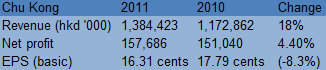

CHU KONG Shipping Development Company Ltd (HK: 560) boosted its 2011 top line by 18% to 1.38 billion hkd, resulting in a 4.4% net profit hike to 158 million despite enduring a “difficult year,” management of the shipping firm and logistics play told investors in Hong Kong.

Chu Kong Chairman Liu Weiqing said the firm managed to give a strong performance despite the economic slowdown in the US and the debt crisis in the EU.

“We responded to the difficulties brought by the financial crisis and aimed at becoming stronger and better through aggressive and professional operations and integration of resources. We seized opportunities for development and acquired quality assets to achieve low-cost expansion.

“Hence, we achieved better operating results,” he said.

Thanks to the Hong Kong-listed enterprise’s performance last year, the board has recommended a final dividend of 2.5 HK cents per share.

“In 2011, Chu Kong saw several achievements in logistics for terminals and shipping. We formed a logistics business department in Mainland China, integrated management of affiliated enterprises in Hong Kong and the PRC to strengthen coordination of resources, cargo sources and information, and we also shortened the management chain and enhanced usage efficiency of resources,” Mr. Liu said.

He added that Chu Kong Shipping implemented segmental marketing management in PRC locales such as Foshan, Zhongshan and Zhaoqing, as well as strengthening internal cooperation and coordination between the group’s shipping and terminal businesses.

“We actively advanced the construction of our overseas marketing network, formed a comprehensive logistics team and provided one-stop integrated logistics services for key customers.”

Chairman Liu added that Chu Kong Shipping also reformed its existing business processes, implemented terminal central control management and practiced ISO quality system controls last year.

“We improved operational efficiency and also deepened our cooperation with major shipping hub companies in order to set up a domestic feeder services between the Pearl River Delta and Shenzhen Western Port so as to increase our overall business volume of terminal logistics.”

He said last year was an historic one for the company.

“The year 2012 marks the 15th anniversary of the company being listed in Hong Kong. The group will concentrate on stronger, better and faster development, and we will hold onto the themes of industrial upgrades and planning optimization,” Chairman Liu said.

“We will continue to endeavor to change from a traditional inland transportation and handling business to modern and integrated logistics. Making full use of our resources such as our existing terminal network, storage facilities and fleet, we will extend toward both the upstream and downstream logistics chain, initially forming ‘one-stop’ logistics supply chain networks while maintaining the company’s distinguishing characteristics.”

He added that the goal was to seek benefits for all three corners of its most important regional triangle – Hong Kong, western Shenzhen and Guangzhou’s Nansha Port.

“Leveraging on our leading transportation services industry position in Guangdong, Hong Kong and Macau for the high-speed passenger business as well as improving the integration of internal resources, our operational efficiency and corporate governance quality will continuously be enhanced to achieve the sustainable and healthy development of our enterprise.”

Chu Kong Shipping’s container transport volume reached 1,069,000 TEU in 2011, representing a 16.3% year-on-year increase as well as a record high.

Terminal container throughput over the 12-month period rose 32.2% to 981,000 TEU, while bulk cargo throughput was up 20.8% at 1,702,000 tons.

Tonnage at the several of Chu Kong’s major terminals also achieved record highs; including Foshan Gaoming Terminal surpassing 200,000 TEU, bringing a profit contribution of 36.5 million hkd for the group.

“For the high-speed passenger transportation business, we built an integrated marketing network, organized and launched Taiwan promotional events, and actively participated in the Canton Fair and a series of promotional activities by the Hong Kong Tourism Board,” Chairman Liu said.

He added that Chu Kong signed new and renewed contracts with 50 travel agencies that hold consignment tickets and 30 airlines that provide baggage tags.

“We also lowered operating costs and increased resource utilization through the organization and implementation of call-port operations along the Gaoming-Heshan route, and the ‘amphibious’ route between Zhongshan and Jiangmen.

Photos: Chu Kong

Chu Kong Shipping Director & General Manager Huang Liezhang said 2011 was a “difficult year with many challenges.”

“One of the keys to our success last year was our aggressive promotion of our port operations in Western Shenzhen. As it turns out, this push was very fruitful and we bolstered our market position in the Pearl River Delta quite considerably,” he said.

Nansha in Guangzhou, Yantian Port in Shenzhen as well as the aforementioned Western Shenzhen were three of the biggest growth drivers for Chu Kong last year.

“At last check, some 70% of our assets are tied up in port operations, so this sector’s strong performance is very encouraging,” Mr. Huang said.

Chu Kong Shipping Director & Vice General Manager Hua Honglin said that the company was well-equipped to respond to fluctuations in export markets as well as realign itself more strongly to shipping goods to Mainland China’s 1.3 billion-strong consumer market whenever the moment arose.

“Yes, certainly the EU debt crisis and the delayed recovery in the US has impacted China’s export business. In addition, higher oil prices these past two years have not been particularly helpful. But thanks to our business diversification and our operational flexibility, we have managed to ride out the storm in style, and turn a healthy profit into the bargain,” Mr. Hua said.

He added that an untiring commitment to boosting both efficiency and technological prowess was key to competing in the shipping and logistics sector.

“Each of our ports has its own warehouse and we aggressively move to put in place the most state-of-the-art technology to manage the increasingly complex logistical challenges coming to the fore.

“In fact, we hope to make logistics account for 30% of our revenue sooner rather than later,” he said.

See also:

COURAGE MARINE Bolsters Fleet

YANGZIJIANG: BOA Stays ‘Buy’, Credit Suisse Keeps ‘Outperform’

YANGZIJIANG is a potential 3-bagger