Excerpts from Maybank KE report

Analyst: Yin Shao Yang

Tracking the Chinese outbound tourism dragon

|

| MY - room to improve but AirAsia flying the flag |

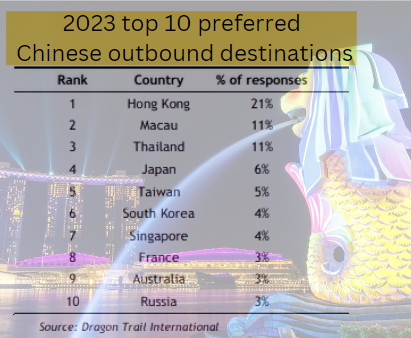

To be sure, Malaysia is not at the top of most Chinese tourists’ minds. Yet, the AirAsia Group is very popular in China.

Actual travel from China to Malaysia ranks 8th in the 1H23 top 10 Chinese outbound departures relative to 2019 list despite not being in the top 10 preferred Chinese outbound destinations list of any survey.

Potential beneficiaries under our coverage are Capital A & Malaysia Airports (aviation) and Pavilion REIT & KLCCP Stapled (shopping). Non-rated potential beneficiary is AirAsia X (aviation).

| TH – still ramping up but top ASEAN destination |

Actual travel from China to Thailand is not in the 1H23 top 10 Chinese outbound departures relative to 2019 list.

Airlines that traditionally ply the China to Thailand route have not returned many aircraft to service compared to airlines that traditionally ply the China to Singapore and Malaysia routes.

Yet, it is without a doubt that Thailand is at the top of most Chinese tourists’ mind when they think of an ASEAN destination.

Potential beneficiaries under our coverage are Erawan (hotelier) and Airports Of Thailand (aviation). Non-rated potential beneficiaries are Dusit Thani (hotelier) and Siam Wellness (spa chain).

|

Full report here.