KOH BROTHERS has demonstrated an enthusiasm for buying back its shares, making it one of only a handful of construction companies which have done so in recent times, as NextInsight reader James Kuwe observed in a recent forum posting.

The company is more than a construction company (which, by the way, built the Marina Barrage, among other iconic projects) as it is also a property developer with a track record of building luxury projects.

It also owns the Oxford Hotel in the city and Alocassia Apartments, a service apartment in Bt Timah.

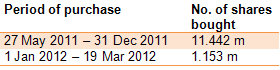

Its share buyback started in May 2011, and it has since bought back 12.595 million of its shares, representing 2.6% of the company's issued shares excluding treasury shares. See table above.

Back-of-the-envelope calculations show that it coughed up about $2.6 million for the purchases assuming a 21-cent average price.

Still, the stock price, as the chart on the right shows, has stubbornly stuck to a narrow trading range: If you had bought the stock about three years ago and are still holding it, you would have little or no capital gain to cheer you.

This, despite the company reporting net profit doubling from $10.7 million for FY09 to $20 million for FY11.

The dividend payout would not have given much comfort: It was 0.3 cent a share for FY09 and FY10 and 0.35 cent for FY11. In other words, the dividend yield was just between 1.4% and 1.7% or so.

The stock buyback is, of course, some comfort to long-suffering minority shareholders who interpret it to mean that the company believes the stock is grossly undervalued.

After all, the stock’s net asset value, at 38.63 cents, is about 84% higher than the stock price.

The PE ratio is 5X.

More interestingly, Koh Brothers and Heeton Holdings equally own the retail mall in Sun Plaza, which is located next to Sembawang MRT station.

In 2010 when the two companies offered to sell the property, they received an offer of over S$300 million - or $2,000 per square foot of net lettable area.

Subsequently, in Nov 2010, the companies decided to continue holding Sun Plaza.

“Sun Plaza offers a stable recurring income with good potential for capital gains. The five levels of shopping mall enjoy almost full occupancy. With its close proximity to Sembawang MRT station and increasing population density around the vicinity, both the Company and Koh Brothers Group are optimistic of the prospects of Sun Plaza,” they explained.

A sale of the mall would generate solid cashflow for Koh Brothers, which has short-term borrowings of $87.2 million and long-term borrowings of $158.6 million.

A sale would also probably trigger a re-rating of the languishing stock.

At current book valuation, thats a yield of 6.3%.

All suburban malls located beside the MRT are in prime locations. No doubt about that. If clementi mall can command 3000psf, all suburban mall owners are sitting in a sweet spot.

Compass point is going for 2500psf of NLA. If we apply this benchmark price on Sun Plaza, it will translate to a valution of 375million or 187.5million in assets on koh Brothers books. Currently, Sun Plaza is valued at 150million on Koh brothers books.