Photo: Company

Translated by Andrew Vanburen from a Chinese-language piece in Sinafinance

IN TEMPERATE ZONES, locals often jokingly say to visitors that if you don’t like the weather at any given point, just wait five minutes, as it’s bound to change.

The same could also be said for the current state of the PRC's stock markets in Shanghai and Shenzhen.

They also say that herding cats is one of the toughest jobs out there.

A close second might be getting four analysts to agree on anything.

But just as in deciding what to do about any upcoming major elective surgery and opting for a second opinion, it's also best to seek multiple counsel regarding our investments.

So let’s take a look at what seasoned market watchers from four research houses have to say about where shares in Mainland China are headed.

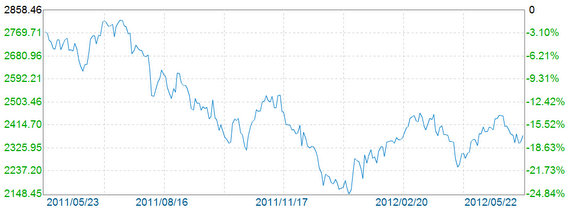

Nanjing Securities says the current volatility in the benchmark Shanghai Composite Index, which is down nearly a quarter from year-earlier levels, is producing a very tempting jumping in point.

“Admittedly, there isn’t much to cause cheer on the economic front in most parts of the world, and growth at home is slower than originally thought. But thanks to stimulatory measures from Beijing, it is increasingly looking like now rather than later is the best time to get in on the ground floor of the next bull market... whenever that may arrive.”

The brokerage added that despite the promise of support from economic regulators in the capital, investors shouldn’t get their hopes up too high for a near-term resurgence in A-share values as the benchmark index is likely to range in and around the 2,300-2,350 levels for the foreseeable future.

“Credit easing measures and more confident spending by domestic consumers would both be very welcome phenomena by investors in domestic listed equities,” Nanjing Securities said.

Changjiang Securities believes the lack of certainty as to when and where the current downturn will peter out is one of the biggest hidden dangers in the current investment environment.

“After the ‘slowdown started to slow down’ late last year, the market anticipated the helping hand from Beijing that was soon to be outstretched and made a promising bounce back in the beginning of this year. However, that all seems like a distant memory now and sentiment is showing no signs of being once again buoyed by the prospect of more help from the Central Government,” the brokerage said.

It added that the stimulatory measures in the first half so far have been more spread out and are therefore not as impactful as seen in the second half of 2011.

“We might see a marginally upbeat technical rebound this week, but also we’re likely to hit a new near-term nadir over the summer that might last two to three months, after which new opportunities will likely arise.”

Huatai Securities says the macro-measures implemented so far this year have had little real effect in turning around the economy, or the capital markets.

“We haven’t seen much of a turnaround or seasonality effect at all in terms of domestic consumption, industrial output, finance, electricity usage, trade, auto sales or other important litmus-test metrics. However, most of the stimulatory moves from Beijing so far have been little more than tinkering around the edges.”

Therefore, the brokerage said investors should not overplay the “helping hand” card, and should return to basics, choosing their stocks based on intrinsic strengths and solid fundamentals alone.

UBS China was more sanguine than the rest, saying that it felt the primary purpose of current and anticipated macro-measures from Beijing was meant to help institute stable growth.

“We are guiding for somewhat volatile market behavior this quarter trending to the upside. Investors would likely do well to await more concrete credit data at end-May or the appearance of more substantial stimulatory measures before taking new positions.”

See also:

FOREIGN TASTES: What QFIIs Are Buying In China

HALF HEARTED: 50% Of PRC Firms Expect Weaker 1H

ALL BLACKS: China’s Listed Brokerages All Profitable

NEW KID ON BLOCK: 21 A-Shares In Red; 4 In Hot Water