Translated by Andrew Vanburen from a Chinese-language piece in First Financial

MASTER KONG, the flagship brand of beverage giant Tingyi Cayman Island Holdings (HK: 322), is struggling to slake its thirst in a hypercompetitive PRC drinks market offering bone dry bottom lines.

The maker of soft drinks, instant noodles and snacks saw its first quarter beverage sales take a nosedive even after a recent landmark tieup with US carbonated beverage and snack behemoth Pepsi-Cola.

Master Kong’s fizzling performance just shows how tough a going it has become in China’s beverage market and how there is no easy money for those hoping to make a big splash in the world’s biggest country.

Tingyi has a lot of numbers to pour over for the January to March period, with some bright spots but a resounding thumbs down for its beverage operations.

As for the Hong Kong listco’s top line, things could have been better, with first quarter revenue down 5.23% year-on-year to 1.93 billion usd.

The gross margin improved by 2.44 percentage points to 29.1% and gross profit grew by 3.42% to 561.1 million usd.

Tingyi said the main reason for this was the “high season” for instant noodles, which make up 53% of total revenue.

In the first quarter, turnover for the instant noodle business grew by 10.85% year-on-year to 1.03 billion usd, still allowing most consumers to think of steaming bowls of ramen and beef noodle soup first when hearing the word Tingyi.

This allowed the best news of all for the F&B giant to be the bottom line, which soared over 61% year-on-year to 198.3 million usd in the first three months of the year.

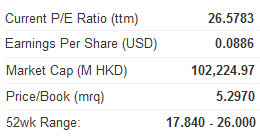

This produced a head turning earnings per share of 3.55 US cents compared to 1.35 US cents a year earlier.

However, the company has not been shy about its aspirations of taking the world’s most populous country by storm in the beverage battlefield.

And that’s where the soft drinks outlook gets decidedly flat.

Despite owning almost half of the market share in tea drinks, Tingyi’s flagship Master Kong brand saw total beverage business turnover for the first quarter decrease by 21.56% year-on-year to 817.5 million usd, with the division now representing 42.4% of the group’s total sales.

Last year, Tingyi signed a landmark deal with PepsiCo, which would make the Hong Kong-listed firm the US soft drink and snack behemoth’s bottler in Mainland China.

Apparently, the fizz surrounding the signing has faded, and Tingyi is facing the reality of an extremely overcrowded, hypercompetitive PRC marketplace for all variety of beverages – from bottled water to teas.

Investors would do well to closely monitor who is toasting whom in the half-year on the beverage front come interim results time.

See also:

Juice Wars: PRESIDENT Squeezing HUIYUAN'S Hold Over China

DUKANG: 2Q2012 Net Profit Up A Whopping 55% At Rmb 94.4m

VITASOY: Stronger Revenue/Profit Growth Expected From 1Q12 Onwards

FOOD FOR THOUGHT: WANT WANT, TINGYI Noodle Blue-Chip Bound