JP Morgan said it is reiterating its 'Negative' view on Mainland China's sportswear sector.

Fashion sportswear firm Xtep International fares relatively well among China's listed sportswear plays, with JP Morgan recommending investors "trade sportswear for fashion."

Holders of shares in Singapore-listed athletic shoemakers like China Sports International Ltd and China Hongxing Sports Ltd are quite likely familiar with the sportswear landscape in Mainland China, which is both a major production base as well as a market for both of these SGX-listed manufacturers.

Photos: China Sports

China Sports, owner of the Yeli brand of sneakers, had a year to forget in 2011.

Its revenue shrunk 25.3% to 1.22 bln yuan, leading to a 28.3% drop in the bottom line to 47.6 mln.

Meanwhile, Singapore investors are well aware of the trials and tribulations of China Hongxing.

The Quanzhou-based owner of the Erke sportswear brand has been keeping its investors on tenterhooks for several months, still not having released its FY2010 results.

Currently, China Hongxing is undergoing a special audit, and most recently has petitioned the Singapore bourse authorities to allow the release of its full-year 2010 financial results on March 1 of this year (Thursday), as well as a further extension of three months to April 1 to hold its FY2010 AGM.

It is also requesting a further extension of three months up to 15 May 2012 to announce its 1QFY2011 financial results, a further extension of three months up to 15 May 2012 to announce its 2QFY2011 financial results, and an extension of six months up to 15 May 2012 to announce its 3QFY2011 financial results, according to a statement on the SGX website.

PRC-based sportswear firms under JP Morgan's coverage saw share prices fall by a staggering 47% in the second half of 2011, which represents a 29% underperformance vis-a-vis Hong Kong's benchmark Hang Seng Index.

However, these same athletic footwear and apparel firms within JP Morgan's coverage universe have done decidedly better of late, rising an average of 21% year-to-date versus just 4% for the Hang Seng Index (HSI).

The US investment bank recommends shareholders switch to "mid to high-end fashion brands," which it predicts will represent a higher growth segment over the next several years.

As China's leading fashion sportswear brand, Xtep International Holdings Ltd (HK: 1368) is well-positioned to fit rather snugly into the characteristics JP Morgan spells out for achieving success in the hyper-competitive sector going forward.

The research note added that sportswear and apparel firms that appeal to consumers on both a quality and "personalized" level -- qualities inherent in Xtep's product line -- will likely fare the best in the sector down the road.

JP Morgan suggests investors "trade sportswear for fashion."

But the note cautions investors against being too bullish on the sector, despite the strong YTD perfomance.

JP Morgan said it doesn't expect the bounceback in the sportswear sector to have legs, given the sector's prolonged and bitter consolidation trend.

Hence, the reseach note has issued a downgrade of Fujian Province-based sportswear firms Anta Sports Products Ltd (HK: 2020) and Xtep to 'Underweight', while keeping its 'Underweight' recommendation on Li Ning Company Ltd (HK: 2331).

The rationale for JP Morgan's downbeat take on the PRC sportswear sector is due to three challenges: heightened competition from mid- to high-end fashion names; growing market shares of global sportswear brands in smaller mainland urban areas, and worsening cost pressures.

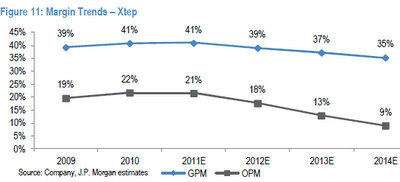

The investment bank is reducing Xtep's 2012/2013/2014 earnings forecasts by 20%/44%/63%, respectively due to expectations of slower sales.

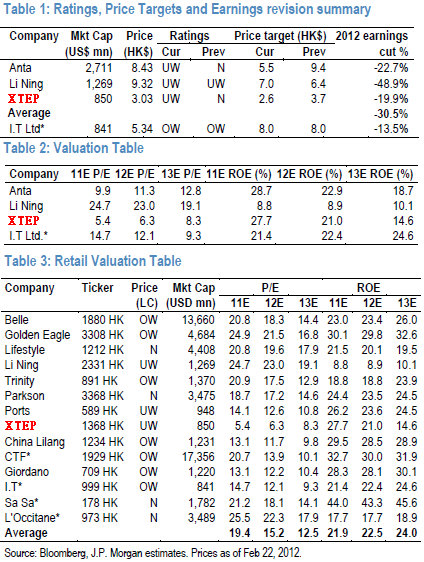

Nevertheless, Xtep fares far better than Hong Kong-listed rivals Anta and Li Ning on the earnings side, with JP Morgan only cutting Xtep's 2012 earnings estimates by 19.9% compared to a 22.7% reduction for Anta and a whopping 48.9% downgrade for Li Ning.

Furthermore, Xtep is outsprinting its bitter Fujian-based rivals on the return on equity (ROE) front, with JP Morgan estimating Xtep's ROE for 2011, 2012 and 2013 to be 27.7%, 21.0% and 14.6%, respectively, versus a much more discouraging 8.8%, 8.9% and 10.1% for Li Ning.

Although JP Morgan's report is 'Negative' on the sector and does not offer a ringing endorsement of any of the established PRC-based, Hong Kong-listed sportswear brands, Xtep does come away looking more attractive than both Anta and Li Ning, including in the bargain-hunting arena.

Xtep's P/E ratio for 2011, 2012 and 2013 is just 5.4x, 6.3x and 8.3x, respectively, all within single-digit territory.

Meanwhile, Li Ning's P/E ratios over the corresponding periods stand at 24.7x, 23.0x and 19.1x, with Anta's ranging between the two rivals.

Nevertheless, due to intense competition in the industry, JP Morgan is also cutting Xtep's target price to 2.6 hkd from 3.7 previously.

But Xtep is by no means standing still in the cut-throat running shoes sector.

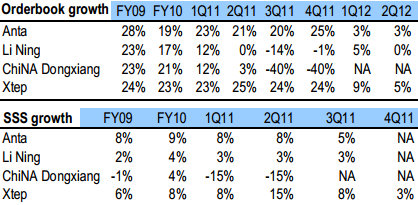

The Hong Kong-listed firm is fresh off a successful official supplier deal with the wildly popular Standard Chartered Hong Kong Marathon 2012, and Xtep is expected to continue having the strongest order growth among its sportswear sector peers, Bocom International said in a recent report.

Bocom added that compared to rivals Anta, Li Ning and China Dongxiang (HK: 3818), Xtep has consistently been atop the heap in terms of order strength for its extensive line of running gear, athletic footwear and accessories.

"China’s sportswear sector has seen a strong share price rally over the last two weeks. We believe the price strength has been mainly due to the following two factors: 1) the laggard search given the sector’s depressed valuation; and 2) the impact of TPG buying into Li Ning recently helps to create some hope that the sector may bottom out,” Bocom said.

The brokerage has an ‘Underperform’ rating on China’s sportswear sector.

See also:

XTEP: In It For The Long Run With Marathon, Social Media

XTEP: Fashion Sportswear Co's 1H Net Soars 25% To 466 Mln Yuan

I apprecdiate you spending some time and energy to put this short article together.

I once again find myself personally spending a significant

amount oof time bith reading and posting comments. But so what, it wass still worthwhile!