THE YEAR OF THE DRAGON is upon us.

Every year, the Chinese Spring Festival is ushered in by a new animal representative.

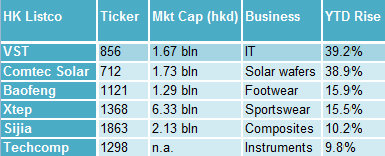

And this year, six mid-caps in particular have certainly been no drag in the Year of the Dragon, with all outperforming a key index.

Okay, admittedly we aren’t tallying things from the first day of the Lunar New Year, which fell on Monday, January 23.

That wouldn’t allow enough trading days to make a fair assessment of where these tickers are tracking.

Instead, we have highlighted a half dozen overperformers since January 1 of this year that are rising faster than one of the most heavily watched indices tracking the Hong Kong stock market – namely, the MSCI China Small Cap Index.

For reference, the MSCI CSCI has itself risen a very respectable 7.8% since the start of this calendar year.

VST HOLDINGS

VST Holdings Ltd (HK: 856) distributes a comprehensive range of IT products such as CPUs, data storage devices, PC motherboards, server motherboards and media products.

VTS’s shares have surged 39.2% YTD, with a current P/E of 4.35 times, a 52-week range of 0.67 - 3.03 hkd and a current price of 1.35 hkd.

The company, founded in 1991 and headquartered in Hong Kong, also engages in the retail sale of IT products, IT equipment and accessories in Singapore, while also providing value-added services to its suppliers as well as support and after-sale service to its customers.

See also:

VST Holdings: IPads, China Market Propel 1H Sales

HK Bourse Aggressively Courting Beijing's 'Silicon Valley’ Firms

COMTEC SOLAR

Comtec Solar Systems Group Ltd (HK: 712) is one of China’s top producers of high-quality monocrystalline solar wafers and solar grade silicon ingots.

Comtec’s shares have soared 38.9% YTD, with a current P/E of 5.38x, a 52-week range of 0.94 – 4.80 hkd and a current price of 1.53 hkd.

The company, founded in 1999 and headquartered in Shanghai with 1,135 employees, received a 1.2 bln hkd investment from TPG Capital last year for a 21% stake.

See also:

COMTEC SOLAR: Economic Cloudcover Not Obscuring Wafer Demand

COMTEC SOLAR: ‘Buy' With 134% Upside

BAOFENG MODERN

Baofeng Modern International Holdings Co Ltd (HK: 1121) is China’s leading producer of casual footwear such as slippers, sandals and flip-flops.

Photos: Andrew Vanburen

Baofeng’s shares have risen 15.9% YTD, with a current P/E of 7.05x, a 52-week range of 0.97 – 1.78 hkd and a current price of 1.30 hkd.

The company, founded in 2001 and headquartered in Fujian Province with 2,511 employees, signed landmark joint-promotion deals last year with the NBA and crystal king Swarovski.

See also:

MISS ASIA Contestants Lend ‘Hand’ To China’s Top Slipper Play

OSK Stays ‘Buy’ On BAOFENG

XTEP INTERNATIONAL

Xtep International Holdings Ltd (HK: 1368) is the PRC’s top fashion sportswear designer, producer and retailer.

Xtep’s shares have risen 15.5% YTD, with a current P/E of 5.68x, a 52-week range of 2.16 – 6.20 hkd and a current price of 2.91 hkd.

The company, founded in 1999 and based in Hong Kong with 7,860 employees, was the official apparel supplier to the 2012 Standard Chartered Hong Kong Marathon, held this past Sunday with some 70,000 runners participating.

See also:

XTEP: In It For The Long Run With Marathon, Social Media

XTEP: Fashion Sportswear Co's 1H Net Soars 25% To 466 Mln Yuan

SIJIA GROUP

Sijia Group Company (HK: 1863) designs and manufactures polymer-processed high-strength polyester fabric composite materials, as well as inflatable and waterproof products for the outdoor, leisure, recreation and sports consumer markets.

Photo: Aries Consulting

Sijia’s shares have risen 10.2% YTD with a current P/E of 7.25x, a 52-week range of 1.65 – 4.46 hkd and a current price of 2.57 hkd.

The company, founded in 2002 and based in Fujian Province with 1,338 employees, saw a recent spike in orders due to the flood relief efforts in Thailand.

See also:

SIJIA: Thai Flood Orders Top One Mln Units

SIJIA: HK-Listed Materials Firm Has Robust 1H; R&D, New Mats Key To 2H

TECHCOMP HOLDINGS

Techcomp Holdings Ltd (HK: 1298; SP: TCH) designs, manufactures and distributes analytical instruments, life science equipment and laboratory instruments, as well as gas and ion chromatographs, UV-Vis spectrophotometers and centrifuges under the Techcomp brand name.

Techcomp’s Hong Kong-listed shares have risen 9.76% YTD with a 52-week range of 2.34 – 2.70 hkd and a current price of 2.70 hkd.

Techcomp, which is also listed in Singapore, was listed in Hong Kong by way of introduction on December 21, 2011.

See also:

TECHCOMP Dual-Lists On HK Stock Exchange

TECHCOMP's Valuation Is Low

I sounded out the alarm bell on Yoma, that it was purely a speculative play based on current sentiments amidst the background of Myammar opening up, and that there is no substantial tangible worth in the counter as at this point of time. Buyers should beware and do due diligence study first before dabbling in such a counter. Today it opened at 0.53 and shot all the way up to a high of 0.575. However, in the closing 10-15 mins it was crashing as fast as a bullet, going down to 0.435. I think the "danger" is not over yet.