Photo: Belle

Guoco: BELLE Boosted To ‘Buy’

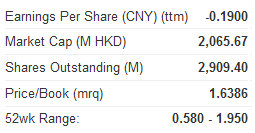

Guoco Capital said it is upgrading its call on China’s leading footwear play Belle (HK: 1880) to ‘Buy’ from ‘Hold’ with a 15.40 hkd target price, implying an 18x 2013 PER.

“Belle tumbled 13% from recent peaks amid weak retail sales figures. We upgrade on share price weakness,” Guoco said.

China’s April retail sales growth was 14.1% y-o-y, down from 15.2% in March and 14.7% in Jan/Feb.

Yet retail sales for footwear/apparel grew 19.5% y-o-y in April, compared to 19.4% y-o-y growth in March and 12.8% in Jan/Feb, indicating that sales in the footwear industry remained robust in April.

Guoco said these figures supported its view that the company’s SSSG (same store sales growth) should have bottomed out in 1Q12 (1Q12 SSSG +2.8% y-o-y for footwear and -2.4% for sportswear) with gradual pick-up starting in 2Q12.

This comes as the brokerage said it expects more favorable policies to surface in order to stimulate domestic consumption while the earlier and warmer weather this year should help kick up the spring/summer sales in 2Q12.

“We keep our current SSSG assumption unchanged at 8% for footwear and 1% for sportswear, and maintain our earnings forecast at RMB4,897mn (EPS RMB0.58) and RMB5,966mn (EPS RMB0.71) for 2012 and 2013, respectively, implying an EPS CAGR of 18% between 2011-2013.”

The counter is now trading at 19x and 15x 2012 and 2013 PER, respectively, that Guoco says is “undemanding” given Belle’s leading position in China’s footwear industry and its solid track record.

“The recent price slump actually creates a good buying opportunity for long-term investors.”

See also:

HONGGUO Stepping Things Up

Bocom: BAWANG Kept ‘Buy’

Bocom International said it is maintaining its ‘Buy’ call on consumer products giant BaWang (HK: 1338) with a target price of 1.20 hkd.

“We hosted a one-day NDR for BaWang in Hong Kong, during which management and investors (including private equity) had active discussions about the resurgence of BaWang’s core shampoo sales, distribution optimization, herbal tea and skin care lines, and its legal case against Next Magazine.

“The endeavors led by a dedicated management team increase our confidence on BaWang's re-emergence as a primary shampoo player,” Bocom said.

The brokerage said it once again advises investors to buy in this differentiated, home-grown herb-based FMCG brand at current levels.

“We don’t think BaWang has seen its best days in 2009. Instead, the best days are yet to come, as the improvement in product appeal and distribution capability coupled with operational efficiency should pay off eventually.”

See also:

MING FAI Gets ‘Buy’ On Retail

Kingston: Summer to Bring Frothier Sales for TSINGTAO

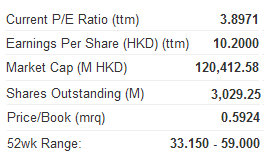

Kingston Securities announced its target price for Tsingtao Brewery (HK: 168) is 52 hkd, with the buy-in price 46.6 hkd and the stop-loss price 45 hkd.

“Due to the slowdown of the domestic economy and climate reasons, Tsingtao’s sales volume of beer in Q1 2012 was 16.4m hl, up 8.9% y-o-y, while sales revenue increased 6.8% only to RMB5.6bn, of which the sales volume of high value-added products including Tsingtao draft beer rose 10%,” Kingston said.

The brokerage added that thanks to the stable growth in high gross profit products, as well as the decrease in selling expenses and financial expenses, the Group’s net profit rose 14.5% to RMB451m in the period.

“The industry will enter its peak season in summer, and the Group’s sales are expected to further expand. Although the Group withdrew from the bidding of Kingway Brew’s (HK: 124) assets, the pace of acquisition did not slow down, especially in South China.”

The Group acquired Shandong Xin Immense Brewery and Hangzhou Zijintan Wine last year, and restructured and expanded two plants, further improving its production capacity and technological level. Moreover, the Group’s first overseas production line in Bangkok will commence operation by end-2013, further enhancing the Group’s market share, Kingston said.

See also:

Tsingtao Facing Soaring Costs

Guoco: EVERGRANDE Top Property Pick

Guoco Capital said its top pick in China’s property market is Evergrande (HK: 3333).

“It is the best proxy to China’s property market. Evergrande, the third largest Chinese property developer, surged 8.4% in one day recently. We believe the rally is sustainable and underpinned by speculation that China may fine-tune its monetary policy to prevent the economy from experiencing a hard landing,” Guoco said.

This may include further cuts in banks’ reserve requirement ratio and asymmetric cuts in interest rates which will eventually benefit property developers, Guoco said.

China’s aggregate property sales GFA and value recently declined 13.4% and 11.8% year-on-year, respectively.

“Given unprecedented tightening measures on real estate market, property developers’ contracted sales targets for 2012 were basically flat as compared with the previous year. For the first four months of 2012, ten largest Chinese property developers achieved only 27% of their full year contracted sales target against 29% for the same period last year. A slowdown in contracted sales caused profit taking on Chinese property stocks since the beginning of May but current sector valuation has turned attractive again,” Guoco added.

The brokerage’s target price on Evergrande is 4.95 hkd, based on 6.0x 2012 earnings, implying a potential upside of 27%.

See also:

Hong Kong Property Selloff Overdone?

Kingston: WHARF Eyeing China Rental Market

Kingston Securities said property developer Wharf Holdings (HK: 4) is targeting rapid expansion into the PRC’s commercial rental property sector.

“The Group is developing a pipeline of 5 IFC projects, scheduled for completion between 2013 and 2016, which will greatly increase the China recurrent rental base in the future,” Kingston said.

The brokerage has a target price of 45.5 hkd on Wharf Holdings, a buy-in price of 40 hkd and a stop-loss price of 37.5 hkd.

See also:

Hong Kong Developers On PRC Bargain Hunting Spree