PRC will be our biggest growth market going forward,” Mr. Keung said.

But hotels and airlines were not the only venues where Ming Fai’s products can be found.

In August 2010, Ming Fai fully acquired cosmetic and skincare retail chain 7 Magic, with approximately 1,400 shops across the PRC, with Ming Fai ultimately becoming the major supplier to its newly-acquired unit.

“7 Magic is experiencing a rapid penetration into Mainland China, with 96% of our POS (Points of Sale) being located in Tier II and Tier III cities to capture the emerging mass market,” said 7 Magic General Manager David Tu.

He said the popular retailer, which retains an enviable list of stars to promote its products, is extending sales further by opening shop-in-shop contracts with 280 Wal-Mart stores across Mainland China.

“Our marketing strategy is very energetic. We hire young and popular celebrities to generate brand awareness among youth, primarily between 15-25, and we continuously launch new products to build a trendy image and eventually become a must-go shop for youngsters,” Mr. Tu added.

In Hong Kong, the company’s products were also widely available in Mannings and Watsons retail outlets, and 7 Magic had also launched flagship stores in several key cities in the PRC, including Beijing, Shanghai, Chengdu, Dalian, Wuhan and Xian.

“We are also targeting our cosmetics and skincare products to contribute 50% to our top line this year from just 39% last year, which is good news indeed because these products enjoy around 45% margins,” Mr. Tu said.

See also: MING FAI Targets 2,000 PRC Cosmetics Stores This Year