SMALL CAPS sprang back to life yesterday, which is reason enough to revisit a Maybank Kim Eng Research report dated Feb 13 which recommended 10 small caps for 2012.

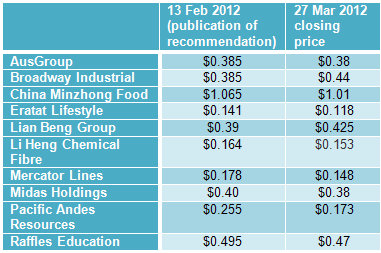

Of the 10 picks, two have so far (six weeks later) have a capital gain to show.

They are: Lian Beng Group, which rose from 39 cents to 42.5 cents, and Broadway Industrial (from 38.5 cents to 44 cents)

So is now an opportune time to buy at cheaper prices some of these stocks?

Can they turn out to be multi-baggers? You decide, of course, with your own money.

Maybank Kim Eng Research made its case for investing in small caps, saying: “Small sums of money invested in undervalued small-cap stocks still appear to offer the best hope for the greatest return. Even institutional funds buy into this logic, picking out small caps for their portfolio in the hope of generating outperformance.”

Among its picks are stocks that are given up for dead, for various reasons.

But Maybank Kim Eng says: “Hate can turn into love. We see some intrinsic value in the 10 stocks and the catalysts that would spur great returns, albeit difficult to quantify.”

You can read everything – the financials, the weak points, and the potential stock catalysts - of its 63-page report at its website.

Recent stories:

LIAN BENG target 71-c, SINO GRANDNESS 70-c, SG property stocks bearish

AUSGROUP: 1H2012 net profit up 63% at A$8.3 million, margins rebound

ERATAT: FY2011 net profit of RMB146 m after awarding sales incentive

WORLD PRECISION, CHINA MINZHONG, DUKANG: What analysts now say...