Excerpts from latest analyst reports....

CIMB says Hu An Cable is 'unjustifiably and severely undervalued'

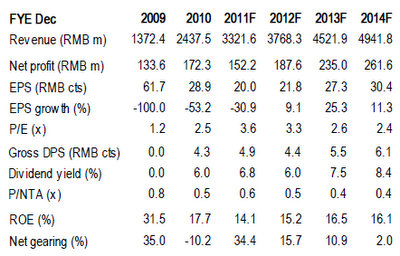

Maintain BUY with a lower target price of S$0.332 based on 6.0x CY2013 EPS. Our P/E is based on the historical forward P/E since Hu An’s IPO.

We believe that the current stock price is unjustifiable and severely undervalues Hu An.

Factoring in its expected high dividend yield of 6.0% for 2012, the upside for the stock stands at 133%, a definite keeper for value investors.

• Sell down in October not warranted. The recent sell down of Hu An’s stock was due to the negative 11.3% growth in net profit from its 9M11 results, we believe.

We think that such a sell down is not warranted as the negative growth was due to a spike in operating cost and interest expense and not due to a lack of sales.

The management explained that these spikes were due to the recruitment of new staff for its new plant and tightening bank lending policies in China (we reduced our target price accordingly by incorporating higher operating costs and increased interest expense into our forecast).

With these factored in, we still see this as a chance for investors to re-accumulate the stock.

Recent story: HU AN CABLE: 9M2011 revenue up 40.8% but margins squeezed by higher costs

Phillip Securities Research says SIA's profit outlook remains hazy

Analyst: Derrick Heng

Our analysis suggests that the parent company (SIA) & SIA Cargo could struggle to stay profitable in the Oct-Dec 2011 quarter (3Q).

Jetfuel prices remained elevated at levels close to 1QFY12, where both SIA & SIA cargo reported operating losses.

The deceleration in growth of premium traffic also implies that SIA’s passenger yield probably leveled off at best.

Hence, we argue that SIA’s passenger and cargo operations could have been below breakeven levels for 3QFY12E.

Investment Actions? Despite its depressed valuation (1.0X FY12E BVPS), we continue to stay on the sidelines as profit outlook remains hazy for SIA.

We cut our earnings estimates by a further 26% for FY12E, but kept our FY13E numbers largely unchanged. Maintain Neutral.