Sandy Chin, an avid reader of NextInsight, sent us this article to share her ideas and experience of investing. She also hopes to provoke other investors to comment and share their views.

A YEAR HAS passed since I shared a story on my CPF investment portfolio: INVESTOR: How my stocks bought with CPF savings have done

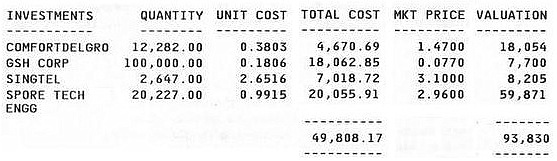

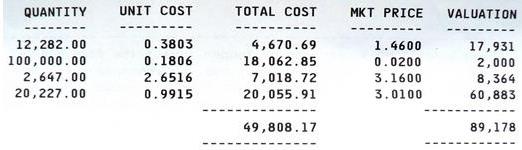

A year ago, it stood at $89,178 (see screenshot below). Recently, the bank statement said it is $93,830 (see above).

That doesn't include dividends of nearly $4,000 paid by SingTel, ST Engineering and ComfortDelgro.

Inclusive of dividends, my gain was 9.7% over the past year. The Straits Times Index was down about 12%, so my small portfolio outperformed it by about 22% percentage points!

Hey, not bad, I thought. I have identified two key boosters:

> Dividends. Never underestimate the power of dividends in investment returns. Investors know this and will gladly chase stocks for their yields. Bosses of S-chips can only do their stock prices a favour if they declare dividends.

Otherwise, people won't be investing in them, since capital gains may be elusive because of the economic slowdown.

> A stock called GSH. This one died on me for several years. Now, it is up and about because of a great effort by management and shareholder Sam Goi to revive it. Thank you!

Lesson: Sometimes we just get lucky -- a business does turn around.

In the first place, I was unlucky though. The stock crashed after the former CEO of GSH (used to be known as JEL Corp) was caught for being part of a scheme that cooked the books, and he went to jail for that.

|

|

Q: How long does Fidelity usually hold its investments for?

It varies from fund manager to fund manager. We have some fund managers who'll hold stocks for five years or more.

We like to buy and hold. About 30 to 40 years ago, the average holding period of a stock was seven years, but today it's only seven months. The average holding period of Apple's stock is two months.

You can see why, when you've a lot of hedge funds, a lot of day traders. But we don't think that's the best way to invest in equities.

They are a long-duration asset. To really reap the benefits of an equity investment, you have to act as an owner.

If you made good profit on property investing, congrats!

You got calculate how much you would have earned if you had placed a 10% deposit using that $50k ? You could have gotten anything worth $500k property...

discounting the rental... your capital gain now is at least $500k. $50k become $500k (profit excl. capital).