These ladies are well-educated and have high incomes. Ironically, these very positives are stalling their marriage plans as they find themselves with little leisure time after work, and even less time as age catches up.

The following is NextInsight's translation of an article that appeared in the Chinese-language Financial Week on the typical financial profile of a “Lady Left-Behind”:

High income, long working hours

Miss Mok is a 33-year old single lady born and bred in Shanghai. After graduating from the university, she joined a MNC and climbed her way up the ranks and is finally a manager, commanding a salary of Rmb 15,000 a month, which is slighter more than what her peers get.

Ms Mok does not have any real estate to her name and lives with her parents. On top of her personal expenditure on dining, fashion apparel, transport and entertainment, she shoulders part of the household bills. This amounts to about Rmb 6,000 a month.

Her monthly savings amounts to more than Rmb 9,000 each month.

Each year-end, Miss Mok gets about Rmb 50,000 in employee bonus. She also goes on a holiday with friends each year, splurging up to Rmb 20,000 for each trip. Dating expenses amount to about Rmb 10,000 or so. For festive celebrations, she would gift her parents about Rmb 10,000 a year.

Life is smooth sailing, but Miss Mok is a little worried about medical expenses in the event of unexpected illnesses, because of her long and demanding 12-hour workdays. She frequently needs to work overtime, and has little time to manage her personal assets.

She has hesitated from buying a home as home prices are high.

Her main aim now is to find a life partner to share life’s burdens. Her parents are pressuring her to find one. Friends are also constantly introducing prospective spouses. But Prince Charming has yet to appear.

Many of such "Ladies Left-Behind" hope to get married and buy a home, and realizing these two goals require planning for significant cash outlay. Shenzhen Development Bank’s financial planner Wei Jie evaluates Miss Mok’s case and offers the following advice:

Miss Mok’s financial situation is very healthy, but home purchase and marriage are challenging issues for her. Her family asset structure could change significantly. That is, her savings will fall, her liabilities and monthly expense will increase.

We recommend that Miss Mok strengthen her cash management, enlarge her investment portfolio, and purchase personal insurance plans.

Cash management

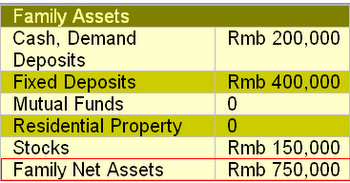

Currently, Miss Mok has Rmb 200,000 in demand deposits, Rmb 400,000 in fixed deposits and these make up more than 80% of her financial assets.

This is overly conservative, and her return on assets is relatively low.

Since she is cash-rich and financially stable, our recommendation is Rmb 20,000 of cash reserves suffices.

To balance between liquidity and return on financial assets, she can invest in currency deposits, or daily-rated financial management banking products.

The remaining Rmb 580,000 can be put into low-risk financial products that provide stable yields. Banks provide such products with a range of investment horizons. She can expect a return of 5% to 5.5% for a holding period of 3 to 6 months.

Note that we recommend investments of short holding periods because Miss Mok is likely to make a decision to purchase a home within the next 12 months. With the property curbs rolled out by the Shanghai municipal government, we are expecting housing prices to fall significantly.

Diversification of portfolio risks

Stocks are good investments but risky. The thing about young people is they have a higher ability to undertake risks.

As Miss Mok has a busy lifestyle, it is not possible for her to spend too much time looking after her own investment portfolio. So, she should invest in mutual funds, even though the equity market has not performed well in 2011.

When choosing a mutual fund, she should look at the track record of the fund manager. Choose financial products with a good reputation, and with diversified structures.

Given the current economic climate, her portfolio should largely consist of stable funds or fixed-income products. This protects her against market risk, and provides returns that are relatively higher.

Increase mutual fund investments

As Miss Mok has a relatively high income, we recommend putting aside 25% of her monthly surplus for investments. This can eventually be drawn upon for her retirement or for her children’s education.

Her investment horizon can be 10 years or more, but she should spread her money over investments with different holding periods.

History tells us that it is almost impossible to lose money on investments with holding periods of 10 years or more. In fact, the return over such a long horizon averages as much as 10%.

Ideally, Miss Mok should choose equity mutual funds or small cap index mutual funds as these are more volatile but provide opportunities for higher returns.

Insurance plans should be targeted

Miss Mok has public insurance benefits, but none from commercial insurers. This will not meet her needs should she encounter any mishap.

We recommend that Miss Mok purchase insurance policies that provide benefits in the event of accidents or serious illness. If she suffers accidental death, the compensation will supplement her parents’ financial needs.

Another area that she has to consider is her plan to set up a family. Getting pregnant when one is older has risks for both mother and child. When looking at insurance plans, she should also try to obtain coverage for illnesses that may befall her child.

Source: http://finance.sina.com.cn/money/lcgh/20120116/104211211455.shtml