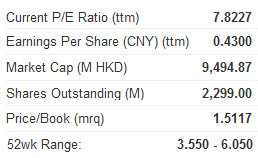

BILLION INDUSTRIAL Holdings Ltd (HK: 2299) has quite a yarn to spin, namely, the story of its fabulous profitability.

On hand in Hong Kong to hear the synthetic yarn manufacturer's tale were several investors packed into a conference room in the heart of the island's financial district.

The Fujian Province-based enterprise may right well be asking “What downturn?” as its recent financial performance has been stellar.

Its 2011 revenue jumped 40.5% year-on-year to 6.1 billion yuan.

This resulted in a 102.6% surge in net profit to nearly 904 million yuan.

“We should be able to maintain around 20% sales growth going forward,” said Billion Industrial’s Investor Relations Manager Jacqueline Wong, speaking at the event sponsored by Aries Consulting as part of its Company of the Month series.

Ms. Wong added that the firm’s net profit margin of nearly 15% last year would also likely be maintained, and that the company once again planned to offer a 50% dividend payout ratio to its shareholders.

“We are benefiting greatly from the rapid growth of China’s consumer product market, and we enjoy continuous growth with a healthy capacity expansion plan.”

Billion Industrial, founded in 2003 and based in the Eastern Chinese industrial city of Jinjiang, listed on Hong Kong’s main board in May 2011, raising nearly three billion hkd at the time.

It was surely an auspicious beginning for the firm as a public enterprise, having chosen a relatively buoyant time to launch its IPO.

The polyester filament yarn manufacturer is a major supplier to downstream textile makers who then go on to provide their wares to a wide range of household names in Mainland China’s clothing and apparel making industry.

Some of their fabric and textile clients include Texwinca Holdings, Victory City International, A-share listed Fynex Textiles and China’s top zipper maker SBS.

Photo: Andrew Vanburen

Meanwhile, its end-product clients are a who’s who in the clothing and apparel sector, such as fashion sportswear leader Xtep International, athletic apparel names Anta, 361 Degrees and Peak, and men’s clothiers Lilanz, K-Boxing and Septwolves.

But lest investors think Billion Industrial might be resting on its laurels with an enviable client list like this, they better think again.

“We currently have over 7,000 clients so we are very well spread out in that way,” Ms. Wong said.

She added that the firm had a minimal to nil budget for advertising and promotions (A&P) because its operations were situated far up the supply chain.

“We supply polyester yarn to textile fabric manufactures who then sell to clothing and apparel makers, with 70% of our current sales within Fujian Province itself.

“And because we are such a big player in the crucial Southeast Chinese marketplace, we enjoy a tremendous amount of bargaining power and cash discounts from suppliers,” Ms. Wong said.

And this was critical to keeping the books healthy.

“Last year, 85% of the cost of our sales was dedicated to covering raw material purchase prices, with PTA (purified terephthalic acid, the most common feedstock used in the making of polyester fiber) alone accounting for upwards of 60%.”

Billion Industrial was also not content to wed itself to any one product, but was always chasing new products with higher margins and greater market potential.

To this end, Billion High-Tech Material Industry Co Ltd was established in September 2011, a new business segment to develop the polyester thin film 350 million yuan investment in Phase I, with commercial production expected to commence later this year with 36,500 tons designed capacity.

“An additional 1.6 billion yuan investment is going to our BOPET (biaxially-oriented polyethylene terephthalate) which has applications in food packaging, insulation and solar power industries,” Ms. Wong added.

But even more important for Billion Industrial was that these two new product endeavors promised higher margins, with polyester thin film expected to reap 23% margins.

The company’s CFO, Ms. Stella Ng, explained that the reasons for expanding into thin film and BOPET were twofold.

“First, we are chasing the higher margins for these products. Secondly, we are also following their strong market demand,” Ms. Ng said.

She went on to describe the logistical benefits that Billion Industrial enjoyed thanks to its experience and geographic location.

“Having nearly a decade of experience in the industry and being located in Fujian Province – home to so many textile and apparel makers – we certainly enjoy cost benefits that put us at a distinct competitive advantage vis-à-vis our competitors,” she said.

As for the firm’s traditional product lineup, its current designed capacity for fully-drawn yarn (FDY) partially-oriented yarn (POY) both stood at 475,000 tons, while that for drawn-textured yarn (DTY) was 350,000 tons.

Its annual production capacity of around 710,000 tons makes it the sixth largest manufacturer in China in terms of combined designed production capacity of DTY, FDY and POY.

“We’re eyeing another 20% capacity expansion this year,” Ms. Wong added.

See also:

FUJIAN FYNEX Visit: Cotton Prices Critical, But Bottom Line Still Strong

HK-LISTED WEIQIAO TEXTILE: High Dividends, Low P/E

Houses Hike XTEP To ‘Outperform’, 'Buy'; GIORDANO Target 15% Upside

XTEP Orders Lead Sector