CHU KONG SHIPPING Development Company Ltd (HK: 560) is in a catbird seat of sorts when it comes to geographic, physical and market positioning within the port handling, passenger and freight transport business given the limited number of players operating in each sector.

Therefore, the Hong Kong-listed firm enjoys a near monopoly in some areas and capably endures high fuel cost burdens alongside its peers, management told a group of investors portside at their Pearl River Delta facilities.

"Fuel prices make up 55% of our costs for our passenger transport operations, but our competitors also pay the same prices so we’re all in the same boat in that regard,” said Chu Kong Shipping Development Chairman Hua Honglin.

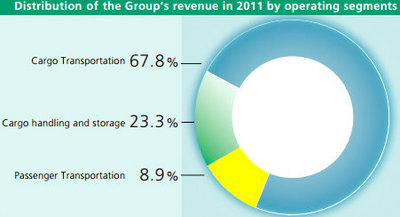

He added that despite the relatively high fuel cost burden for Chu Kong’s high-speed passenger transport operations in and around South China’s famed Pearl River Delta, the percentage of costs dedicated to petrol in the company’s other two major business sectors – cargo transportation and cargo handling/storage – was significantly lower.

And passenger transportation via their spacious but speedy boats contributed less than 9% to the top line last year, so Chu Kong was not overly concerned with oil prices.

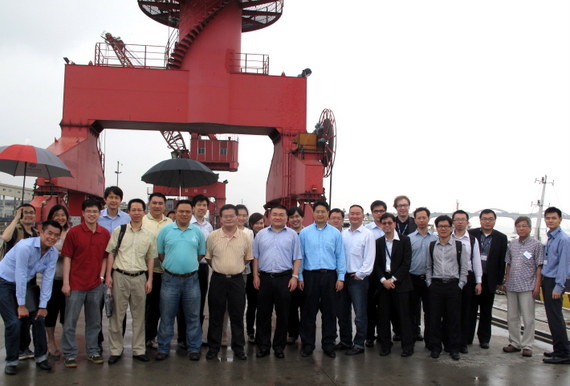

The 20 or so investors that took the day-long river and sea journey assembled early on Friday morning at Chu Kong’s dedicated passenger terminal in Hong Kong’s densely populated Tsim Sha Tsui district.

They boarded one of the Hong Kong-listed firm’s many highspeed watercraft on a 90-minute first-class cabin excursion to its port handling facilities in Shunde, Guangdong Province.

"We obviously offer passengers a smooth, rapid commute devoid of traffic-jam fears.

"The only thing that keeps our boats from taking to the waterways is a typhoon warning," said Mr. Hua, as a small group of investors were shuttled to Guangzhou Station after a day of river travel.

Not to waste an opportunity, many participants jumped at the chance to meet with the company's chairman in a private room just beside the captain’s quarters to learn more about Chu Kong Shipping while being shuttled from Hong Kong up the Pearl River Delta onboard one of the company’s primary products.

And just as management assured us, the meetings went smoothly and hot drinks placed casually on the table held their contents admirably.

Chu Kong executives added that this was another draw to waterborne commuting that was preferable to subways, namely, that everyone was assured a spacious seat and ample workspace to take full advantage of the "downtime" that travel usually involves.

The listed ticket price for first class berths that day was 268 hkd a seat, meaning the revenue earned from me and my three conversationalists in our mini-row of recliners would net Chu Kong well over one thousand HKD on a typical day.

“Luckily, our passenger transport segment allows us the luxury of adjusting ticket prices in tandem with fuel price fluctuations,” Mr. Hua said.

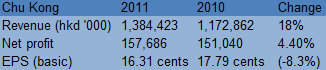

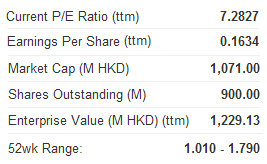

Chu Kong managed to boost its 2011 revenue by an impressive 18% to nearly 1.4 billion hkd despite higher fuel prices and a sluggish recovery in the global economy.

“Last year’s rising fuel prices did impact our margins,” Mr. Hua added.

Indeed, the firms’ full-year net profit didn’t rise as fast as the top line, adding just 4.4% year-on-year to 158 million hkd.

Nevertheless, one of the most strikingly positive aspects to the firm’s performance has been its consistently rising top and bottom lines over the past several reporting seasons.

“We are quite confident looking ahead. We have locked in usage rights to our port facilities and cargo handling assets until at least 2017, and we feel we occupy a very competitive market position in our logistics and passenger ferry operations.”

As for the big picture, Chu Kong was thinking even bigger. “Our ultimate goal is to build a fully-integrated logistics base in the Pearl River Delta,” Mr. Hua said.

Photo: Terence Wong, Aries Consulting

Chu Kong Shipping Development (CKSD) is well-established in the region in more ways than one.

The Hong Kong-listed and Hong Kong-incorporated firm is held by Chu Kong Shipping Enterprises (Holding) Co Ltd (CKSE), which itself is subject to Guangdong Province Navigation Holdings Co Ltd – one of seven leading logistics enterprises in Guangdong Province.

And as Guangdong Province accounts for a quarter of all of Mainland China’s exports, having a significant stake in this sector is very advantageous, to say the least.

Photos: Chu Kong

CKSE, established way back in 1962, is primarily engaged in shipping operations between Hong Kong and major cities and ports along the adjacent Pearl River Delta, high-speed passenger transportation along the same routes, passenger ship trading and repair.

To even further hedge itself against potential downturns, the firm is also involved in the sale and supply of oil and duty-free goods, investment and management of highway infrastructure, real estate development, tourism and marine advisor operations.

In 1996, CKSD was established by CKSE to take over its cargo transportation business, including shipping agency operations, river cargo direct shipments and transshipments, wharf cargo handling (including mid-stream operations), cargo consolidation as well as container hauling and trucking in Hong Kong.

“Listed on Hong Kong’s Main Board in 1997, CKSD has become a large-scale modern logistics enterprise with the support network of port, transport, and market information in the Pearl River Delta,” Mr. Hua said.

CKSD currently owns an equity interest in 20 river trade terminals and operates 30 container routes and 13 bulk cargo routes with a fleet of 80 operational vessels between Hong Kong and ports of call in neighboring Guangdong Province.

The company’s name “Chu Kong” means “Pearl River” in the Cantonese dialect, but that didn’t mean the Hong Kong-listed enterprise was not looking to set sail to other areas in search of expansion.

“We are particularly interested in port and transport operations in Guangxi,” Mr. Hua said of the region facing the South China Sea and separating Guangdong Province from Vietnam.

See also:

Ship Shape: CHU KONG Ups Revenue 18% Despite ‘Difficult Year’

COURAGE MARINE Bolsters Fleet

YANGZIJIANG: BOA Stays ‘Buy’, Credit Suisse Keeps ‘Outperform’

YANGZIJIANG is a potential 3-bagger

Thank you very much for your query. I did ask management in March this very same question and they said this was the plan, yes. But they are conducting due diligence on what to inject, where to inject it, and when. They said they want to find the healthiest balance spread between listed and non-listed vehicles of the Group. Most of the investors were most impressed with the firm's range of services, not putting all their eggs into one basket (passenger, freight, logistics) so to speak.

ALSO WE DID ask the same question to management again earlier this month during our site visit, and they neither confirmed nor denied the asset reallocation plan. Sincerely, Andrew Vanburen

Is that true?

And it is a government company too.

What is the NTA of this Company