Translated by Andrew Vanburen from a Chinese language piece in the Securities Times

MANY ANALYSTS WERE caught a bit offguard by this weekend's downward adjustment to the reserve requirement ratio.

The move came even as Beijing had gone to great lengths these past several months in emphasising that controlling inflation was one of its top priorities.

However, the decision may signal a slight shift by Beijing towards more pro-growth policies, and the cash-hungry real estate sector will be one of the biggest beneficiaries.

As proof of this, A-share housing counters went through the roof in early Monday trade.

Zhongtian Urban Development Group Co Ltd (SZA: 000540) surged nearly 6% in during the morning session while Jiangsu Phoenix Property Investment Co Ltd (SHA: 600716) rose as much as 5.7% just after the opening bell.

Meanwhile, Lander Real Estate Co Ltd (SZA: 000558) jumped 5% in early trade.

CRED Holding Co Ltd (SHA: 600890) had an even more eventful weekend.

On Friday, the Shanghai-listed commercial and residential developer issued a statement saying there was “unusual trading activity and excessive turnover” in its shares, causing trade in CRED to be halted from 9:30-10:30 am that day.

Then today, CRED’s share price soared 5.1% at one point in trading this morning.

What does all this mean for those holding shares in property counters, or for those on the sidelines waiting to get in on or near the ground floor on a property rebound?

Well, if recent statements by two standard bearers of Hong Kong finance are to be trusted, then it means that now is quite possibly an excellent time to take a second look at the beleaguered property sector.

Standard Chartered said that it expects at least three more reserve requirement ratio reductions this calendar year while cross-town rival HSBC Holdings anticipates at least two such moves by China’s Central Bank – The People’s Bank of China (PBOC).

So Hong Kong’s two most prestigious lenders expect Beijing to make three (or even more) credit loosening moves over the next 10 months.

We saw this morning how even a 50 basis point prying open of the vault brings about a jubilant display of bullishness among developers, to whom the availability of cash to fund aggressive land bank accretions (or pay off short-term debts) is all-important.

Imagine how the real estate sector would celebrate if three or more similar credit thaws occurred in rapid succession?

As it stands, major banks in the PRC are required to keep 21% of their holdings on reserve, but after this latest RRR downward adjustment kicks in this coming Friday, the percentage will be shaved down to 20.5% -- still significantly higher than a few short years ago.

Meanwhile, after the new RRR kicks in this week, mid- to small-sized lenders will have a new reserve requirement ratio of 17%.

According to the latest figures from the PBOC, this latest RRR adjustment frees up a staggering 400 billion yuan in lendable cash.

And guess which sector is eyeing it with the widest eyes?

Therefore, as long as inflation is kept at tolerable levels, China’s economic regulators – working hand in hand with Central Bank officials – will be keen to keep the mighty property sector viable and safely situated somewhere between the two electrified rails that are bubble and crash territory.

After all, real estate simply employs too many people, has too heavy a weighing on the stock market and affects so many citizens in manifold ways.

Beijing certainly is keen to nip runaway inflation in the bud so as to effectuate “harmonious development,” one of its most coveted goals.

But sacrificing a sector as large as property for the sake of a reasonable CPI increase is not likely to be on the docket anytime soon.

See also:

PROPERTY SURVEY II: Settling Down In Shenzhen

SHENZHEN: Home Rentals Range From Cheap To Steep

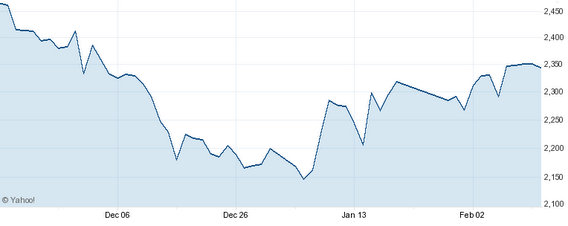

CHINA MARKET: Unraveling The A-Share Ascent