HANKORE 1H2012 revenue up 40% after recognizing construction revenues

WATER TREATMENT solutions provider Hankore posted a 1H2012 revenue increase of 40% year-on-year to Rmb135.4 million after it began recognizing construction revenue in the current financial year.

Group revenue comprised of construction revenue of Rmb 49.1 million (36.6%), discharge fee income from water and wastewater treatment of Rmb 12.2 million (9.0%) and finance income from service concession arrangements of Rmb 74.1 million (54.7%).

Hankore is constructing a new Build-Operate-Transfer plant in Henan for the San Men Xia project, and this has brought in additional construction revenue and profit.

The management expects revenue to continue to improve, pending the successful completion of the following projects, which will also bring in discharge fee income:

1. Preliminary work on the second phase expansion of the Xianyang project and a new project in Liquan.

2. Phase two expansion and overall upgrading work of the Suzhou plant.

3. Overall upgrading of the Xianyang project.

4. Preliminary work of the Sanmenxia water supply project.

Construction cost from the Sanmenxia project amounted to Rmb 44.6 million.

Gross profit margin was 60% (1HFY2011: 68%). The Group generated Rmb 32.4 million in net profit, up 26%.

Formerly known as Bio-Treat Technology, the company changed its name to HanKore Environment Tech Group in May 2011.

Its cash and cash equivalents decreased by 45% to Rmb 43.5 million as at 31 December.

The Group intends to embark on sludge treatment and water recycling projects in the next 12 months.

Related story: HANKORE: Bio-Treat Legacy Behind It And Ready To Fly

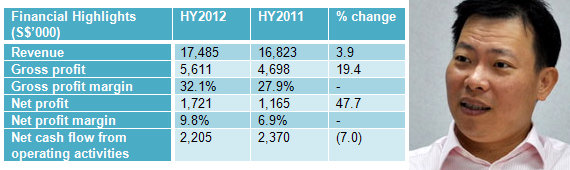

Teho 1H2012 net profit up 48% against tide of shipping slump

Teho, one of the leading suppliers of rigging and mooring safety equipment in the region for the marine and offshore industries, has posted a 48% year-on-year increase in 1H2012 net profit to S$1.7 million.

Group revenue increased 3.9% and reached S$17.5 million, thanks to a higher contribution from the marine sector. Singapore contributed over 80% to Group revenue.

“We expect the offshore oil & gas sector will continue to exhibit resilience and growth in the near future. Demand for natural resources has stimulated trans-shipment services within the South-East Asian and the Australasian regions,” said Chairman and CEO Lim See Hoe (photo above).

Gross profit margins improved by 4.2 percentage points to 32%, as there were improved selling prices and lower material procurement costs due to a relatively weaker USD/SGD.

The Group had net cash reserves of S$7.9 million as at 31 December, with net gearing at only 11.0%.

Previous story: TEHO: Key Customer Is PSA, Now Eyeing China Market