KINGSWAY: HK-Listed Retail Plays ‘All In’ PRC Story

Kingsway Research said Hong Kong retailers are spurred on by a strong Chinese New Year holiday performance – both by the phenomenon of Mainlanders visiting Hong Kong shops as well as the massive commercial activity in the PRC over the break.

“Our recent on-the-ground check at Nathan Road and Canton Road (two major Hong Kong shopping venues) just after the Lunar New Year holiday suggests a post-CNY recovery may be underway for Hong Kong retailers. We have seen more ‘walking suitcases’ (mainlanders carrying suitcases for shopping).

"We believe warmer weather compared to that during the CNY holiday may be one of the important factors for restoring consumption power. We also believe Valentine’s Day stimulated gifting purchases,” Kingsway said.

Nothing says “I care” during Chinese New Year and Valentine’s Day, and especially for the latter event, than expensive gifts -- and precious gems and jewelry say it the loudest.

“Chow Tai Fook, Chow Sang Sang (HK: 116) and Luk Fook stores in the Tsim Sha Tsui section of Nathan Road and Canton Road were generally quite packed with mainlanders during an afternoon session (2-5pm) on Saturday.

"Chow Sang Sang saw good traffic with 10-15 customers.”

Kingsway said international luxury brands such as Louis Vuitton, Hermes, Chanel, etc continued to enjoy good traffic with customers queuing up outside the street, illustrating resilient Chinese luxury demand.

“These findings should alleviate some concerns over weaker-than-expected same-store-sales growth during Chinese New Year and support our constructive view on sector fundamentals.”

See also:

XTEP Orders Lead Sector; CMS Surges In 2011 On Drug Sales

DUKANG: 2Q2012 Net Profit Up A Whopping 55% At Rmb 94.4m

BOCOM: ‘Limited Room’ For PRC Property Upside Surprise

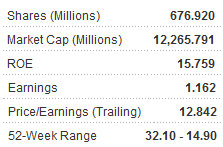

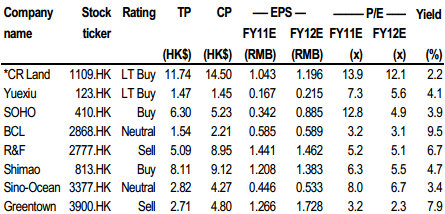

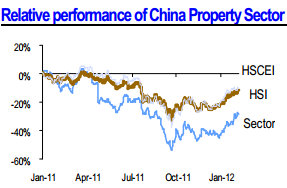

Bocom Ltd said that given the selling price declines in Mainland China for real estate, there is “limited room” for any upside surprise in the sector.

“It is expected that the FY11E core earnings would be well-supported by the property sales revenue recognition of robust contracted sales proceeds achieved in FY10 and 1H11 (growth of 36% and 29% YoY, respectively).

"We estimate average growth of 32% and 33% YoY for FY11E turnover and core earnings, respectively, for the companies under our coverage,” the brokerage said.

Bocom added that its earnings forecast is 5% above consensus on average.

“Having said that, we believe the earnings growth for FY11E should have already been anticipated by the market. We note deteriorating gearing levels and cash flows, especially for Greentown.

“On the other hand, we believe the disappointing contracted sales performance since 2H11, together with the increasing capital expenditure, would make it difficult for developers to have significant improvement in their net gearing levels.”

Bocom said it expects the average net gearing level (excluding Greentown) will increase from 60% (end-FY10) and 68% (end-1H11) to 71% as at the end of FY11.

“We predict the financial position of Greentown, in particular, to be worse than the street expectation. The slow contracted sales progress (achieving only 61% of sales target in FY11) and huge capital expenditure (estimated RMB13.9bn for 2H11) lead us to predict its net gearing ratio to reach 233% (including minority interest) as at end-FY11, the highest level ever. It will remain the most financially distressed developer among peers.”

See also:

Hong Kong Developers On PRC Bargain Hunting Spree

LISTED PRC HOTELS: Hot Bet On Domestic Push